| InvestorMint provides personal finance tools and insights to better inform your financial decisions. Our research is comprehensive, independent and well researched so you can have greater confidence in your financial choices. |

Fidelity is most frequently associated with administering work retirement plans but its brokerage division has industry-leading research, a comprehensive list of mutual funds, and reasonable commissions.

As a full-service brokerage firm with almost $2 Trillion in client assets, Fidelity shines in customer service. What counts against Fidelity most is its account balance, trade frequency and amount minimums.

Fidelity Spotlight

| FIDELITY SPOTLIGHT | |

InvestorMint Rating 4.5 out of 5 stars |

|

Fidelity Customers

Fidelity is well known in professional workplace environments for administering retirement plans but its brokerage division has much to offer: best-in-class research, top notch customer service, reasonable commissions and a wide range of tradeable securities.

Beginner traders won’t find an easier platform to research equities than Fidelity. The user interface, user experience and intuitive navigability are without equal across the industry. Experienced traders will be just as pleased with the visuals and how easy it is to navigate the platform but will also find extensive proprietary and third-party research.

Traders seeking to stay informed and on top of current news and market movements will be spoiled for choice with market reports, educational articles, sector outlook reports, and regular weekly email communications.

Fidelity caters well to mutual fund investors, equities traders, bond investors and even options and Forex traders. Fee-conscious traders, who are seeking lower-cost platforms that focus on options, futures and Forex, may be better served elsewhere, such as at thinkorswim® or TradeKing.

Fidelity is best for traders of:

- Mutual Funds

- Bonds

- Stocks

- Options

- Forex

Traders who are uncertain which category they fall into are provided a helpful quiz to match research providers to investment style.

Fidelity serves the following trader and investor categories best:

- Traders seeking extensive research

- Active traders

- Retirement investors

- Mutual fund investors

Rising interest rates...Skyrocketing inflation...Exploding debt...A looming recession...It's no wonder Americans are becoming more and more concerned about their savings and investments. That's why I wrote my newest report…This FREE REPORT shows YOU how you could protect your retirement savings before it's too late. Request your free report today and learn how you could protect everything you've worked for!

Request Your FREE Ben Stein Report Today!

Fidelity Promo Deal

Fidelity offers the following promotions:

- Get 300 commission-free trades for 2 years with a deposit of $50,000-$99,999 to open or fund a brokerage or IRA account

- Get 500 commission-free trades for 2 years with a deposit of $100,000+ to open or fund a brokerage or IRA account

➤ Free Guide: 5 Ways To Automate Your Retirement

Fidelity Pros and Cons

Fidelity is a full-service brokerage firm offering 24/7 support, the best research in the industry, fair commissions, and an easy-to-use platform interface. The biggest drawbacks with Fidelity are its fee structure for less active traders as well as its high account minimums.

| Fidelity Pros | Fidelity Cons |

| ✅ Industry-Leading Research: Fidelity stands above its peers when it comes to free, extensive research. An intuitive, polished interface presents information clearly from numerous third party research companies in addition to Fidelity’s Equity Summary Score. Fidelity does promote its own funds, which is to be expected, but regardless of that fact, it is easy to quickly compare mutual funds and find low expense ratios, investment philosophies and other valuable metrics. Third party providers include S&P Capital IQ, Recognia and McLean Capital Management. | ❌ High Account Minimums: A $2,500 minimum is required to trade mutual funds and a $5,000 deposit is required for margin trading. |

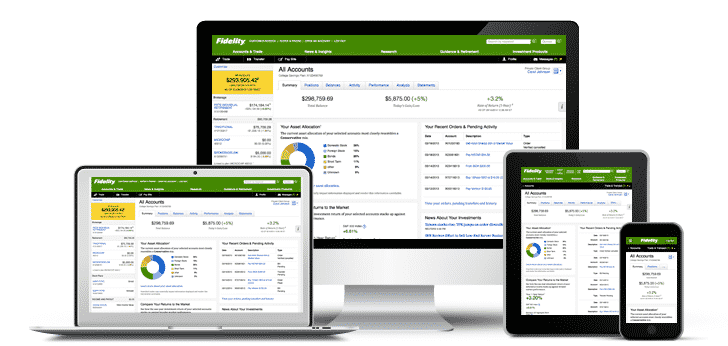

| ✅ Platforms & Tools: Desktop, mobile and web-based platforms are available through Fidelity. Active Trader Pro, which serves active traders, has both a downloadable desktop and web-based platform that are well-designed and intuitive to navigate. Wealth Lab Pro provides traders that ability to customize strategies. | ❌ High Activity Minimums: To access Fidelity’s Active Trader Pro platform, traders must execute thirty six traders for each 12 month period ongoing. |

✅ Customer Support: Fidelity supports an extensive list of tradeable securities:

| |

✅ Commissions: Fidelity charges:

These costs are not the lowest in the industry but are reasonable given the full-service offering provided. | |

| ✅ Customer Support: Fidelity distinguishes itself from its peers by rewarding active traders with dedicated trading specialists around the clock 7 days a week. Fidelity’s phone support is as good as any brokerage firm in the industry, and available 24/7. Live Chat and Email are also available as well as in branch support, including free investment seminars. Educational webinars and courses are designed and segmented well to target clients by experience and category. | |

| ✅ Mobile Trading: Mobile solutions provide a quality experience and cater to both Apple and Android regardless of device: phone, tablet or watch. |

Fidelity Securities

Fidelity caters primarily to mutual fund investors as well as stock and options traders but traders looking to transact in options may find a better fit at thinkorswim® or tastyworks, which were specifically built with options traders in mind.

- Stocks

- Options

- Bonds

- Mutual funds

- Forex

- Pink Sheets (OTCBB)

- Certificates of Deposit (CDs)

- DRIPs

How a 300-square-mile stretch of America's Heartland could power a multi-billion-dollar tech boom… and create a new generation of American millionaires

Learn more here.

Fidelity Fees

Fidelity has an industry-leading fee schedule, particularly as it relates to options and stocks:

| Security | Fees |

| Stocks | $4.95 flat fee |

| Options | $4.95 + $0.65 per contract |

| Mutual Funds | Approximately 4,000 no-transaction-fee (NTF) mutual funds |

| Margin rate range | 4.00% – 8.83% |

| Broker-assisted trades | $32.95 |

| Account Minimum | $2,500 brokerage; $0 IRA |

| Fees | Inactivity Fees: $0 IRA Closure Fee: $50 Account Closing Fee: $50 |

Fidelity Platform Features

| Type | Capability |

| Desktop | YES (Active Trader Pro) |

| Web-based | YES (Active Trader Pro) |

| Mobile | YES (Phone, Tablet, Watch) |

| Virtual Trading | YES |

| Screeners | YES (Stocks, ETFs, Bonds, Mutual Funds, Options) |

| Customer support | Phone Support 24/7 Email Support Live Chat Support 180 Local branches |

| Real-time quotes | YES |

| Research | YES (Over 20+ research supported) |

| Chart Tools | YES (20+ drawing tools 160+ chart studies) |

| Commission-free ETFs | YES (90+) |

| No-transaction-fee Mutual Funds | YES (approximately 4,000) |

Fidelity Summary

Fidelity offers best-in-class research, exceptional customer support and very well-designed, intuitive platforms for desktop, web, and mobile (compatible with Apple and Android phones, tablets and watches).

Though fees are not the lowest in the industry, they are reasonable, particularly given the high quality of abundant services, local branch support, and educational offerings provided.

If you've struggled with trading techniques in the past and watched your mistakes affect your bottom line, you're not alone-but you can change that starting now!

I'm trading expert Thomas Wood and my e-guide, "Naked Trading Mastery" could give you the edge you need to make earning consistently easier than ever!

Get your free copy here!