Michael Burry water investments are increasingly drawing curiosity among investors. And with good reason. After all, Burry made his name during the 2008-9 crisis betting against, or shorting, the housing bubble.

As manager of Scion Capital hedge fund, Burry applied his expertise in value investing to generate extraordinary returns for investors. In less than a decade, Scion recorded aggregate returns of 489.34% net of fees and expenses.

When the housing bubble imploded, Burry’s contrarian bets on credit default swaps paid off so well that he was featured in The Big Short, a movie inspired by a Michael Lewis book. It featured stories of the economic crisis through the lens of a few investors who bet against the housing bubble.

At the end of the movie, viewers got a hint of where Burry was turning his attention to next. The final line of the movie was emblazoned with his bold next investment:

“Michael Burry is focusing all of his trading on one commodity: Water” – The Big Short

If an investor with proven returns who, like Warren Buffett, is a student of Benjamin Graham and David Dodd’s famous book, Security Analysis, is focusing on investing in water, then maybe you should consider it too?

Why Invest In Water

Although investors typically think of gold and silver as precious resources before water springs to mind, the reality is water is so valuable that it has even led to serious conflicts.

The list of conflicts relating to water include:

- Nearly 3 million people left without access to reliable water supplies in Ukraine

- Clashes in Darfur between farmers and herders over water access

- Attack on Islamic State forces controlling the Tabqa dam

And water related illnesses are responsible for approximately 80% of all illnesses and deaths in the developing world.

In fact, over 2 billion people lack access to adequate sanitation according to the United Nations.

Let us send you the downloadable version so you can read it when it’s more convenient for you.

Sewage and waste are causes of water pollution that leads to disease but another huge factor is limited fresh water on earth. While it’s easy to think of the earth as having a plentiful supply of water – after all 71% of the earth is covered in water – the reality is fresh water makes up only 0.76% of all water.

“Fresh, clean water cannot be taken for granted. And it is not — water is political, and litigious” – Michael Burry

And as any value investor worth his or her salt knows: where demand is high and supply is limited, prices rise.

In this case, the demand comes from an ever growing population of humans on earth who demand more of the earth’s limited freshwater resources.

How To Invest In Water

Perhaps the simplest way to invest in water is to invest in exchange-traded funds, though stocks, farmland and water rights are other investment possibilities

INVEST IN WATER-RELATED ETFs

A leading water-related ETF is the Guggenheim S&P Global Water Index ETF [NYSE: CGW].

The fund has the goal to invest in companies spanning the water sector with a view to benefiting from the development of new infrastructure that is designed to ensure efficient delivery and quality of water.

The idea behind the fund is to also to access opportunities arising from population growth, consumption, and climate, as well as to benefit from global demand for water.

Like any exchange-traded fund, it does have an ongoing expense ratio, and it’s a little hefty at 0.64%, which is quite a bit higher than many of the best Vanguard funds.

One of the reasons why the ongoing expense ratio is higher than say the expense ratio of an S&P 500 fund is that the fund invests in global companies as opposed to U.S. companies only.

Some of the top holdings in the fund include:

- American Water Works Co Inc.

- Danaher Corp

- Xylem Inc/NY

- Pentair PLC

- Veolia Environment SA

- Geberit AG

- Idex Corp

- Suez

- United Utilities Group PLC

- Severn Trent PLC

Another way to invest in water is via the S&P Global Water Index [CWW], which also tracks companies around the world that are related to the water business.

To create diversified exposure to the global water market, the 50 companies featured are divided equally across two main groups:

- Water utilities & infrastructure

- Water equipment & materials

Utilities and infrastructure companies include areas such as water supply, waste water treatment, sewer and pipeline construction, water purification, water utilities, water testing, and water well drilling.

Equipment and materials companies focus on areas such as water treatment appliances, plumbing equipment, water treatment chemicals, counting devices, fluid power pumps and motors, pumps and pumping equipment.

>> Want To Invest In Water ETFs? Select The Best Brokers For ETF Trading

INVEST IN WATER RIGHTS

Investors purchase water rights, which give them the right to use water from a source such as a river or lake.

As an investor, you can rent out the water right to farmers, municipalities, or even corporations.

The problem with water rights is much like the problem with a non-dividend paying asset, such as gold. And that is, the way to make money is for someone else to pay more than the investor.

However, some investors believe so much in the idea of water-related investments that they exclusively focus on water rights. Aqua Capital Management, for example, is a water rights and investment management company that accumulates water rights in water-scarce regions across the globe.

As water scarcity and droughts increasingly become challenges for arid regions like California and Nevada, some local governments have come up with innovative solutions to recycle water. For example, Las Vegas recycles close to 100% of its indoor water.

INVEST IN FARMLAND

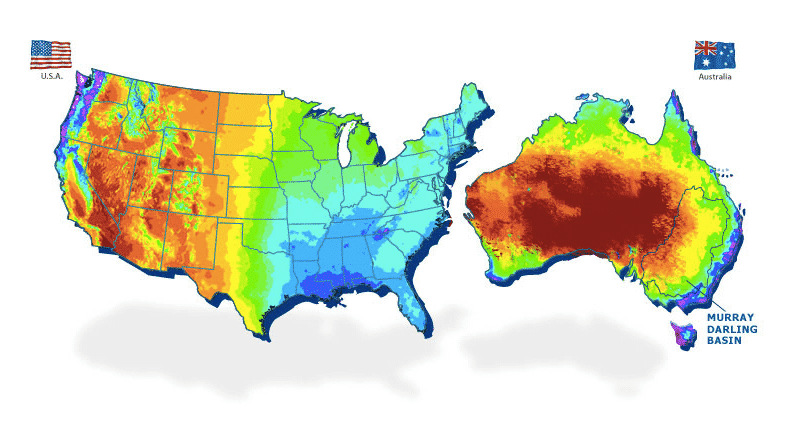

As appealing as water rights may be to some investors, they don’t attract Michael Burry as much as farmland.

A PBS segment ran a piece about how Michael Burry is investing in farmland. Now, this type of investment isn’t for everyone but seeing how Burry is allocating his money is instructive in understanding how value investors think about making money over the long-term.

When Burry was interviewed by New York magazine about his water investment thesis, he stated that:

“Transporting water is impractical for both political and physical reasons, so buying up water rights did not make a lot of sense to me. What became clear to me is that food is the way to invest in water” – Michael Burry

According to the segment, Burry is investing in almond farms. Why on earth is he investing in almond farms you might ask?

Well, it turns out that growing almonds requires lots of water and when water shortages take place farmers will sometimes walk away which results in even less supply of almond growers, and therefore almonds.

The almond growers who remain in business can increase their prices and profit as a result.

Another popular yet water-intensive good is wine. Studies show that 872 gallons of water is needed to produce 1 pound of wine.

The water footprint for popularly consumed items, includes:

| Item | Gallons Of Water Needed To Produce 1 Pound |

| Chocolate | 2,061 |

| Cinnamon | 1,860 |

| Beef | 1,847 |

| Olive oil | 1,729 |

| Hazelnuts | 1,260 |

| Sheep | 1,248 |

| Walnuts | 1,112 |

| Coffee | 1,056 |

| Wine | 872 |

| Pork | 718 |

| Lentils | 704 |

| Ginger | 199 |

| Peppermint | 35 |

Source: Huffington Post

When hedge funds start buying almond and walnut farms because of the high margins, you know they believe in the long-term supply-demand imbalance investment thesis.

INVEST IN STOCKS

Another way to invest directly in water-related projects is to bet on individual stocks. Historically, when industries are fragmented they are ripe for disruption and the opportunity for a roll-up play that aggregates many players becomes lucrative.

For example, American Water Works Company (NYSE: AWK) is a holding company that provides water and waste services to public utilities in 16 states.

Aqua America (NYSE: WTR) is another company that has consolidated its grip on wastewater services by acquiring over 300 companies between 1993 and 2013.

No shortage of competitors exist in the water space, such as York Water (NYSE: YORW) which impounds and purifies water to meet or exceed safe drinking water standards.

A slightly larger company is American States Water (NYSE: AWR) which is the parent company of a handful of utility operators that engage in the purchase, production, distribution, and sale of water.

If the prospect of researching water companies in an online brokerage, such as thinkorswim or tastyworks, seems daunting then the Guggenheim ETF may be a better bet. However, the cost of buying the stocks will be limited to trading commissions costs whereas the ETF will incur an ongoing annual expense ratio.

Biden's disturbing new government program may be worse than Obama's. You are at risk for having your bank account frozen. A former bank regulator is blowing the whistle on Biden's frightening plan to take over your money.

Discover the immediate steps you need to take now.

Michael Burry Water Investments

A key takeaway from Bloomberg’s interview with Michael Burry is that investing in water or farmland is smart in special situations. Not every piece of farmland or every water rights venture will pay off or even pay dividends, but where limited supply meets increasing demand, prices will likely rise over time.

For the hands-off investor not sure where to begin, the best place is generally via an exchange-traded fund that has a lower risk yet lower reward payoff because it is diversified compared to buying shares in a specific company that may have higher upside potential and higher downside risk.

Riskier than stocks are water-rich farmland and water rights opportunities, which may have the greatest upside but equally are the least liquid investment opportunities, so they are probably best for the most sophisticated and experienced of investors – which is why Michael Burry is investing in farmland directly – though shunning water rights!

>> Check Out The Best Online Brokers For ETF Trading

>> Why You Should Not Put All Your Eggs In One Basket

>> What Are The Best Value Stocks?

If you've struggled with trading techniques in the past and watched your mistakes affect your bottom line, you're not alone-but you can change that starting now!

I'm trading expert Thomas Wood and my e-guide, "Naked Trading Mastery" could give you the edge you need to make earning consistently easier than ever!

Get your free copy here!