| InvestorMint provides personal finance tools and insights to better inform your financial decisions. Our research is comprehensive, independent and well researched so you can have greater confidence in your financial choices. |

OptionsXpress was acquired by Charles Schwab Corporation in 2011. OptionsXpress has consistently been awarded top-star rankings in Barron’s Magazine, and been awarded top rankings by personal financial publications, including Forbes and Kiplinger’s.

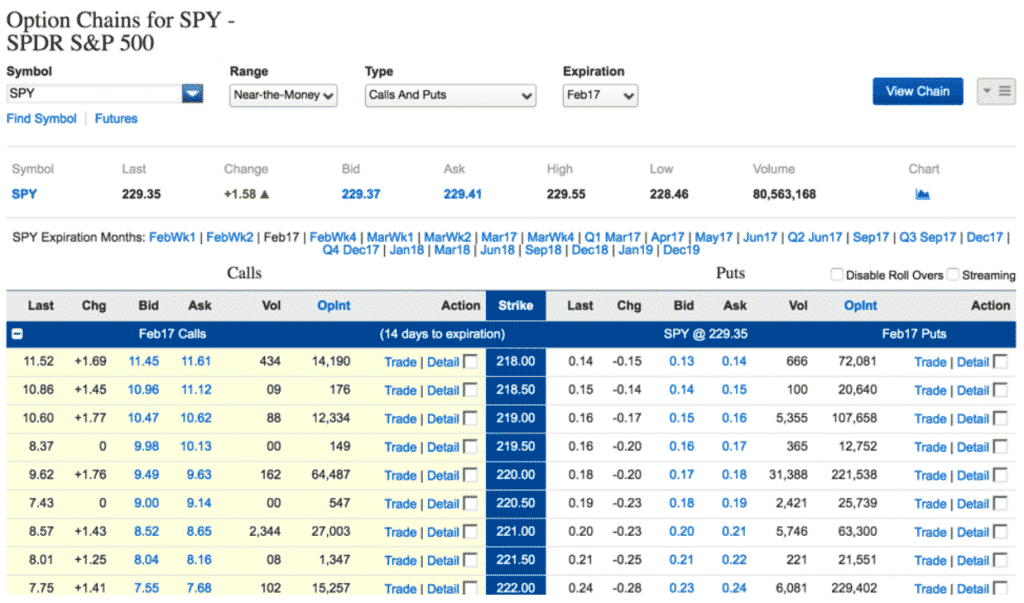

OptionsXpress as its name suggests has a core expertise in serving options traders. The trading platform caters to options traders of every level: beginners can find extensive training to get up to speed on basic options strategies and experienced options traders can place virtually any options strategy conceivable. Beyond options trading, OptionsXpress also serves futures traders well.

Rates are competitive, particularly for frequent traders who may enjoy volume discounts.

OptionsXpress Spotlight

| OPTIONSXPRESS SPOTLIGHT | |

InvestorMint Rating 4 out of 5 stars |

|

OptionsXpress Customers

OptionsXpress trading platform is best for active options traders as well as futures traders.

OptionsXpress has superb customer service features including live chat, phone and email support. When we called representatives by phone, we found them to be highly knowledgeable about advanced options strategies, capable of rapidly executing orders, and clearly articulating options trading strategies. Support staff are knowledgeable across the whole gamut of offerings from options to futures and from stocks to mutual funds. OptionsXpress trading platform is best for traders who are:

- Options traders

- Futures traders

- Stock traders

- Active traders

- Self-directed

Common options trading strategies may be executed on the OptionsXpress platform, including:

- Covered calls

- Married puts

- Collar Trades

- Ratio put backspread

- Ratio call backspread

- Iron butterfly

- Iron condor

- Bull put spreads

- Bear call spreads

- Credit spreads

- Debit spreads

- Bull call spread

- Bear put spread

- Combination trades

- Straddle

- Strangle

New traders will find OptionsXpress’s virtual trading platform an excellent testing ground to practice new options trading strategies. Although back-testing and customization isn’t as advanced as on the thinkorswim® trading platform, the OptionsXpress trading platform user interface is more friendly, especially for new traders.

This list ranks the top stocks daily based on our proprietary algorithm. FREE Bonus: 3 Stocks To Double This Year

View this list for FREE now!

OptionsXpress Promo Deal

OptionsXpress is offering a promo deal to new account holders:

- Get 50 free trades when you open an account with OptionsXpress and transfer $5,000

➤ Free Guide: 5 Ways To Automate Your Retirement

OptionsXpress Pros and Cons

OptionsXpress trading platform has pros and cons as described below.

| OptionsXpress Pros | OptionsXpress Cons |

| ✅ Options Trading: OptionsXpress trading platform has a core competency serving active options traders. The company has options in its DNA which means, unlike some better known brokers, OptionsXpress can typically serve you rapidly when placing advanced options trades, and their algorithms and staff have a deep understanding of margin implications for combination strategies. | ❌ Costly For New Options Traders: OptionsXpress targets experienced options traders and rewards them with volume discounts but new options traders are penalized with high cost structures that don’t compare favorably to discount brokers with deep options expertise like TastyWorks. |

| ✅ Virtual Trading Platform: OptionsXpress has an excellent virtual trading platform that simulates all the functionality of its real world trading platform. This allows for a risk-free opportunity to learn options strategies. | ❌ Mutual Funds Costs: Although OptionsXpress parent company, Schwab, has no-transaction-fee (NTF) mutual funds, OptionsXpress customers don’t receive the benefit. |

| ✅ Educational Resources: OptionsXpress hosts webinars, provides video on-demand education, and because Schwab owns OptionsXpress, you can also visit representatives in person at local branch offices. | ❌ Customization & Back-testing: For experienced traders looking to perform extensive back-tested simulations and custom scans and screens, OptionsXpress falls short compared to thinkorswim®. |

| ✅ Free Broker Assistance: Across the brokerage landscape, few brokers offer free trade execution assistance but OptionsXpress stands out among its peers in so doing. | |

| ✅ Automatic Order Optimization: Frequent traders will appreciate the Walk Limit feature from OptionsXpress that mitigates the need to track and adjust orders by doing so automatically. | |

| ✅ Trade Ideation Tools: What strategy is best in high volatility environments? How can you take advantage of quarterly earnings? What options strategy works best in a trending market? OptionsXpress provides suggestions to these and many other queries via its Idea Hub and Trade Pattern ideation tools. | |

| ✅ $0 Account Balance Minimum: No minimum account balance threshold applies to standard, taxable brokerage accounts but qualified IRA accounts have a $200 account balance minimum. |

OptionsXpress Securities

OptionsXpress caters to the following securities.

- Stocks

- Options

- Bonds

- Futures

- ETFs

- Mutual Funds

If you've struggled with trading techniques in the past and watched your mistakes affect your bottom line, you're not alone-but you can change that starting now!

I'm trading expert Thomas Wood and my e-guide, "Naked Trading Mastery" could give you the edge you need to make earning consistently easier than ever!

Get your free copy here!

OptionsXpress Fees

OptionsXpress fees are charged on trading transactions as follows.

| Security | Fees |

| Stocks | $4.95 Flat Rate |

| Options Standard Rate | $4.95 plus $0.65 per contract |

| Futures | $3.50 per contract |

| Mutual Funds | $9.95 + Load Fee |

| Margin rate range | 6.00%-8.25% |

| Transfer fees | $60 (outgoing account transfer) |

| Broker-assisted trades | $0 |

| Account Balance Minimum | $0 regular account< $200 IRA account |

| IRA Closing Fee | $50 |

OptionsXpress Platform Features

| Type | Capability |

| Desktop | YES |

| Mobile | YES |

| Customer support | Mon-Fri 7am-8pm ET Live Chat Support at local Schwab branch offices |

| Real-time data | FREE |

| Research | FREE |

| Chart Tools | FREE |

| ETFs | Commission-free ETFs from Schwab platform available to OptionsXpress customers |

OptionsXpress Summary

OptionsXpress targets active options traders, provides excellent ideation tools such as IdeaHub and Trade Pattern, offers no account balance minimums on non-qualified accounts and just $200 minimums on IRA accounts, has attractive volume discounts, extensive and capable support staff, and beyond options traders, serves futures trades and facilitates mutual fund investments too.

In times of inflation, gold prices have an inverse relationship with the markets, growing in value during market volatility. Amid economic instability, some retirement savers see precious metals, as an opportunity for profit and wealth preservation. Get the practical insights to take back control of your retirement with safe-haven assets like Gold & Silver.

Download the latest Global Gold Report, featured in Fortune Investors Guide.