No doubt you have read over the years about companies who employ child labor, provide poor working conditions for employees, or destroy local habitats to make money. Investors who struggle ethically with the idea of investing in these types of companies now have a choice to allocate their money to “socially responsible” firms.

The idea behind socially responsible investing, or SRI, is to consider both the financial return and social good when making investments. The factors raised by asset managers who favor SRI investing include environmental, social justice and corporate governance, or ESG.

It is not just major asset managers, such as Generation Investment Management, who are guided by socially responsible investing principles but casual investors too. With ever growing demand from ordinary investors, leading robo-advisors, such as Betterment, have expanded their automated investment management services by catering to client preferences via socially responsible investments.

What Is Socially Responsible Investing (SRI)?

At a high level, socially responsible investing encompasses the practices of impact investing, shareholder advocacy, and community investing. More colloquially, it can be thought of as seeking to avoid harm when investing.

Asset managers who practice socially responsible investing often avoid the following areas:

- Weapons manufacturers

- Fossil fuel producers

- Alcohol and tobacco producers

- Casino and gambling companies

- Fast food restaurants

- Manufacturers of military products

Some asset managers look to avoid negative consequences that may not be obvious at first glance. For example, some soda companies may tick a lot of boxes for value investors. But an SRI asset manager may take a pass, not because the financials aren’t compelling or the business case isn’t attractive but because of concerns over possible negative externalities – sugar consumption might lead to health consequences for consumers over the long term.

>> More: Compare Betterment Vs Vanguard

What Is A Betterment SRI Portfolio?

As a leading robo-advisor, Betterment has embraced the idea of socially responsible investing and responded to customer requests to better align their investments with their values.

Betterment looks to create portfolios that reduce exposure to companies that are seen to have a negative social impact. This may span a wide gamut from environmental destruction to poor labor standards. Equally, Betterment aims to increase exposure to companies supporting social good, such as promoting environmental sustainability.

The big idea at Betterment is to cater to socially responsible investing consumer demands while still offering low fee, diversified portfolios that are automatically managed via technology as part of its basic service (and provide access to human advice in its higher tier service).

| BETTERMENT SPOTLIGHT | |

InvestorMint Rating 5 out of 5 stars |

via Betterment secure site |

>> More: What Is The Betterment Minimum?

During and after the Great Financial Crisis of 2008, 485 U.S. banks went under. Here at Weiss Ratings, we warned about 484 — an accuracy rate of 99.8%. Now, we have a new warning. But this time, it's not just about a few hundred banks … it's about nearly every single bank in America …

Get all the details here

What Is Betterment’s

Socially Responsible Investing Method?

Although socially responsible investing has been around as far back as 1758 when Quakers were prohibited from participating in the slave trade, it has not been accessible to the general public until much more recently, and even then the costs have been prohibitive.

The challenge facing Betterment has been to provide customers access to low-fee and highly liquid funds while maintaining portfolio diversity. It turns out that SRI alternatives for small cap, value stocks, international stocks and bonds do not, at this time, meet Betterment’s cost or liquidity requirements so only large cap SRI alternatives are offered.

Due to their focus on fossil fuels companies like Exxon and Chevron may be excluded from SRI portfolios at Betterment. Other companies that may not make the cut include Walmart, Wells Fargo, Pfizer and Philip Morris.

On the other hand, companies deemed to have strong SRI practices, such as Disney, IBM, Intel, Procter & Gamble, Alphabet, Microsoft and Cisco may comprise a larger part of an SRI portfolio.

As a Betterment client, when you choose an SRI portfolio, you are in effect voting with your dollars for low cost, diversified, socially responsible funds – a rarity in the investing world.

>> More: What You Need To Know About Betterment Securities

➤ Free Guide: 5 Ways To Automate Your Retirement

How Betterment Defines

Socially Responsible Investing

Asset managers define socially responsible investing in different ways. At Betterment, the SRI approach falls into two broad definitions:

1. Reduce exposure to companies involved in non-socially responsible activities and environmental, social, or governmental controversies.

2. Increase investments in companies that work to address solutions for core environmental and social challenges in measurable ways.

Environmental, Social and Governance (ESG) criteria are used to define the Betterment SRI approach.

ESG seeks to quantify the aspects of socially responsible investing along each of the three dimensions. Betterment uses these ESG factors to score and define the extent to which a portfolio is socially responsible.

>> More: What Is A Betterment Tax-Coordinated Portfolio?

How Are ESG Factors Used In

Betterment’s SRI Approach?

Companies that sell tobacco, civilian firearms, or military weapons may be excluded. So too companies involved in controversies that relate to corporate governance standards may be excluded, such as:

| Company | Controversy Example |

| BP | Deepwater Horizon oil spill in 2010 |

| Wells Fargo | 3.5 million fraudulent accounts set up |

| Yahoo | Data breach of 500 million user accounts |

| Sterling Jewelers | Gender discrimination lawsuit |

Beyond controversies, Betterment looks to leverage the MSCI framework for a socially responsible investment approach:

| Pillars | Themes | ESG Issues |

| Environment | Climate Change | Carbon Emissions Energy Efficiency Product Carbon Footprint |

| Natural Resources | Water Stress Biodiversity & Land Use | |

| Pollution & Waste | Toxic Emissions & Waste Electronic Waste Packaging Material & Waste | |

| Environmental Opportunities | Opportunities in Clean Technology Opportunities in Renewable Energy Opportunities in Green Building | |

| Social | Human Capital | Labor Management Human Capital Development Health & Safety Supply Chain Labor Standards |

| Product Liability | Product Safety & Quality Privacy & Data Security Chemical Safety Responsible Investment Financial Product Safety Health & Demographic Risk | |

| Stakeholder Opposition | Controversial Sourcing | |

| Social Opportunities | Access to Communications Access to Health Care Access to Finance Opportunities in Nutrition & Health | |

| Governance | Corporate Governance | Board Ownership Pay Accounting |

| Corporate Behavior | Business Ethics Corruption & Instability Anti-Competitive Practices Financial System Instability |

Source: MSCI

As you've no doubt seen on the news, our economy is facing uncertain times ahead. Inflation continues to skyrocket, the Fed has been failing us left and right, and the government is in shambles. As it stands, your money is not safe. But there is hope, the Inflation Survival Plan will tell you everything on how to not only survive, but actually thrive through this harsh economic change.

So don't wait until it's too late, act now and secure your future TODAY!

Limitations Of

Socially Responsible Investing

For Betterment, the limitations to building a socially responsible investing portfolio include:

- Poor quality data

- Shortcomings in SRI products

- Liquidity in SRI ETFs

The challenge in gathering ESG data is that some companies don’t disclose ESG metrics. Betterment relies on MSCI, which in turn gathers data from company disclosures and media sources.

Product shortcomings include lack of diversification, a core philosophy upon which Betterment portfolios are built. Also, ETFs that may promote say gender diversity can fall short when it comes to environmental issues. Betterment strives to avoid these contradictory SRI issues in its portfolio holdings.

Another limitation is cost and liquidity concerns. Expense ratios can seriously hinder client returns over the long-term, which is why Betterment aims to keep costs low. But low expense ratio ETFs often lack the liquidity needed to feature in Betterment SRI portfolios.

>> More: Compare Betterment Vs SoFi

Compare Betterment SRI Portfolio

Vs Betterment Core Portfolio

The main change between Betterment core and SRI portfolios (taxable and tax-deferred, such as traditional IRAs) is the composition of large cap holdings.

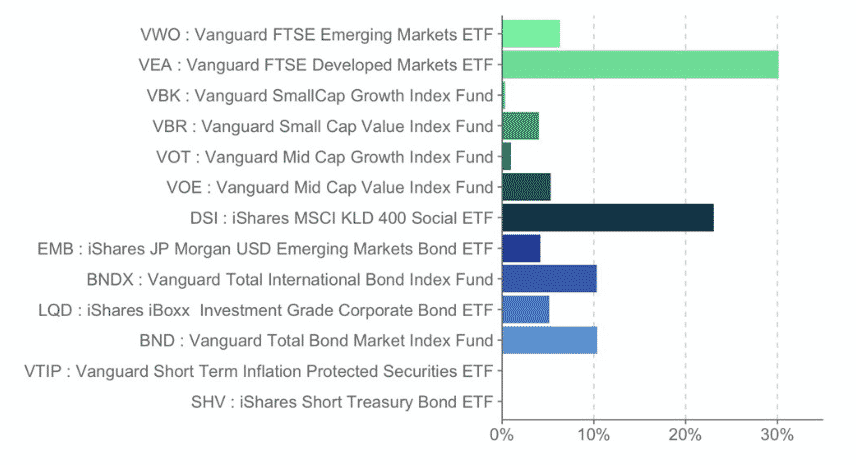

In SRI portfolios, Betterment allocates to a U.S. ESG exchange-traded fund, DSI, which is the ticker symbol for the iShares MSCI KLD 400 Social Index Fund ETF, and secondarily to KLD for tax-loss harvesting.

These ETFs track a benchmark that includes companies that score highly against ESG benchmarks and excludes companies involved in activities, such as:

- Nuclear power

- GMOs

- Adult entertainment

- Tobacco

- Military weapons

- Civilian firearms

An example of a Betterment SRI portfolio for an IRA account is shown below:

>> More: Compare Betterment Vs Wealthfront

Do Betterment SRI Portfolios

Score Highly?

To evaluate how well a portfolio scores on socially responsible investment criteria, the MSCI Quality Score Scale quantifies ESG criteria:

| Scale | 0-10 Score |

| 8-10 | Very high ESG quality — underlying holdings largely rank best in class globally based on their exposure to and management of key ESG risks and opportunities |

| 6-8 | High ESG quality — underlying holdings largely rank above average globally based on their exposure to and management of key ESG risks and opportunities |

| 4-6 | Average ESG quality — underlying holdings rank near the global peer average, or ESG quality of underlying holdings is mixed |

| 2-4 | Low ESG quality — underlying holdings largely rank below average globally based on their exposure to and management of key risks and opportunities |

| 0-2 | Very low ESG quality — underlying holdings largely rank worst in class globally based on their exposure to and management of key ESG risks and opportunities |

>> More: Compare Betterment Vs Acorns

What Are The Risks Choosing A

Betterment SRI Portfolio?

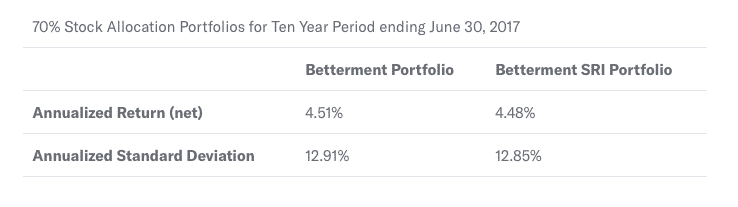

Betterment has conducted historical back-testing showing that SRI portfolios have tracked core portfolios with a correlation of 0.9979, so while past history cannot be used to predict future returns, the quantitative studies may provide investors some comfort.

Factoring in expense ratios had no significant change either on total net returns of core portfolios vs SRI portfolios.

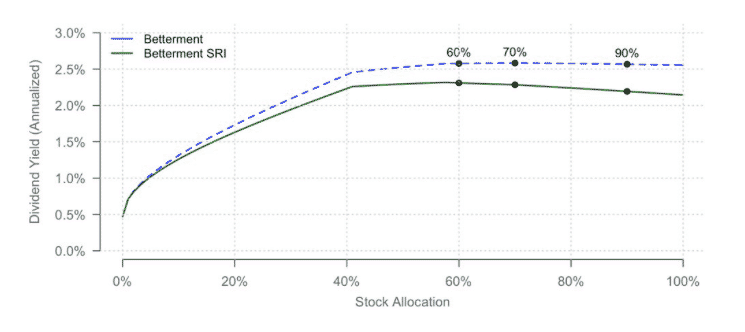

However, dividends may be lower by selecting a Betterment SRI portfolio vs a Betterment core portfolio. Although future dividends are random variables, past results show that income returns from Betterment SRI portfolios have been lower than core portfolios.

Summary: Betterment SRI Portfolios

Betterment SRI portfolios are a way for you to better align your social and environmental preferences, as well as your values overall with your investments.

Although limitations with respect to liquidity and fee schedules of funds remain, you can still build a globally diversified SRI portfolio that rivals a core portfolio on costs and performance returns – with the caveat that dividends may be lower.

The more clients who choose SRI portfolios the greater the demand for socially responsible investments and the more likely it is over time that costs will come down and liquidity concerns will fall to the wayside.

| BETTERMENT SPOTLIGHT | |

InvestorMint Rating 5 out of 5 stars |

via Betterment secure site |

Official tax return reveals how one trader nabbed annual gains of 228%, 309% and 339%. His tax return was released online, exposing this simple trading technique used to pocket nearly half a million in profits.

Click here to see the official tax return before it is deleted...