A lot has been written about how Warren Buffett picks value stocks, but much less is known about how he got started. What are the principles he uses to compound portfolio returns at a faster pace than almost anyone in history?

Did Buffett reveal an insight to his strategy for building wealth in 1994 when he stated that Berkshire Hathaway would have been worth half as much if one crucial decision had not been made?

Banks and insurance companies apply the same principle as Warren Buffett to build enormous wealth. So, what is this powerful concept that few know about and even fewer apply well to get rich?

The Secret To Wealth

That “Rich Dad Poor Dad” Popularized

In his New York Times bestselling book, Rich Dad Poor Dad, Robert Kiyosaki popularized the idea of using other people’s money to build wealth.

If you can use or borrow other people’s money, known as OPM, at low cost, and invest those proceeds at higher rates of return, it may be possible to turbo boost your wealth.

What could be better than borrowing at low cost and investing the money into higher yielding assets?

Warren Buffett discovered the answer is to get paid to use other people’s money.

By reducing his borrowing cost in some areas to zero or even negative, and knowing how to earn positive rates of return, Buffett found the virtual holy grail of wealth building.

The strategy of borrowing to invest works similar to this example:

- Borrow money, say $100, from a bank

- Invest in a high yield bond that guarantees you a fixed payment, say 7% annually

After 5 years, you repay the bank its $100 or, if you get paid to use the funds like Buffett, a lesser amount, say $95.

So, the bank effectively paid you $5 to borrow the money for 5 years, and the bond interest earned you another 7% each year.

You end up with $40 ($35 from the bond interest plus $5 from the bank) plus your original $100.

>> Related: What Is A Bond?

How To Use Other People’s Money To Get Rich

Real estate is one of the most common vehicles used to build wealth using other people’s money.

So, let’s imagine two identical homes that cost $500,000 each next to each other.

You decide to buy home A with $500,000 in cash. While your neighbor buys home B with $250,000 of cash and a $250,000 mortgage.

A year later, home prices in the area have gone up 10%, and each of you owns a home worth $550,000 now.

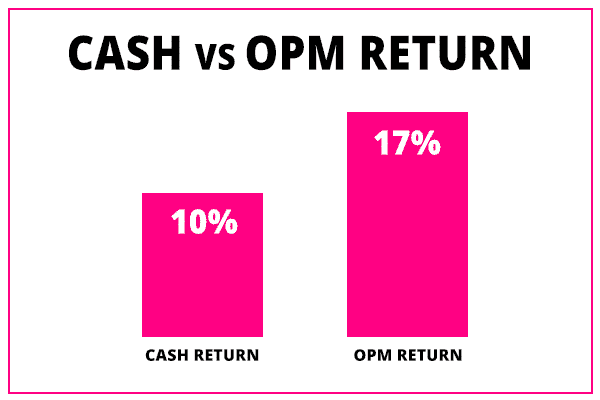

Your $50,000 gain on the $500,000 invested corresponds to a 10% profit.

But how much does your neighbor make by taking out a mortgage costing 3% in interest annually?

He can sell the home for $550,000 and pay back the bank $250,000 plus 3% interest, which amounts to $7,500.

So, his net proceeds are $550,000 – $250,000 – $7,500 = $292,500

All in all, he invested $250,000 and got back $292,500, resulting in a profit of $42,500.

At first glance, you might think that is not so attractive. After all, you made a full $50,000, which is more than your neighbor made.

But for the extra $7,500 you profited, you had to invest an additional $250,000!

Your neighbor made $42,500 on a $250,000 investment, corresponding to a 17% return.

If both you and your neighbor began with $500,000 of cash, and he used $250,000 to buy the home next to you (with the help of a $250,000 bank mortgage) and another $250,000 to buy a home elsewhere also with a mortgage, then all else being equal at the end of the year his $500,000 would have produced $85,000 in profit after paying mortgage costs whereas by paying for your home in cash, your profits would be just $50,000.

More>> What Property Tax Deduction Can You Claim?

Quickly, you can see that wealth can grow faster by borrowing other people’s money at low rates and investing it at higher rates.

In this example, your neighbor had to pay an interest rate to the bank to borrow funds to invest. But where does Buffett go to get paid to use other people’s money?

We could be facing one of the harshest economic challenges ever experienced thanks to an incompetent government and severe global unrest. If you aren't proactive, you could see yourself and your family become another financial casualty. But, the Inflation Survival Plan has you covered. Learn insider tips and tricks, IRS loopholes and more that will help your finances soar.

Take 15 Seconds to get the FREE Inflation Survival Plan and ensure your family's financial security.

How Does Warren Buffett Get Paid

To Invest Other People’s Money?

You can’t walk into a bank and ask for a loan and expect to get paid for the privilege. And neither can Warren Buffett. So, how does he get access to other people’s money?

He revealed the answer in 1994 when he stated:

“Had we not made this acquisition, Berkshire

would be lucky to be worth half of what it is today.”

The acquisition he was referring to was an insurance company, called National Indemnity Company, or NICO, which he purchased for $8.6 million in 1967.

In the insurance business, Buffett’s Berkshire Hathaway collects premiums from policyholders. By paying out fewer claims than Berkshire collects in premium payments, Buffett’s company gets paid to use other people’s money.

The key to success is knowing how to underwrite successfully. If insurers pays out more in claims than they collect in premiums, the opportunity to use other people’s money is zilch!

➤ Free Guide: 5 Ways To Automate Your Retirement

The Risks Of Investing Other People’s Money

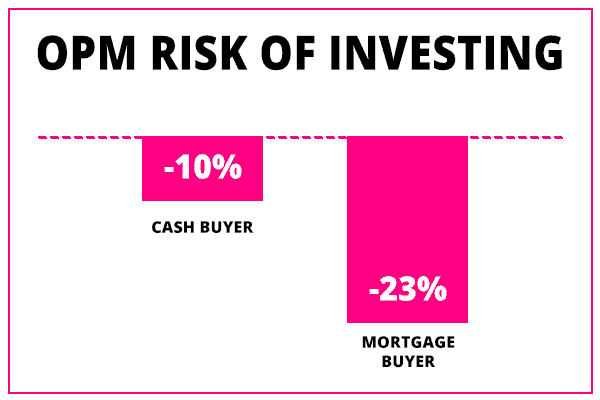

When you use other people’s money to grow your wealth, it is called leverage. The upside of leverage is you can boost returns when an asset, like the home above, rises in price. But when assets fall in price, negative returns are amplified too.

For example, if the house had instead fallen from $500,000 in value to $450,000, then you would experience a 10% loss as a cash buyer. But how would your neighbor have fared?

If he sells the home for $450,000, he must still pay back the bank its $250,000 plus $7,500 in interest owed.

So, he now gets back $450,000 – $250,000 – $7,500 = $192,500.

Overall, he ends up losing $57,500 of his original $250,000, corresponding to a loss of 23%.

You can see that when investments go in the wrong direction, you can lose out not only on the asset declining in price but also on the interest owed to the bank.

EXCESSIVE LEVERAGE

Buffett has said in the past that the way a rich person can go poor in a hurry is by borrowing excessively.

Said another way, borrowing too much and investing in an asset that declines in price can destroy wealth fast.

For example, your neighbor borrowed 50% of the value of the home previously. But what if he had borrowed 90% of the value of the home?

If he borrowed $450,000 and invested just $50,000 of his own cash to buy the home then a 10% decline in value would be catastrophic.

A 10% decline from $500,000 to $450,000 in the value of the home would mean paying back the bank its $450,000 loan in addition to paying interest owed, and losing the full $50,000 invested.

So, an asset only needs to fall 10% in value to wipe out 100% of your equity when you borrow 90% of the money to pay for the asset upfront.

NO PREDICTABLE GROWTH VEHICLE

The reason Buffett is confident in using other people’s money is because he invests conservatively and can predictably estimate what he will earn from the borrowed funds.

He buys value stocks that have high upside potential and low risk. And his expectation is the returns over time will far exceed any costs from using other people’s money.

If you are not sure whether a company is overvalued or undervalued, using leverage or margin to buy more than you have in cash is not wise.

To help you understand the value of companies, financial tools are available to quickly see how much possible upside or downside in share price a company has.

In summary, you should only consider leverage when you can confidently generate higher returns than you pay in costs on borrowed money.

Summary Of Buffett’s

Strategy To Get Rich

The secret to Buffett’s success is to use other people’s money at low cost and invest those cheap funds in long term investments that most investors don’t have the patience to hold onto.

Buffett doesn’t worry about a Fed rate hike or even whether the stock market is open.

He encourages investors to buy companies not stocks. Focusing on a stock can distract you as you eye share price movements as opposed to a business model.

Rising interest rates...Skyrocketing inflation...Exploding debt...A looming recession...It's no wonder Americans are becoming more and more concerned about their savings and investments. That's why I wrote my newest report…This FREE REPORT shows YOU how you could protect your retirement savings before it's too late. Request your free report today and learn how you could protect everything you've worked for!

Request Your FREE Ben Stein Report Today!

Extra, Extra!

Although Warren Buffett came up with a creative way to access other people’s money at low cost and invest it at higher rates of return to build enormous wealth, he advocates that most people select low fee index funds to grow their nest egg.

If you are not sure where to begin or prefer a hands-off approach, consider a robo advisor with low fees that can manage your savings automatically.

Once you answer some questions related to your time horizon, risk profile, and lifestyle expenditures, a robo advisor, such as Betterment, will invest your money in a diversified portfolio and optimize it for tax efficiency.

What investment tips do you have for growing wealth? Share your money making tips with us. We would love to hear from you.

>> View 21 Legendary Investing Quotes

>> Find Out Why Retiring Baby Boomers Are A Big Deal

>> Who Are The Top 5 Best Robo Advisor CEOs

We have the world's leading artificial intelligence forecasting trends in the market. A strategy so precise it achieves a proven accuracy rate up to 87.4%. Check out the next 3 stocks this A.I. has on its radar for you in this free, live training.

Claim your seat now by clicking here.