If you ever had the sinking feeling of betting the market would go up only to see it fall soon after you place your trade then the straddle options strategy might be what you need.

A straddle is designed to make money no matter which way the market moves. If it rises, you can earn a profit. And if it falls, you can make money too.

The key to making money with the options straddle is for the security you are betting on to move by a big amount in a small time frame.

When volatility does occur, the options straddle can be highly lucrative. But if the underlying security you place a straddle on doesn’t move much, your options position can fall underwater.

How To Capitalize On Volatility:

The Options Straddle

Many casual investors make money when markets rise by passively investing in index funds over the long term.

But how do you trade when you know a company is reporting earnings soon and you expect the share price could be volatile?

How do you profit when a pharmaceutical company is due announce whether a new blockbuster drug has been approved or denied by the FDA?

Are there ways to make money when you expect significant share price movement in a stock based on a new product release, a change in management or some other fundamental reason?

Markets move up and down so why limit yourself to making money only when stocks rise?

While some options trading strategies, such as the covered call, make money regularly for shareholders, others limit risk, such as the married put. But the options straddle is different because it can make money whether share prices rise or fall.

The secret to making money with the straddle is for the share price to rise or fall by a large amount. If it doesn’t, the straddle can lose money in a hurry.

>> Related: How To Trade Options

Options Straddle Basics

When you place a straddle, you will be buying both call and put options.

Buying call options is a bullish strategy, betting on share prices rising. While buying put options is a bearish bet that prices will fall.

| Type | Buy | Sell |

| Call | Bullish | Bearish |

| Put | Bearish | Bullish |

By purchasing both call and put options, you can make money when the underlying share price rises or falls.

Seems like an easy way to make money? After all, share prices go up or down, so it seems like you can make money no matter which way they go?

Well, not so fast.

It is true that you can make money if the stock price rises or falls, but a better way to think about this options strategy is that the stock price needs to soar or plummet.

To profit from an options straddle, volatility is needed. It is generally not sufficient for the share price of the stock you place the straddle on to meander higher or lower. It needs to move higher with some gusto or collapse lower in a hurry.

The reason sharp price movement needs to happen fast is that looming up ahead is expiration, the date when the call and put options cease trading.

And each day the options lose a little bit of value due to time-decay (which you can learn more about in this options trading basics article).

When you sell options, you can make money from this slow decay in options value due to time decay. But when you buy options, time decay becomes your enemy as it erodes value a little every day until options expiration.

Thanks to forgotten 50-year-old legislation, often ignored by investment advisors, gold bugs, and silver hounds... You can now collect $10,000 or more in free silver.

Millions of Americans know NOTHING about this... Because it exploits a "glitch" in the IRS tax code that helps protect your retirement... While paying ZERO TAXES & PENALTIES to do it. That's why you need to see this NOW.

Click Here to get all of the details in this FREE Kit

How To Buy An Options Straddle

The way to structure an options straddle is to buy both call and put options at the same strike price for the same expiration month.

Imagine a stock was trading at $100 per share, you would buy the strike 100 call and strike 100 put options for the same expiration month.

When you buy both call and put options to form a straddle, the options strategy is called a long straddle.

(It is possible to sell both call and put options at the same strike price for the same expiration month to create a short straddle. The risk in a short straddle is high so we won’t explore it further).

The cost of the long straddle is the risk in the trade. It is the most you can lose, no matter which way the underlying stock moves.

So, if you paid $3 for the call option and $3 for the put option, the most you could lose is $6 per share.

Options are traded in contracts so if you purchase 1 call contract and 1 put contract whereby a contract corresponds to 100 shares, then the total cost would be $300 to buy the call and $300 to buy the put, for a total cost of $600.

When you place the trade, you will pay commissions so the total cost would be $600 plus commissions costs.

At most brokers, you will also need to pay commissions when you exit the trade, or sell the call and put options. But as competition has increased among brokers, so too have commissions costs declined. And these days, you can close out long options without paying a dime in commissions costs at TastyWorks.

| tastytrade SPOTLIGHT | |

Investormint Rating 4.5 out of 5 stars |

via tastytrade secure site |

➤ Free Guide: 5 Ways To Automate Your Retirement

What Is The Risk and Reward

Trading Options Straddles?

OPTIONS STRADDLE RISK

The cost of buying a straddle is also equal to the risk, or the most you can lose.

Cost Basis = Purchase Price of Call Option + Purchase Price of Put Option

Cost Basis = $3 + $3 = $6 = Maximum Risk

But what are the conditions that can lead to a trading loss when you own a long straddle?

The short answer is when volatility doesn’t materialize, you can end up underwater in a hurry trading options straddles.

Both call and put options will have no value if the stock stays at $100 through to the expiration date.

So you would end up losing $3 on the call option and $3 on the put option for a maximum loss of $6.

This is the worst case scenario.

If the stock ended up at $101 on the expiration date, the call would have $1 of value so it would show a $2 loss, and the put would lose all $3.

Similarly, if the stock declined to $98 by expiration, the put would have $2 of value while the call would expire worthless.

OPTIONS STRADDLE PROFIT

You can quickly see that no matter which way the stock moves, one of the options will be worth zero at expiration – guaranteed!

As a result, the share price must move a lot either up or down for the straddle to profit.

In this example, you paid $6 to buy the straddle so you need the stock to move $6 above the call strike price of $100 or $6 below the put strike price of $100 in order to end up at breakeven.

Any share price movement greater than $6 will result in a profit.

A $6 share price movement corresponds to a 6% movement in the share price of the $100 stock.

It is common for stocks to move by 6% over the course of a few months or a year but it is not an insignificant movement. And remember, the share price must move by at least 6% to begin profiting.

Once the share price moves by more than 6%, each additional $1 is gravy when it comes to making money.

If the share price rose to $115, the call would be worth $15 at expiration, so the profit would be $15 minus the cost of the straddle, $6, which is $9 per share.

Buying 1 call option and 1 put option for $600 would then lead to a $1,500 payout, and $900 of profit – a 150% return!

It is these high percentage payouts that make straddles so alluring to options traders.

The higher the stock goes, the more money you can make – with theoretically no limits.

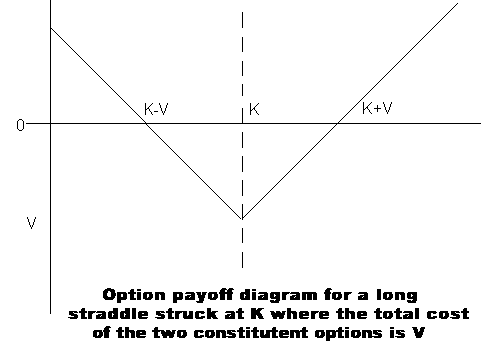

You can see visually how the straddle performs in this risk graph.

Image Credit: Wikipedia

If the stock were to fall, a limit does exist to your profit potential because the stock cannot fall below zero. Still, you can make money on the put option with each dollar the share price declines all the way to zero.

When Should You Trade

A Long Straddle?

A long straddle is inherently a speculative bet on future volatility.

The share price will need to move a lot in order to make money but the uncertainty is high that it will do so.

As a result, the straddle is not part of a core investment strategy for most casual traders but should be thought of more akin to a gamble that could pay off in a big way or lose out in a big way.

If you cannot afford to lose the money it costs you to enter the straddle, then think twice about entering it. It is best to consult with a financial advisor or pass on the trade if you have any doubts at all.

If the prospect of losing all your money on such a speculative options trading strategy seems perilously concerning, a passive investing approach might be a better fit for your risk tolerance and financial goals.

Many robo advisors offer a hands off, automated investing approach so you don’t have to “get your hands dirty” so to speak.

For example, one of the larger robo advisors, Betterment, will automatically invest your money on your behalf, conduct tax loss harvesting to minimize your tax liability, and help you set financial goals to reach retirement.

| BETTERMENT SPOTLIGHT | |

InvestorMint Rating 5 out of 5 stars |

via Betterment secure site |

The next 10 minutes could change your life. We've recorded a special sit-down interview with a reclusive millionaire who details how he's closed out winning trade after winning trade throughout the volatility of 2022. In fact, he hasn't closed a single losing trade since 2016. Sounds impossible? It's not - and he'll prove it to you.

Click to see this exclusive sit-down interview

Which Stocks Work Best For Straddles?

Stocks that work best for straddles are ones that tend to move a lot after big news events.

But how do you know when a big news event is occurring or whether it will lead to substantial share price movement?

Perhaps the most predictable news event that leads to volatility is a company’s quarterly earnings announcement.

If a stock has a history of moving up or down a lot over time when quarterly earnings are announced, you could reasonably assume that volatility will continue in the future.

But there are no guarantees. It is possible a share price that historically has displayed lots of volatility after earnings announcements displays almost no volatility after you place a straddle.

It is a speculative options strategy after all, so you must be prepared for lots of price movement or no movement at all.

After earnings, the implied volatility will seep away from the options and they will lose value quickly, especially if the stock doesn’t move by much.

Certain stocks like Twitter, Autozone and Facebook have historically been volatile but there are no guarantees they will remain so.

And there’s another factor to consider…

How To Decide Whether

To Buy A Straddle

It is not enough to simply buy a straddle on a volatile stock and hope for the best.

The key to making money with a straddle is not only that the share price moves a lot but also that it moves by more than the cost of the straddle.

So if our $100 stock historically had a history of moving $10 after earnings, and it cost us $6 to buy the straddle, then another $10 movement would lead to a profitable outcome.

But if the stock historically moves by 5%, which is still a big move following a single news announcement, the size of the move is still not enough to justify buying the straddle – because it costs $6 to buy the straddle, which requires a 6% movement in the share price to break-even in the example above.

So you need to look not only at how volatile the stock tends to be but also make sure the amount of volatility exceeds the cost of the straddle.

How do you trade stock market volatility? Share your trading stories with us below. We would love to hear from you.

>> Get Started With Options Trading For Dummies

>> Is Facebook Stock A Buy Or Sell?

>> Discover The Best Online Options Trading Brokers

The early bird gets the worm and the options trader who waits until 9:30EST can win big! Hi, I'm Dave Aquino and if you're new to options trading, my e-book "How To Master the Retirement Trade" will show you exactly how to take advantage of this early morning, profitable, but often overlooked window of trading time.

Download your copy today and let's get started!