If you had a 20-ticket punch card, and each time you bought a stock you had to punch the card, which stocks would you buy?

This is the question billionaire investor Warren Buffett poses to college kids and investors. Your limit is reached when twenty stocks have been bought. After that, you are not allowed to buy any more stocks.

Knowing you are restricted in how many stocks you can buy over a lifetime, which twenty would you choose?

The idea behind this question is to force you to be thoughtful and selective about which stocks to buy. But how do you research stocks to find the golden nuggets?

How To Research Stocks Intelligently

To research stocks like a pro, you need to evaluate a company from two perspectives. You need to understand the company itself and you need to understand factors outside the control of the company that can affect its performance.

These factors are called:

- Qualitative Quotient

- Business Quotient

Think of Business Quotient, or BQ, and Qualitative Quotient, or QQ, as being similar to intelligence quotient, or IQ.

The higher a company scores in each category, the better the company is from an investment perspective.

Business Quotient relates to all things related to the operations and financials while Qualitative Quotient pertains to non-quantitative aspects of the business, such as competitive risk.

How To Perform Qualitative Research

Casual investors generally think business research is most important. News reports about a company often focus on revenues, earnings, and other quantitative factors.

In the short-term, these factors move stocks higher or lower. But over the longer term, qualitative factors can have an even larger impact.

If a business model is flawed or competitive dynamics change, a business can be harmed over time.

For example, when Blockbuster dominated the market for movie rentals, the financial statements may not have revealed from one quarter to the next that a competitor was sneaking up behind it and about to eat its lunch. But that’s exactly what Netflix did, and ultimately Blockbuster went out of business.

So, what do you need to pay attention to when selecting a company to lower the risk of falling victim to competitive dynamics like Blockbuster.

>> Related: Find Stocks To Buy Now

CUSTOMER FOCUS

When asked what any business can do to thrive, Warren Buffett answered simply:

“Delight your customers”

Keeping customers happy might seem like an airy fairy way to analyze a company, but it could be the most important. As Buffett says, no company with millions of happy customers has ever gone out of business.

To know whether a company delights its customers, find out whether customers buy often from a business. Are they repeat customers?

A company that has a high customer lifetime value most likely delights its customers because they are repeat customers who buy again and again.

You want to find the company whose customers are receiving more value than they are paying, may even be fully dependent on the product or service, and will continue to pay the company into the foreseeable future.

LARGE MARKET SHARE

If you were asked to name social media companies, which ones spring to mind?

Facebook and Twitter are the most common answers because they dominate their respective markets.

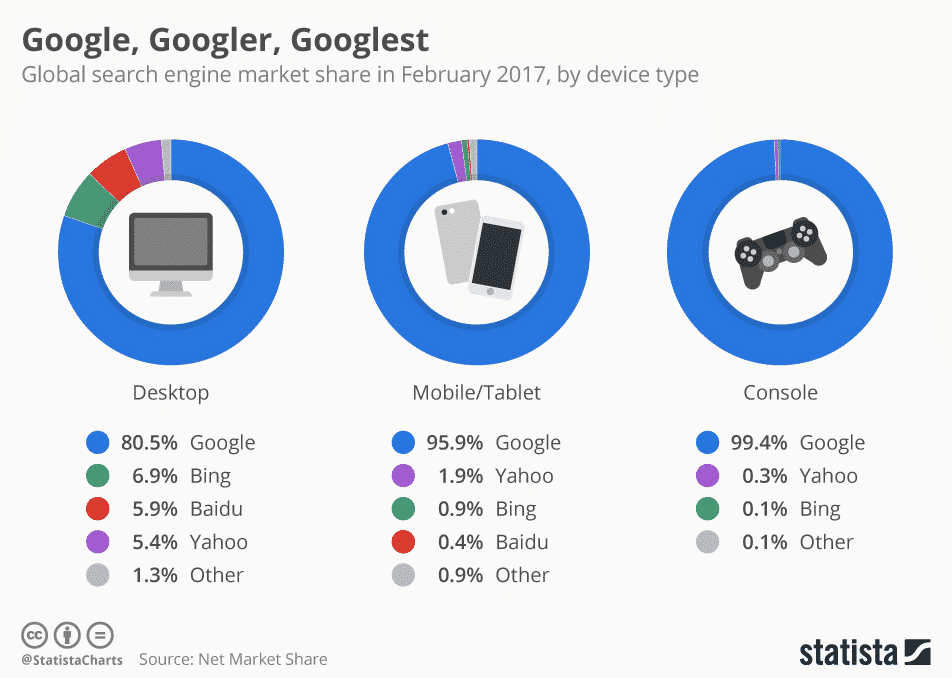

Similarly, if you were asked to name a search engine, you might say Bing or DuckDuckGo, but most likely your first answer will be Google.

Google dominates the search market.

Source: Net Market Share

Given the choice to own a market leader who dominates rivals or a small company trying to cling on to a small market share, which company would you choose?

A market leader can remain entrenched and hold onto its positions as long as it has a MOAT.

BUSINESS MOAT

The concept of a business moat was popularized by Warren Buffett and relates to the protection a company has from competitors.

Think about the company as a castle and the moat as walls around the castle to stop invaders from conquering it.

A moat can take many forms.

Network Effects

The moat Facebook has is its network effects, meaning if all your friends are on Facebook, it is hard for you to make the leap to another social network, even if it is better – because you will be all alone there!

High Switching Costs

High switching costs is another challenging moat for competitors to overcome. When it is hard to move from one company to another, high switching costs act as a moat.

Companies like Salesforce have high switching costs. When a customer signs up to Salesforce, every additional data record added acts as a hurdle for customers to overcome to move away from Salesforce’s customer relationship management, or CRM, platform.

Low Cost Leader

Some companies can deliver goods to consumers cheaper than others. Maybe they have better technology or a better distribution network. Whatever the reason, customers get a better deal with a low cost leader than its competitors.

Amazon is a prime example of a low cost leader. Amazon has figured out how to centralize warehouses so its fixed costs are lower than those of big box stores. It has better technology than most companies, and it can serve customers faster than most.

By offering a greater selection than most rivals, having lower fixed costs, and automating processes better than most competitors, Amazon can deliver customers better value than most of its peers.

Intangible Assets

Imagine you wanted to set up a new cola company called New Better Cola, what are the chances you could beat Coca Cola or Pepsi?

Both Coke and Pepsi possess a valuable competitive advantage, which are their respective brands.

You can’t necessarily see or touch a brand, but you know Coke and Pepsi brands well. When customers know brands well, they trust those brands and implicitly the companies, making it more likely they will buy from those companies than competitors.

The other challenge with Coke and Pepsi is their distribution networks. How do you deliver new cola bottles globally to all corners of the earth?

MANAGEMENT ALIGNMENT WITH SHAREHOLDERS

If you were to buy shares in a company, wouldn’t you want them to put your interests first?

You might think it is obvious that they would do so. After all, management are themselves usually company owners too, so it seems intuitive that they would be on your side.

But managing a public company is a complicated business with many stakeholders. Employees have a loud voice, and it is important management treats them well.

But sometimes, management treats employees a little too well. By issuing employees options that dilute shares, your ownership stake gets diluted.

It may not seem like dilution has much of an effect from one quarter to the next, but over time, dilution can add up in a big way to hurt your investment returns.

DO YOU UNDERSTAND THE BUSINESS?

Some of the best investing advice is to buy what you know. If you have been in the fast food business all your life, you can probably evaluate McDonalds, Burger King, and Chipotle better than a Silicon Valley engineer.

As a tech guru, you probably can evaluate the differences between blockchain and artificial intelligence better than a merchant who has worked in retail their whole lives.

If a business is hard to figure out, and you can’t quickly understand the value proposition it provides to customers, then it might be time to skip past it and find another company.

IDENTIFY COMPANY LONGEVITY

If you and I both start lemonade stands, the chances are if we start making a lot of money, another competitor will enter the market and try to win over our customers.

It is hard to find a business that is sustainable and will predictably be around in ten, fifteen or twenty years from now.

You can probably bet that companies which were around a century ago, like Coca Cola, will still be around in the next twenty years, but what about a company that just came public?

Research has shown that many companies don’t stand the test of time. From Pets.com to Blockbuster, the list of bankrupt or failed companies is long.

If you are not sure which companies will survive, the place to begin is blue chip stocks that have survived and thrived through many business cycles as well as value stocks.

Rising interest rates...Skyrocketing inflation...Exploding debt...A looming recession...It's no wonder Americans are becoming more and more concerned about their savings and investments. That's why I wrote my newest report…This FREE REPORT shows YOU how you could protect your retirement savings before it's too late. Request your free report today and learn how you could protect everything you've worked for!

Request Your FREE Ben Stein Report Today!

How To Perform Business Research

The research you conduct on the business itself will focus heavily on its financials.

REVENUE GROWTH

When a company is growing its revenues, it might be because the market share within which the company operates is expanding, or the company is gaining market share from its rivals.

More important than historical revenues are future revenues. But it is important to look in the rearview mirror and see whether a company has predictably increased revenues over time.

With a consistent history of growing revenues, you can be more confident the company will predictably continue to grow revenues.

EARNINGS PER SHARE (EPS)

Each quarter, public companies report earnings that make news headlines. And while earnings are an important metric to gauge the success of a company, they only provide a clue to performance.

Earnings do not provide insights on how efficiently a company is using its capital. Does the company reinvest earnings to produce higher rates of return, or distribute them to shareholders in the form of dividends.

By issuing dividends, a company is implicitly stating that it believes it cannot produce greater returns than the shareholders investing elsewhere.

Ideally, you want a company to project growing earnings for the foreseeable future.

RETURN ON INVESTED CAPITAL (ROIC)

Among the most important of all valuation metrics is return on invested capital, or ROIC.

Return on invested capital is a profitability ratio that tells you how good a company is at converting capital into profits.

Both shareholders and bondholders demand a return on their investments, and ROIC measures how well a company delivers returns to its stakeholders.

PRICE / EARNINGS RATIO

Another common metric shareholders pay attention to which also makes headlines in the financial news networks is the price/earnings ratio.

A low price/earnings ratio is not necessarily good and a high price/earnings ratio is not necessarily bad.

However, over the long-term high price-earnings ratios tend to stabilize at lower levels. In the short-term, they may be elevated because of high expectations among shareholders for future growth.

Blue chip companies tend to have lower price-earnings ratios than new technology companies expected to scale nationally or internationally.

FINANCIAL STATEMENTS

Companies report quarterly updates in reports called 10-Q forms and annually in reports called 10-K forms.

In these financial statements, management reports how the company has performed over the prior period and you can analyze their income statements, balance sheets and cash flow statements.

You can often glean insights into new innovations, projects and initiatives as well as the state of the company and how it is faring in the marketplace against rivals.

What tips do you have when researching stocks? Have you found research methods that have worked over you? We would love to hear from you.

>> When Will The Stock Market Crash?

>> How Does A Fed Rate Hike Affect You?

>> Why Retiring Baby Boomers Are A Big Deal

Discover the top 3 hidden AI stocks that could hand you profits of 874% of more!

ChatGPT is the fastest growing app EVER – hitting 100 million users!

Jeff Bezos… Bill Gates… and Elon Musk are betting billions on this "game changing" technology. And you can get in on the ground floor.

Click here to download it for free – with no strings attached.