When bitcoins first appeared, they were marginalized and dismissed by many but the value of bitcoins steadily climbed over the years and major companies, such as Microsoft, Dell, Subway and Virgin Galactic, now accept bitcoins for payments.

The cryptocurrency ecosystem has expanded with the launch of Ethereum, Ripple, Litecoin and a host of others. And as cryptocurrencies have grown more popular, the initial coin offering, or ICO, has become more mainstream.

An ICO is similar to an initial public offering, or IPO, and is favored as way to launch a new cryptocurrency.

What Is A Cryptocurrency?

The best way to think about a cryptocurrency is as digital money. You can’t touch it or feel it as you can a dollar bill, but it can be used as a medium of exchange to buy goods and services.

The big difference between cryptocurrencies and major currencies, such as Dollars, Sterling, and Yen is that cryptocurrencies, such as bitcoin, are decentralized.

In the U.S., the Federal Reserve increases money supply by purchasing Treasury bonds and decreases money supply by selling Treasury bonds, which removes cash from the economy.

The idea behind cryptocurrencies was to create a digital asset that was controlled by no central authority.

Unlike centralized banking systems that use electronic money, the decentralized nature of cryptocurrencies means that money can be transferred anonymously using a blockchain transaction database that relies on a distributed ledger.

What Is Bitcoin?

Perhaps the most famous of all cryptocurrencies is bitcoin. Bitcoin was created by an unknown programmer, widely reputed to be Satoshi Nakamoto, and released as open source software in 2009.

Bitcoin allows you and and another person to transact directly with each other. Unlike a peer-to-peer transaction whereby you pay a fee to say PayPal for the privilege of making the transaction, a digital transaction using bitcoins is direct and avoids paying fees to any intermediary.

A network of nodes verifies each transaction and records them in a ledger called a blockchain.

Unlike electronic transactions, digital cryptocurrency transactions take place without any administrative oversight. But the integrity of the transactions have largely been validated and, less than a decade after launch, over 100,000 merchants accept bitcoins and millions of users have cryptocurrency wallets.

We have the world's leading artificial intelligence forecasting trends in the market. A strategy so precise it achieves a proven accuracy rate up to 87.4%. Check out the next 3 stocks this A.I. has on its radar for you in this free, live training.

Claim your seat now by clicking here.

How Initial Coin Offerings Work

An initial coin offering, or ICO, is a way to raise funds by trading future cryptocoins for cryptocurrencies with liquid value. The best way to think about an ICO is like an IPO but for a cryptocurrency.

If an investor wants to raise money in a cryptocurrency, they can do so via the issuance of cryptocoins.

The coins from an ICO can be traded much like shares can after an IPO. However, the coins do not confer ownership as shares do.

So, let’s say you wanted to buy a new cryptocurrency, Bill & Jane’s Extraordinary Cryptocurrency, you would hand over bitcoin or ethereum and receive some of Bill & Jane’s Extraordinary Cryptocurrency.

The ICO coins mimic digital coupons and are issued on a ledger, or blockchain, to allow for easy trading and over time your hope is the value of the coins will rise.

>> More: How To Diversify Your Portfolio Intelligently

➤ Free Guide: 5 Ways To Automate Your Retirement

How Do You Partake In An ICO?

New initial coin offerings are posted on social media sites, such as Facebook, as well as specialty sites, such as Cyber.Fund.

The way to get started is as follows:

- Set up a cryptocurrency wallet

- Identify a project of interest for which the ICO is financing

- Verify your wallet is compatible with the tokens (which are the digital coins offered during the ICO)

- Export private keys into another wallet to access the new coins (for security reasons)

Wallets are increasingly compatible with different types of tokens so buying tokens is becoming easier but it’s not yet quite as simple as buying shares in a public company, such as Twitter or Autozone.

What You Need To

Know About An ICO

When you buy coins in an ICO, you participate in a project, an economy or a Decentralized Autonomous Organization (DAO).

You will generally buy either coins or tokens. Coins correspond usually to participation in an economy while tokens let you participate in a project or DAO.

| ICO Type | Participation In |

| Coin | Economy |

| Token | Project or DAO |

A defined number of coins or tokens is specified prior to sale and the prices are set by the creators of the project, DAO or economy.

During and after the Great Financial Crisis of 2008, 485 U.S. banks went under. Here at Weiss Ratings, we warned about 484 — an accuracy rate of 99.8%. Now, we have a new warning. But this time, it's not just about a few hundred banks … it's about nearly every single bank in America …

Get all the details here

How Is An ICO

Different From An IPO?

OWNERSHIP RIGHTS

The major difference between participating in an ICO vs an IPO is that you receive shares in an IPO that provide you ownership in a company whereas in an ICO you get rights to a project only.

VOTING RIGHTS

Unlike an IPO, you don’t get a right to vote with an ICO, and fundraising may span many rounds.

Generally, tokens increase in value as the release date approaches, creating an incentive for investors to buy in early.

REGULATORY OVERSIGHT

IPOs are heavily regulated with transparent reporting. In contrast, ICOs are launched on exchanges that are minimally regulated, if at all.

FINANCIAL DATA TRANSPARENCY

Access to financial data is straightforward when participating in an IPO whereas ICO details are released in a whitepaper or publicly accessible via blockchain.

TAX LIABILITIES

In an IPO, both investors and companies pay taxes whereas in an ICO investors are subject to capital gains taxes but companies may not be liable to direct taxation.

The Murky Underworld Of Cryptocurrencies

Cryptocurrencies make it easy to anonymously transact online. This anonymity has spawned a murky world of veiled economies where drugs, trade secrets and other illicit transactions exchange hands.

Another dark side of the cryptocurrencies revolution is ransomware attacks where hackers demanded bitcoins to remove harmful software.

Because of these drawbacks, some governments have taken steps to crack down on cryptocurrencies. For example, China’s major bitcoin exchange halted trading in early 2017.

While the harmful bi-products of cryptocurrencies are apparent, the blockchain technology that is central to its success has increasingly been touted as having the potential to disrupt other industries.

What Industries Are At Risk Of Disruption From Blockchain Technology?

BANKING

Blockchain technology is intended to be a secure, digital ledger which has the potential to supplant banks as storehouses of value.

Where blockchain could prove disruptive in the banking industry is by cutting out the function of middlemen and back-office staff.

A consortium of financial institutions, called R3, has already come together to develop a platform and commercial applications for blockchain distributed ledger technology.

MONEY TRANSFERS

Decentralized payment technologies, such as bitcoin and ethereum, have the potential to transform business architecture for money transfers according to The World Economic Forum.

By using blockchain technology, direct money transfer between senders and recipients internationally is made possible faster and with less cost.

CYBERSECURITY

Data interceptions pose risks for cybersecurity but when the source of the data is robust as is the case with blockchain technology, the integrity of data communications using cryptographic methods is believed to be more secure.

AUTO SALES & AUTO LEASES

If you have ever experienced the paperwork hassles when buying or leasing a car, you will know just how time consuming it is.

Visa and Docusign recognized how much wasted time is associated with these transactions and have partnered on a “proof-of-concept” car leasing program to streamline the process.

ONLINE MUSIC

Online music sharing has historically been a contentious area because major streaming platforms take such a big portion of the revenue pie from artists.

Blockchain has the potential to cut out the hefty commissions paid so artists can receive direct payments. The idea is to create direct engagement between artists and customers.

STOCK TRADING

How do you trade shares in a private company? That’s the problem blockchain start-up Chain wants to solve.

And it’s not alone, Overstock.com subsidiary TØ.com has been approved by the SEC to issue public bonds and the hope is to enable stock transactions online using blockchain technology.

What Are The Risks Of

Buying Cryptocurrencies In An ICO?

CRYPTOCURRENCY FRAUD

ICO thievery and fraud is a risk when buying cryptocurrencies. A quick Google search will uncover a host of scams that makes you think the world of cryptocurrencies has similarities to the Old Wild West.

PRICE VOLATILITY

The price of cryptocurrencies are famously volatile too. You will need to buckle up and hold on for a rollercoaster ride when you buy cryptocurrency coins because it is not uncommon for prices to swing by 20% and more in a single week, or even a day.

LIMITED LEGAL PROTECTION

Legally, you have little protection if you fall victim to a cryptocurrency scam. Proponents of cryptocurrencies advocate for little regulatory oversight because it hinders innovation.

But that’s no solace if you hand over your hard earned real world dollars only to find them lost in a digital currency scam.

The way ICOs are promoted makes it difficult for investors to clawback money if problems arise, not least because ICOs generally market the sale of coins as donations whereby you buy “software presale tokens” that provide you with little recourse.

PRICE BUBBLES

Following the enormous success of bitcoin, investors stampeded into Ethereum causing prices to soar at first.

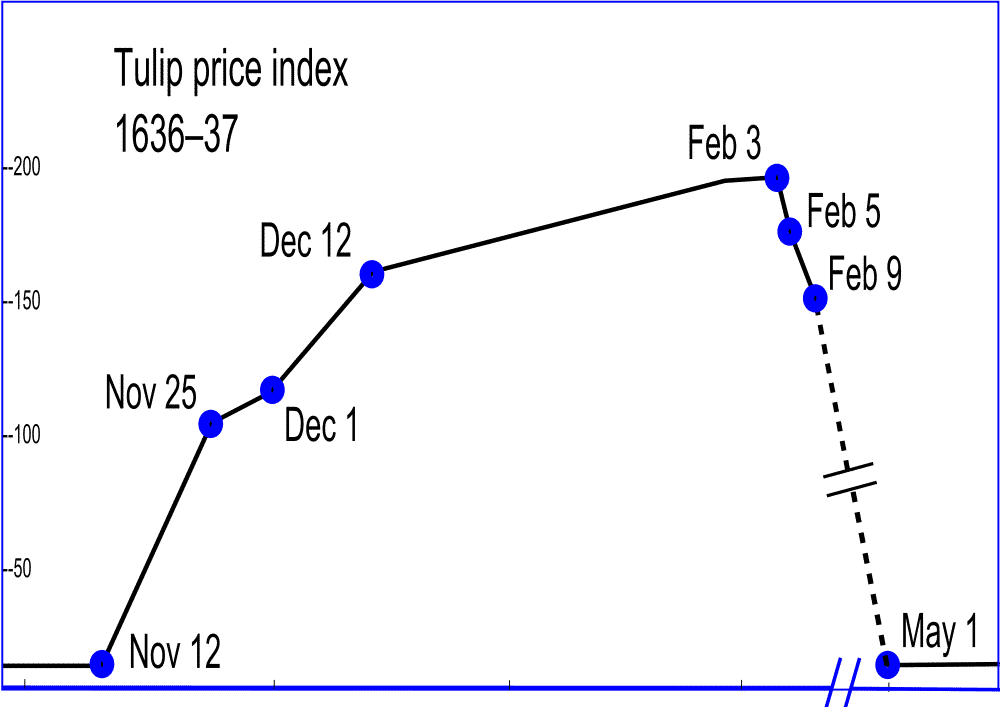

As with any investment, bubbles and busts may occur. One of the most famous market bubbles in history took place between 1636-1637 in tulips.

During the Dutch Golden Age, speculation in tulip bulbs caused prices to skyrocket and collapse almost as quickly.

In retrospect, it might seem preposterous but at the time many investors got suckered so history teaches investors to err on the side of caution when any asset is soaring higher.

>> Related: What Are The Best Stocks To Buy Now?

List Of Cryptocurrencies

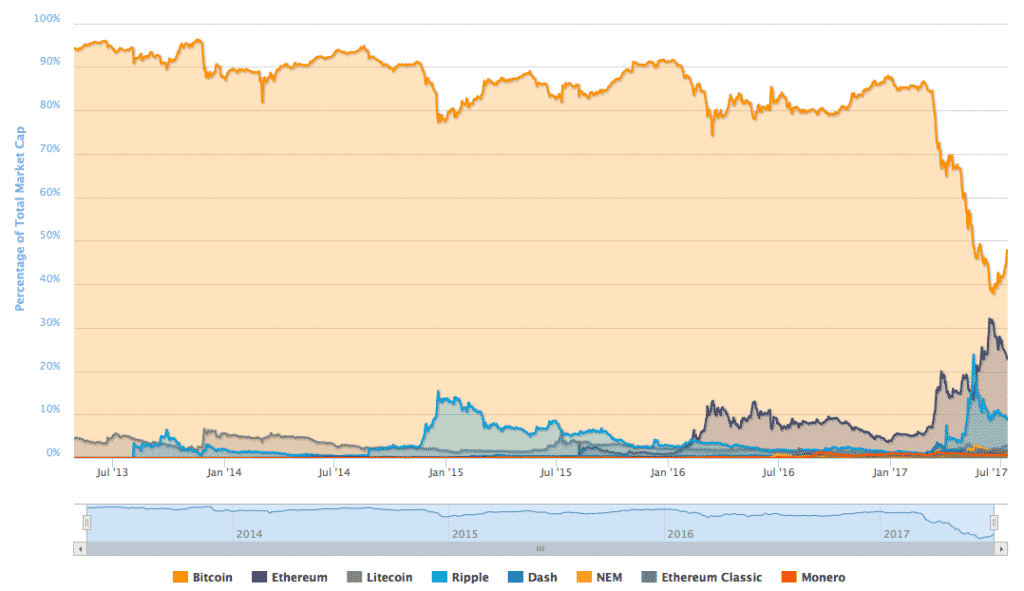

Bitcoin remains the premier cryptocurrency by market capitalization. However, in recent years its share of market has significantly declined.

% Share Of Cryptocurrency Market By Market Capitalization

Source: CoinMarketCap

A list of cryptocurrencies that have gained popularity include:

| Name | Symbol |

| Bitcoin | BTC |

| Ethereum | ETH |

| Ripple | XRP |

| Litecoin | LTC |

| Ethereum Classic | ETC |

| NEM | XEM |

| Dash | DASH |

| IOTA | MIOTA |

| Monero | XMR |

| BitShares | BTS |

| Stratis | STRAT |

| EOS | EOS |

| Waves | WAVES |

| ZCash | ZEC |

| Steem | STEEM |

| AntShares | ANS |

| BitConnect | BCC |

| Golem | GNT |

| Bytecoin | BCN |

Have you bought bitcoins, ethereum or another cryptocurrency? Have you bought goods and services with bitcoin or ethereum? What were your experiences, positive or negative? We would love to hear from you.

>> Find Out Why Retiring Baby Boomers Is A Big Deal

>> When Will The Stock Market Crash?

>> How Much Does The Top 1% Make?

Mr. Market is fickle and emotional... After ten years of going up in a nearly unbroken line, he abruptly decided to reverse course...

And usher in a bear market that has crushed portfolios — But while most investors were going through the worst year since the Global Financial Crisis...

A small group of 3,700 people had the chance to collect instant "bonus payouts" courtesy of Mr. Market every week.

All thanks to a method most investors have no idea about… watch this demo showing how it works.