The greatest advantage a 25-year-old has – at least statistically – is a lot of time to get their finances just right. With these 10 financial tips, they could be well on their way to a comfortable life, and a well-funded retirement.

1. Invest In Your Own Financial Education

It’s not enough to make money, open checking and savings accounts, and hope for the best.

You need to have an understanding of what it is to save, invest, and manage your money.

Begin by investing in your own knowledge. As Warren Buffett says the investment that pays the best dividends is the one in your own education.

Read books on personal finance and investing Here are some top financial magazines to get you started and some books about the most famous investor of the last century.

2. Pay Down Student Debt

At 25, you have likely incurred some student debt – just like 40 million other Americans.

Unfortunately, interest rates for student loans are typically high, so you may want to consider refinancing that debt.

That’s where companies like SoFi, CommonBond, and Earnest can help.

If you believe you are paying too much in interest and qualify as a creditworthy borrower, they may be great alternatives to government loans.

3. Save For Retirement

According to Shark Tank’s Mr. Wonderful, you should take 10% of your after-tax earnings and invest it.

He bluntly states, “Stop buying all the crap you don’t need,” and in turn, invest in yourself.

It might seem scary to invest, but it’s even scarier to not have a nest egg when you reach retirement.

➤ Free Guide: 5 Ways To Automate Your Retirement

4. Max Out Your Retirement Accounts

At 25, you can invest $19,000 per year into a 401(k) plan (and that number could potentially be more if your employer has a matching program).

A 401(k) is a great way to lower your lower your tax bill, too.

Retirement accounts like 401(k)s, IRAs, and Roth IRAs, are a great way to grow your wealth over time.

Not only do you enjoy tax-free growth of earnings, but you reduce the taxes you pay each year.

5. Make Yourself Rich Not Your Financial Advisor

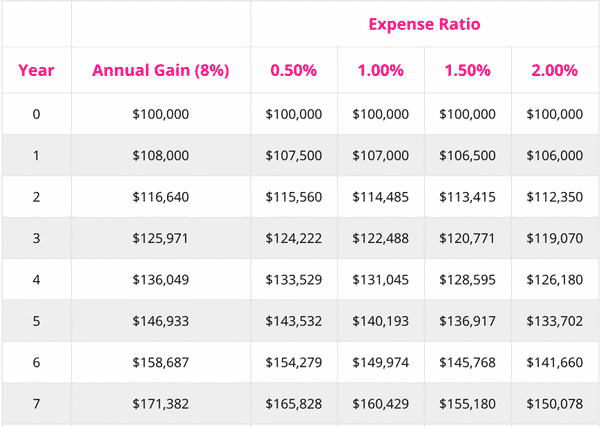

On the path to becoming financially independent, it’s important to pay attention to the small details.

This includes the fees you pay to your financial advisor.

Consider this: an advisor pitches 7-8% in annual returns and a small annual fee of 1.5%. The returns seem to outweigh the necessary fees.

If you’re investing $100,000, you can make $7,000 to $8,000 on the year from this particular advisor. But you’re also paying $1,500 in fees.

If you had shopped around, you may have found a fund charging 0.1% in annual fees, which would give you an extra $1,400 to invest, save, or use however you’d like. Vanguard funds are usually among the cheapest when it comes to expense ratios.

6. Diversify Your Investments

Even Warren Buffett advocates most investors to diversify their holdings.

There is no holy grail of risk-free investing. The best way to mitigate risk is to construct a diversified portfolio that is aligned with your risk profile.

This means that you should allocate your money across different asset classes, such as stocks, bonds, mutual funds, exchange-traded funds, and commodities.

7. Know Your Risk Profile

At 25, with a lot of time in front of you, are you more willing to risk a lot knowing that you have time to make up the difference?

Or, are you hoping for steady growth to ensure a solid financial profile as you age?

Everyone’s preferences are different and require different strategies.

Make sure you’re confident in the risk you’ve attributed to your financial plan.

8. Track Your Finances

Successful saving and investing requires an understanding of what is happening. You should know how much you’re bringing in and how much you’re saving.

Know which investments made you money and which ones lost you money.

Should you reconsider your approach? Or stick with what’s working?

If you can’t answer these questions, go back to the drawing board. Start with a budgeting app like the free one that Personal Capital offers to track your spending, income, investments, and net worth.

9. Have More Than One Credit Card

Another Kevin O’Leary tip: have two credit cards. One with a low limit and another with a higher limit.

It’s a fact; your personal information is at risk online.

Use the low limit card for online purchases just in case there is a breach.

Additionally, pay off your balances each month. Credit card debt can accumulate quickly and get out of hand before you know it.

As Mr. Wonderful says, spend within your means. Stop buying the things you don’t need!

10. Make Rational Decisions About Your Wealth

If offered $100 today versus $150 in one year, research from Katy Milkman shows that most people would take the money today.

However, most people will never generate a 50% annual return, making the $150 in one year a smarter choice.

It doesn’t make sense that you would guarantee yourself less money in the future, but most people still make that choice.

Consider not buying that coffee at the shop, but making it at home.

Make the larger down payment to avoid overpaying on interest.

Consciously decide to focus on building wealth over time.

Make the rational decision to be more wealthy in the future even though it may feel better in the short term to choose otherwise.

InvestorMint Rating

InvestorMint Rating