Whether you are a proud new parent looking out for your new baby or keen to provide for your family down the line, life insurance is a cornerstone of a sound financial plan.

Not only can life insurance replace income for dependents, pay final expenses, and cover taxes, but it can also create an inheritance for your heirs.

If there is one insurance policy not to overlook, it is life insurance.

And it’s never too soon to pick the right policy. But how do you find the right life insurance company to meet your needs? The short answer is…

Policygenius

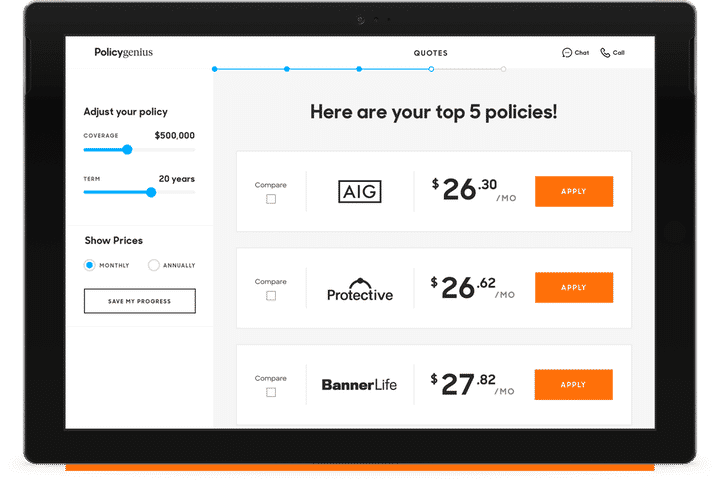

Policygenius provides a comparison shopping portal for you to find top-rated life insurance companies.

It is no surprise that Policygenius earns rave reviews from customers because it only works with insurers who have been awarded high financial ratings, removes pushy agents from the sales process, and allows you to compare and shop 100% online.

No matter what kind of life insurance best meets your needs, you can compare quotes easily.

Best of all, Policygenius is 100% free so it doesn’t cost you a penny to compare life insurance options.

But what else do you need to know before shopping for life insurance at Policygenius?

Policygenius Review Spotlight

| POLICYGENIUS SPOTLIGHT | |

InvestorMint Rating 4.5 out of 5 stars |

via Policygenius secure site |

What Is The

Best Life Insurance Policy?

It’s easy to feel bamboozled by life insurance options, so how do you find the best life insurance policy to meet your needs?

The most common types of life insurance are term life insurance and whole life insurance.

Term Life Insurance

When balancing costs and benefits, term life insurance is typically sufficient for most people

Features of term life insurance include:

- Provides death benefits only

- Most affordable life insurance for most people

- Easiest life insurance policy to purchase for most people

- For the term of the policy, it pays benefits only if you die

- Purchased for fixed time periods, such as 5, 10, 15 or 30 years

Term life insurance can generally be converted to whole life insurance.

Whole Life Insurance

Whole life insurance includes lifetime coverage and you typically need a medical examination to qualify.

Other aspects of whole life insurance include:

- Provides death benefits plus cash value accumulation during the life of the policy

- Cash value can be borrowed or withdrawn during the life of the policy

- Premiums can be higher than other policies initially but, over the long term, can save money

- Offers significant benefits when estate planning

- Can sometimes be purchased without a medical exam, albeit for a higher cost

Whether you are looking for term life insurance, whole life insurance, or other types of life insurance, Policygenius is a top notch comparison portal designed to vastly simplify the insurance-buying process.

As you've no doubt seen on the news, our economy is facing uncertain times ahead. Inflation continues to skyrocket, the Fed has been failing us left and right, and the government is in shambles. As it stands, your money is not safe. But there is hope, the Inflation Survival Plan will tell you everything on how to not only survive, but actually thrive through this harsh economic change.

So don't wait until it's too late, act now and secure your future TODAY!

How Does Policygenius Work?

Policygenius helps people to get the insurance coverage they need and make them feel good about it.

And to make that happen, the first step is to provide you with unbiased advice that is jargon-free.

Next, compare quotes side-by-side to find the best option and save money.

And lastly you can apply and buy life insurance through Policygenius, and leave it to their licensed advisors to handle the details free of charge.

➤ Free Guide: 5 Ways To Automate Your Retirement

What Types Of Insurance

Does Policygenius Provide?

Policygenius is your portal to just about any type of insurance you may wish.

Although life insurance is its flagship product, you can find other types of insurance from disability insurance to auto insurance there too.

| Policygenius Types Of Insurance | Description |

| Life Insurance |

|

| Disability Insurance |

|

| Health Insurance |

|

| Renters Insurance |

|

| Pet Insurance |

|

| Auto Insurance |

|

| Jewelry Insurance |

|

| Homeowners Insurance |

|

| Identity Theft Insurance |

|

| Travel Insurance |

|

Get Free Quotes At Policygenius

If you don’t know exactly what type of life insurance you want or need, Policygenius has an extensive library of articles to help you become more informed.

For example, if you were looking for life insurance, Policygenius provides a series of articles titled:

- How much life insurance do you need?

- Is term life insurance worth it?

- Should you buy life insurance for children?

Policygenius then goes a step further and reviews companies with which it is affiliated so you get a better perspective on your options.

For example, if you are looking for renters insurance, Policygenius features reviews on Allstate, Lemonade, Geico, Progressive, State Farm, Stillwater, and Liberty Mutual.

Once you are clear about what you want, it is simple to get free quotes.

Simply enter some personal information about where you live if you are looking for renters insurance, jot down what stuff you own, and the level of the protection you need, and then checkout.

Similarly, if you were looking for life insurance, you would submit your details, enter your health details, and get free quotes in no time.

It’s as simple and intuitive as it gets, which is one of the reasons Trustpilot reviews of Policygenius are about as close to perfection as possible, almost a perfect 10.

In times of inflation, gold prices have an inverse relationship with the markets, growing in value during market volatility. Amid economic instability, some retirement savers see precious metals, as an opportunity for profit and wealth preservation. Get the practical insights to take back control of your retirement with safe-haven assets like Gold & Silver.

Download the latest Global Gold Report, featured in Fortune Investors Guide.

Is Policygenius Right For You?

If you are looking to provide for your family, Policygenius is a one-stop portal to compare life insurance policies.

Policygenius connects you to insurance coverage from its partners who have financial ratings of A- or higher.

And to give you further peace of mind, Policygenius is licensed in all 50 states.

Since inception, Policygenius claims to have helped over 4.5 million people shop for insurance and protected customers with over $20 billion in coverage.

And it earns an A+ rating from the Better Business Bureau, so it has done an excellent job overall in serving customers and successfully resolving disputes and complaints.

Policygenius Pros and Cons

| Policygenius Pros | Policygenius Cons |

| ✅ Intuitive Portal: Every step of the insurance comparison and buying process is made simple. The widgets to walk you through getting quotes are polished and intuitive. | ❌ Limited Number of Insurance Partners: Because only top rated insurance companies who already partner with Policygenius are featured, you may wish to shop around online to see what other insurance options are available. |

| ✅ Many Types Of Insurance: You can find health, auto, life, disability, renters, pet, jewelry, homeowners, travel, and identity theft insurance quotes. | ❌ High Risk Users: Individuals with impaired risk may need to speak with experienced agents to help find the right insurance options. |

| ✅ Free Quotes: Policygenius makes it easy and free to compare quotes from top insurance companies. | |

| ✅ Extensive Knowledge Base: You can learn more about any type of insurance coverage featured by Policygenius in its extensively library of articles and resources. | |

| ✅ High Rated Partners: Policygenius only partners with insurance companies who have financial ratings of A- or above. | |

| ✅ National Coverage: Users in all 50 states can shop for insurance coverage with Policygenius. | |

| ✅ 100% Online: The entire process of comparing and buying insurance can be done entirely online so you can avoid high pressure insurance sales agents. | |

| ✅ Extraordinary Ratings: Policygenius earns a near perfect 10 score on TrustPilot and an A+ rating from the Better Business Bureau. |

Policygenius Reviews Summary

If the idea of calling a life insurance sales agent who may pressure you into purchasing an insurance policy you don’t fully understand gives you the heebie-jeebies, Policygenius is a 100% online comparison engine to help you find life insurance policy to best meet your needs.

It’s 100% free to get quotes so you don’t have to worry about hidden fees being tacked on after you choose a policy.

Whether you are looking for life insurance, health insurance, disability insurance, or a range of other types from auto insurance to pet insurance, Policygenius connects you only to insurance companies that have been awarded high financial ratings.

From start to finish, it is easy to compare and buy insurance. The process is simple, fast and the user experience is friendly and intuitive.

Who Is The Team Behind Policygenius?

Policygenius got its start in 2014 when its founders, Jennifer Fitzgerald and Francois de Lame, realized that buying insurance is a painful process for consumers who are often made uncomfortable by pushy sales agents.

Even when people buy insurance, they often wonder whether they are on the hook for something they might have missed in the small print of their insurance policies.

Spotting these problems, Fitzgerald and de Lame were inspired to create a better way to shop for insurance and Policygenius was born.

Extra, Extra!

Who Are Policygenius Partners?

Policygenius partners include the best known insurance brands in the United States.

And all of them have earned financial ratings of A- or higher to qualify as partners on the Policygenius platform.

| Policygenius Types Of Insurance | Partners |

| Life Insurance |

|

| Disability Insurance |

|

| Health Insurance |

|

| Renters Insurance |

|

| Pet Insurance |

|

| Auto Insurance |

|

| Jewelry Insurance |

|

| Homeowners Insurance |

|

| Identity Theft Insurance |

|

| Travel Insurance |

|

Policygenius FAQ

What makes Policygenius different from other insurance sites?

Insurance sales agents can be pushy, which makes for an uncomfortables shopping experience.

At Policygenius, you can compare and shop 100% online.

The sales agents employed by Policygenius are available if you have questions. They are salaried not commissioned, so they don’t make more when you buy. That makes for a more enjoyable experience when comparing insurance options.

If it’s free to get quotes, how does Policygenius make money?

When you buy an insurance policy, Policygenius earns a commission.

However, it is baked into the price of the policy you are quoted, so you don’t pay additional fees beyond the price quoted to you.

Is Policygenius licensed?

Yes it is licensed in all 50 states and Washington D.C.

Is Policygenius an insurance agent or broker?

Policygenius is an independent insurance broker that is unaffiliated with any insurance companies.

Because Policygenius represents many insurance companies, it claims to have no bias towards any individual company.

Can you buy life insurance for less through Policygenius?

You can save money by comparing insurance policies of different insurance companies.

Because insurers compete to win your business, they offer the best prices on their best products.

However, you cannot get a cheaper price for a given life insurance policy from a particular insurance company through Policygenius, or from another broker or even directly from the specific insurance company.

The reason for this is that each insurance company is required by law to file prices with state regulators and everyone has to abide by them; it is illegal to discount prices below those price levels.

We have the world's leading artificial intelligence forecasting trends in the market. A strategy so precise it achieves a proven accuracy rate up to 87.4%. Check out the next 3 stocks this A.I. has on its radar for you in this free, live training.

Claim your seat now by clicking here.