When the stock market is moving higher, predictions for a stock market crash echo through financial news outlets.

But step away from the talking heads for a moment and look to stock market history. Is there a pattern in the stock market which repeats each decade that hints at when the next crash will occur?

When Will The Stock Market Crash?

Although nobody quite knows when a stock market crash will occur, a curious historical pattern is evident near the end of each decade.

It is tempting to say the number 7 has “magical” properties because many of the stock market crashes began or continued through years ending in that number.

SHARE THIS INFOGRAPHIC ON YOUR SITE USING THE FOLLOWING CODE

1907 Stock Market Crash

The panic of 1907 was known as the Knickerbocker Crisis or Banker’s Panic. In the middle of October, the New York Stock Exchange plunged nearly 50% over a three week period.

The panic was so severe that it spread nationwide, causing bank runs and runs on trust companies.

It was financier J.P. Morgan who stepped in to save the banking system by pledging his own money and assets as well as convincing New York bankers to do the same.

Following this crisis, Senator Nelson W Aldrich, set up a commission to propose solutions to avoid future similar crises. This ultimately led to the creation of the Federal Reserve.

1917 Stock Market Crash

Towards the end of 1916 and throughout 1917, U.S. stock markets fell as the U.S. was drawn into World War I.

From peak to trough, the crash lasted 393 days. During that time the Dow Jones fell from 110.15 to 65.95, corresponding to a 40.1% correction.

1929 Stock Market Crash

In the late 1920s, perhaps one of the most famous of all stock market crashes took place.

In 1929, the October 29 Wall Street Crash became known as Black Tuesday and led to the Great Depression.

The fallout from the crash was so severe that it is generally considered to be the worst crash in history.

The 1929 stock market crash continued through 1932 and resulted in a decline of 86%.

A buy-and-hold value stock investor would have had to hold on 22 more years until 1954 just to get back to breakeven if they had bought at the top of the market!

1937 Stock Market Crash

During the Great Depression, an economic downturn took place in the late 1930s as unemployment surged higher despite production and wages returning to 1929 levels.

From March 1937 to March 1938, the Dow Jones declined 49.1% from top to bottom over the course of 386 days.

1947 Stock Market Crash

A couple of years after World War II ended, the stock market peaked and began a long descent.

In 1946, the decline began, continuing through 1947 and finally ending in 1949.

The stock market crash lasted 37 months during which time the S&P 500 fell 29.6% from 19.25 to 13.55.

1957 Stock Market Crash

Between July and October 1957, the stock market plunged 20.7%. Shortly thereafter in 1958, economic recession ensued, known as the Eisenhower Recession.

1966 & 1969 Stock Market Crash

The stock market crash of 1966 took place between February to October and resulted in a 22.2% decline from top to bottom.

Just 3 years later in 1969, the stock market plunged again by 36.1% over the course of 18 months, beginning in November 1968 and ending in May 1970.

The causes of the crash were attributed to higher deficits and inflation stemming from the Vietnam War combined with monetary tightening.

1973-74 Stock Market Crash

The collapse of the Bretton Woods system coupled with the U.S. dollar devaluation, and the 1973 oil crisis led to a stock market crash in the early 1970s.

Although most of the crashes in the century took place in the latter part of the decade, the 1973-74 stock market crash took place in the first half of the decade, and led to the Dow Jones Industrial Average losing 45% of its value.

The crash began in January of 1973 and lasted all the way through to December of 1974, wiping out brokerage and retirement portfolios along the way.

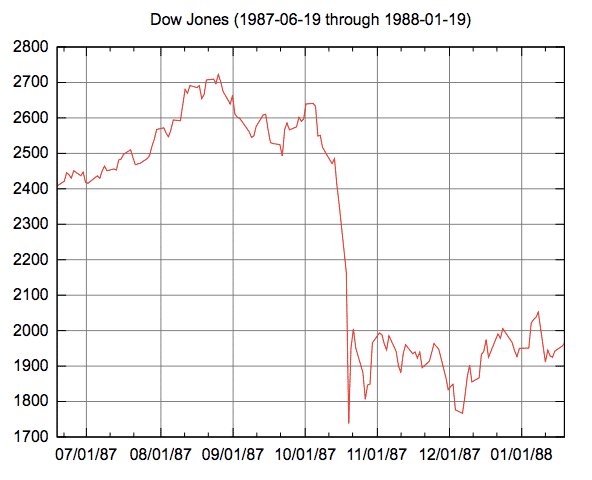

1987 Stock Market Crash

Black Monday is among the most famous of all stock market crashes because of the lightning speed with which prices plunged. In just one day, the Dow Jones plummeted 23%.

This remains the largest one day percentage decline in stock market history.

1997 Stock Market Crash

In October 1997, the Dow Jones suffered another stock market crash, dropping 554 points in a single session – the largest point loss recorded up to that time – causing trading in stocks to be halted.

Preceding the U.S. crash, Thailand had devalued its baht, Malaysia stepped in to defend its currency, the Philippine peso was devalued, and Indonesia allowed its currency to float freely.

Although liquidity was cited as the issue in the emerging markets, it is notable that the problems in the stock market occurred towards the end of the decade again.

2000-02 Stock Market Crash

The dotcom bubble led to runaway share prices in technology stocks and the NASDAQ index. When it popped in March 2000, the ensuing decline wiped out 78% of the value of the NASDAQ Composite by October 2002 as it fell from 5046.86 at the peak to 1114.11 at the bottom.

It took over a decade for the portfolios of buy-and-hold investors who bought at the top to recover to breakeven while short stock traders who bet against the market made a killing on the way down.

2007-09 Stock Market Crash

The 2007-09 bear market lasted from October 2007 to March 2009. Approximately 54% of the value of the Dow Jones Industrial Average was destroyed during that time frame.

Loose credit and sub-prime loans were cited as reasons for the initial housing boom and subsequent bust, which led to the destruction of major banking institutions as well as enormous stock market value.

Is A Stock Market Crash Coming?

Perhaps the one inevitable takeaway from history is that the next stock market crash is on its way.

The precise timing may not be certain but, for whatever reason, the end of each decade is a time to be especially cautious – and even more so when the year ends in 7!

To protect your wealth during a stock market crash, options strategies such as married puts covered calls can be powerful ways to limit risk.

What stock market patterns have you found that help you make better investing decisions? Share your thoughts in the comments below – we would love to hear from you.

>> Find Out How To Short A Stock

>> Retirement Planning For Dummies

>> Find Out What Robo Advisors Can Do For You

This "heartland" town 2,400 miles away from Silicon Valley will be the NEW playground for America's 1%-ers.

Learn more here.

Leave a Reply