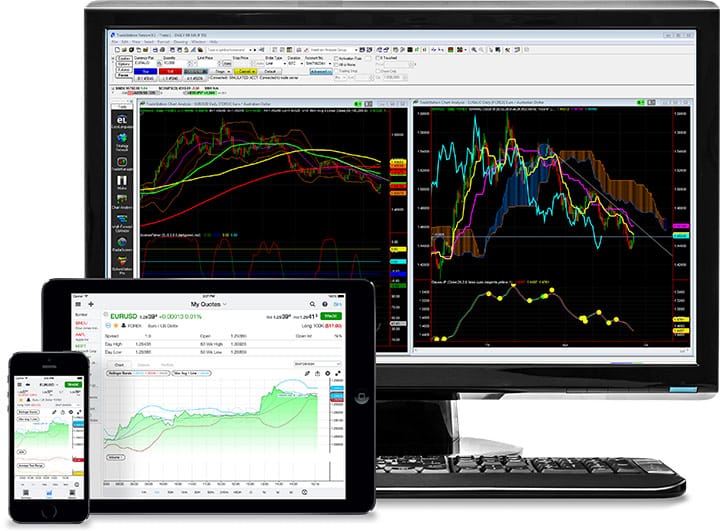

TradeStation is best known for offering a professional-grade, top notch trading platform with world class analytics software that targets active and experienced traders seeking to build, test, analyze, monitor and even automate custom stock, options and futures trading strategies.

Like thinkorswim®, TradeStation was founded by traders for traders; Bill and Ralph Cruz founded TradeStation for the purpose of automating their own trading strategies. And like thinkorswim®, the TradeStation trading platform is enormously powerful, serving both institutional customers as well as active retail traders, and featuring advanced customizable charting, back-testing and analysis capabilities.

TradeStation Spotlight

| TRADESTATION SPOTLIGHT | |

|

Investormint Rating 3.5 out of 5 stars |

via Tradestation secure site

|

TradeStation Customers

TradeStation trading platform is high-powered, customizable, and targets experienced and active traders.

TradeStation rewards highly active equities and options traders with rates as low as $5 per trade.

TradeStation trading platform is best for traders who are:

- Equities traders

- Options traders

- Futures traders

- Forex traders

- Active traders

- Self-directed

- Institutional traders

For options traders seeking to execute simple strategies like Covered Calls, Married Puts and Collar Trades and advanced options strategies, such as Iron Butterfly, Ratio Backspread and Combination Spreads, TradeStation has full order execution capability.

Professional-grade features that cater to experienced, data-driven traders, technology buffs and institutions may be intimidating to new traders, who might prefer a simpler trading platform to begin. Long-term, buy-and-hold investors should pay heed to the high monthly platform fee of $99.95 if certain minimums are not met.

TradeStation Promo Deal

TradeStation is offering a promo deal to new account holders:

- Save 20% on commissions up to $1,500

- Maximum commission rebate of $500 on an initial account funding balance <$100,000

- Maximum commission rebate of $1,000 on an initial account funding balance between $100,000 – $250,000

- Maximum commission rebate of $2,500 on an initial account funding balance > $2,500,000

➤ Free Guide: 5 Ways To Automate Your Retirement

TradeStation Pros and Cons

TradeStation has extensive research capabilities, fast and accurate order execution, a customizable trading platform supporting third party development using EasyLanguage but is costly to non-active traders and intimidating to new traders.

| TradeStation Pros | TradeStation Cons |

| ✅ Professional-grade Platform: TradeStation allows tech-savvy traders to develop customizable strategies using third party development using EasyLanguage. It provides highly advanced tools and charting capabilities as well as advanced back-testing features. Tools include Radar Screen, Scanner Matrix and Walk-forward Optimizer. | ❌ Costly For Less Active Traders: TradeStation has a monthly fee of $99.95 which is waived for active traders, who execute equities trades of at least 5,000 shares monthly and for options traders trading at least 50 contracts per month. |

| ✅ Extensive Research & Education: Tradestation has advanced research capabilities to back-test strategies plus TradeStation University has video tutorials on getting up to speed on the Tradestation platform as well as strategy trading, EasyLanguage and trading books. | ❌ Commission-free ETFs: TradeStation has no commission-free ETFs available. |

| ✅ Trading AppStore: TradeStation allows customers to develop trading apps via its own app store that can be sold to other customers. | ❌ Real-time Data Costs: For real-time S&P 500, NASDAQ, Dow Jones, Chicago Mercantile Exchange quotes, TradeStations charges a monthly fee that can be as high as $105. |

| ✅ Mobile Trading: TradeStation has received high marks in both Apple’s App Store and Google Play store for its easy to use mobile offering which includes mobile options spread support, stock alerts, push notifications, | |

| ✅ Fast & Accurate Order Execution: Active, experienced traders who want and need fast and accurate order execution will find TradeStation’s professional-trade trading platform delivers as expected. |

TradeStation Securities

TradeStation offers traders the following securities:

- Stocks

- Options

- Futures

- Forex

- ETFs

- Mutual Funds

- Bonds

TradeStation Fees

TradeStation has a complex fee structure that’s a puzzle to figure out.

| Security | Fees |

| Stocks & ETFs | $5 per trade |

| Options | $5 + $0.50 per contract |

| Futures | $1.20 per side per contract (<300 monthly contracts) $1.00 per side per contract (<301-1,000 monthly contracts) $0.65 per side per contract (<1,001-10,000 monthly contracts) $0.45 per side per contract (<10,001-20,000 monthly contracts) $0.25 per side per contract (<20,000+ monthly contracts) |

| Mutual Funds | $14.95 per trade |

| Margin rate range | 6.25%-8.50% |

| Bonds | $14.95 + $5 per bond |

| Broker-assisted trades | $20 |

| Account Balance Minimum | $5,000 regular account $5,500 IRA account |

| IRA Closure Fee | $50 |

TradeStation Platform Features

| Type | Capability |

| Desktop | YES |

| Mobile | YES |

| Customer support | Mon-Fri 8am-8pm ET Sun 3.30pm – Fri 8pm ET (technical support) Live Chat Email Support |

| Real-time data | S&P 500 data: $4 monthly Dow Jones: $2 monthly NASDAQ: as high as $16 monthly CME: as high as $105 monthly |

| Research | FREE |

| Chart Tools | FREE |

| Commission-free ETFs | None |

TradeStation Summary

TradeStation is ideal for active and technology-savvy traders who want a world class trading platform with professional-grade features, extensive research, advanced tools, and customizable trading strategies. Active traders are rewarded with significantly discounted commissions and fees.

Less active traders and new traders may find the platform more costly than alternatives such as tastyworks and thinkorswim®, and could be overwhelmed by the extensive suite of tools on offer.