This article may reference financial products from a multiplicity of our advertisers who may compensate us when you click on links to their products. To learn more, please visit our Advertising Policy page.

The American Express Premier Rewards Gold Card is designed for the frequent traveler who wants to avoid the hefty $450 fee associated with premier cards like the Chase Sapphire Reserve Card but still wants generous travel benefits.

No fee is applied for the first year and you earn 3x Membership Rewards® points on flights booked directly with airlines. Plus, you earn 2x points at U.S. restaurants, gas stations, and supermarkets, as well as 1x points on all other purchases.

Amex waives your annual fee in the first year but thereafter the cost is $195 annually. You also receive a $100 Airline Fee Credit each calendar year. And although you can’t use this to pay for flights, you can use it to pay for incidental costs like baggage fees.

The Premier Rewards Gold Card is a charge card so, unlike a credit card that permits the balance to roll forward monthly, you will need to pay your balance in full each month.

Where the Amex Premier Rewards Gold Card really shines is the Membership Rewards Program featuring bonus rewards points on airfares on partner airlines.

American Express Premier Rewards

Gold Card Spotlight

| AMERICAN EXPRESS REWARDS GOLD CARD SPOTLIGHT | |

InvestorMint Rating 4.5 out of 5 stars |

via Amex secure site |

American Express Premier Rewards

Gold Card Review Snapshot

One of the best perks of the Premier Rewards Gold Card is the opportunity to earn 3x points on flights booked directly with airlines.

Keep in mind that flight bookings through third party providers like Expedia, Kayak, and Orbitz will not qualify.

Another attractive feature for frequent travelers is that foreign transaction fees are waived.

Plus, you earn 25,000 points as a sign-up bonus after you spend $2,000 within the first 3 months.

This bonus translates to $250 when redeemed for flight expenses through Amex, meaning your first full annual fee is entirely covered.

| Feature | Description |

| Annual Fee | $195 ($0 into annual fee) |

| Annual Airline Fee Credit | $100 |

| Sign-up Bonus | 25,000 points |

| Flights Booked Directly With Airlines | 3X Points |

| U.S. restaurants, gas stations & supermarkets | 2X Points |

| All other purchases | 1X Points |

| Foreign Transaction Fees | $0 |

In times of inflation, gold prices have an inverse relationship with the markets, growing in value during market volatility. Amid economic instability, some retirement savers see precious metals, as an opportunity for profit and wealth preservation. Get the practical insights to take back control of your retirement with safe-haven assets like Gold & Silver.

Download the latest Global Gold Report, featured in Fortune Investors Guide.

Is The Amex Premier Rewards

Gold Card Right For You?

The American Express Premier Rewards Gold Card provides a good mix of benefits for the annual fee.

You don’t get all the benefits that a luxury card provides but you receive sufficient benefits to make the card compelling, especially if you want to avoid the hefty $450 fee associated with premier cards, such as:

- Chase Sapphire Reserve

- American Express Platinum

Best For Frequent Travelers

The Premier Rewards Gold Card may be a fit for frequent travelers who expect to spend around $3,334 or more annually.

When you multiply $3,334 * 3x points (which you receive when booking directly with airlines), you arrive at about 10,000 points which translates to $100.

And since you receive a $100 Airline Credit Fee already for incidentals like baggage fees, the full annual cost of $195 is covered by combining the two amounts with a few bucks left over for a cappuccino.

Best For Cardholders Who Regularly Pay Off Balances In Full

The Amex Premier Rewards Gold Card is best for people who tend to pay off card balances regularly each month because it is a charge card, meaning the full balance needs to be paid off every month.

American Express provides a Pay Over Time feature to some customers but don’t rely on that to extend your payments.

If you think there is a risk that you won’t be able to pay off your balance regularly then a credit card may be best.

Best For International Travelers

If you venture to foreign lands as part of a frequent travel schedule, the Premier Rewards Gold Card is well worth considering because foreign transaction fees are non-existent.

➤ Free Guide: 5 Ways To Automate Your Retirement

How To Maximize Rewards Using

The Premier Rewards Gold Card

When you pay using the Premier Rewards Gold Card, you earn Membership Rewards® points that can be:

- Redeemed for flights and hotel stays

- Used for gift cards, merchandise, and entertainment with over 500 brands

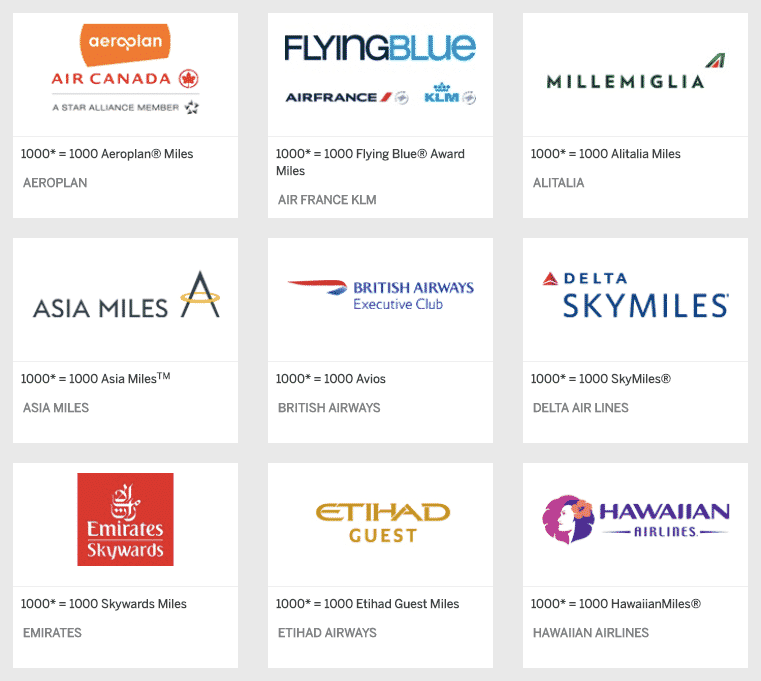

- Transferred to a wide variety of travel partners

To maximize your rewards points, it is usually best to transfer them to travel partners:

Redeeming Points For Travel

When you transfer your Membership Rewards, you can choose to enjoy more luxury or extend the value of your points.

For example, when you transfer your points to the KrisFlyer program by Singapore Airlines, you could enjoy a premium class experience.

Other airline programs will give you the chance to book economy flights with miles that could get you from one coast to the other of the United States for surprisingly few miles.

Redeeming Points For Entertainment

When you redeem points for concerts, sporting events, or theater events, your points don’t generally go as far.

For example, when you buy tickets through Ticketmaster or AXS, you will be able to convert each 10,000 points to just $50 of value.

Redeeming Points For Hotels

You can transfer Membership Rewards points to Starwood Preferred Guest, Hilton Honors, and Choice Privileges.

Hilton Honors has the most favorable conversion ratio while Starwood Preferred Guest has the least attractive.

| Membership Rewards® Points | Hilton Honors Points | Choice Privileges Points | Starwood Preferred Guest Points |

| 3 | 4.5 | 3 | 1 |

Redeeming Points Through Amex Travel Portal

You can view a full listing of how your Membership Rewards points convert to travel when booking through the Amex Travel portal later in this article.

But for the most part, flights booked through Amex Travel will convert on the basis of 10,000 points equating to $100.

Booking hotels, cruises, and vacations booked through Amex Travel isn’t as favorable because 10,000 points gets you $70 worth of value.

Redeeming Points When In New York

If you are living or visiting New York, your points can be used for New York city taxis whereby 10,000 points are worth $100.

Redeeming Points For Charitable Giving

You can even use your points for charitable giving using the MembersGive℠ program. The first 500,000 convert at a rate of $100 per 10,000 points.

In excess of 500,000 points, the conversion rate drops to $50.

Premier Rewards Gold Card

Travel Benefits

The Premier Rewards Gold card comes with generous benefits for the annual fee.

$100 Annual Airline Fee Credit

One of the best perks of the Premier Rewards Gold Card is the $100 annual airline fee credit.

This credit does not apply to flight costs themselves but it does apply to incidental fees like baggage fees.

You should see credits for qualifying purchases show up within 4 weeks on your statements.

$75 Hotel Credit

In addition to the hotel credit, you get 2x Membership Rewards® points on prepaid bookings.

Plus, you enjoy room upgrades at check-in if available.

No Foreign Transaction Fees

No matter where you travel abroad, you will enjoy the benefit of no foreign transaction fees when you charge purchases to your Premier Rewards Gold Card.

Baggage Insurance Plan

Eligible lost, damaged, or stolen baggage is covered under the Baggage Insurance Plan up to $500 for checked baggage and $1,250 for carry-on baggage.

New York State residents are covered to an aggregate maximum limit of $10,000 for all Covered Persons per Covered Trip.

Premium Roadside Assistance

The Amex Premier Rewards Gold Card comes with around-the-clock emergency roadside assistance if you need to jumpstart a battery or change a flat tire.

You also enjoy towing assistance for up to 10 miles.

The premium roadside assistance is available up to 4 times per year, even you use it in your driveway. For example, if you come back from vacation and discover the car won’t start, you can give Amex a call to request roadside support.

Personalized Travel Service

To save you the hassle of making travel arrangements, you will also receive a Personalized Travel Service to help you book flights, schedule ground transportation, or book hotels.

However, fees apply when you use the service for booking air travel.

Car Rental Loss & Damage Insurance

When you pay for an eligible rental car, you can still receive coverage in the event that the car is damaged or stolen even if you decline the collision damage waiver at the counter.

This coverage does not extend to car rentals in Australia, New Zealand, and Italy. Plus, some exclusions apply so it’s worth double checking ahead of time.

The rental car coverage provided by Amex does not extend to liability coverage.

Global Assist Hotline

A nice perk of the Premier Rewards Gold card is 24/7 access to medical, legal, financial, and other select emergency coordination and assistance services, including:

- Medical and legal referrals

- Missing luggage

- Passport replacement

- Cash wires assistance

When you travel more than 100 miles away from home, you have access to this Global Assist Hotline.

This has been one of the WORST years for stocks. But despite the awful trading conditions of the last eight months, I've delivered profit opportunities to my students like 22% on PBT after a week in the trade…And 31% on PEGA in only 8 days. I've JUST sent out a brand-new alert on a stock that's showing all the right signs of an impending breakout…

Click to Get the Trade and a Full Year of Stealth Trades for just $5 Today

Premier Rewards Gold Card

Shopping & Entertainment

Benefits

Along with travel and rewards benefits, the Premier Rewards Gold card comes with Shopping and Entertainment benefits.

Dropped Your Phone

One of the nice perks of the card is the Purchase Protection you enjoy when your purchases are damaged, stolen, or lost.

The coverage is for up to 90 days and capped at $50,000 per year and $10,000 per occurrence.

Return Protection

When you buy something that a merchant won’t take back, Return Protection may cover you for eligible items for up to 90 days.

You are limited to $300 per item and $1,000 per calendar year.

Only purchases made in the United States and its territories qualify for coverage.

Did Your Warranty Run Out?

When you buy an item with your Premier Rewards Gold Card that has a warranty, you are eligible for extended warranty coverage that matches the term length you already enjoy up to a 1 year limit.

The items must already come with an original U.S. manufacturer’s warranty of up to five years or less.

And coverage is limited to $50,000 per calendar year and $10,000 per item.

Shoprunner

At over 140 online stores, you are eligible for free 2-day shipping with Shoprunner.

To enroll, you will need to visit shoprunner.com/amex

Entertainment Access

Whether concert tours, Broadway tickets, or sporting events are your thing, Card Member-only events with exclusive access to ticket presales are a complimentary benefit of your card.

American Express Preferred Seating

Based on availability, you can gain access to premium seating at select cultural and sporting events.

How Does The Premier Rewards

Gold Card Stack Up?

Compared to the Barclaycard Arrival Plus® World Elite Mastercard® and the Blue Cash Preferred® from American Express, the American Express Premier Rewards Gold Card shines with its annual travel credit of $100 for incidental fees and 3x rewards rate when booking directly with airlines.

| Card | American Express Premier Rewards Gold

|

Barclaycard Arrival Plus® World Elite Mastercard®

|

Blue Cash Preferred® from American Express

|

| Annual Fee | $195 (waived 1st year) |

$89 (waived 1st year) |

$95 (waived 1st year) |

| Annual Travel Credit For Incidental Fees | $100 | $0 | $0 |

| Foreign Transaction Fee | $0 | $0 | 2.7% |

| Best Rewards Rate | 3X Points (Direct airline bookings) |

2 miles per dollar (unlimited) |

6% Cashback (Supermarkets) |

| Points On Other Purchases | 2X (restaurants, gas stations, supermarkets) 1X (other purchases) |

2X (miles on all purchases) |

3% Cashback (gas stations & department stores) 1% Cashback (all other purchases) |

| Sign-up Bonus Points | 25,000 | 40,000 | $200 |

| % Rewards Range | 1% → 3% | 1% → 2.1% | 1% → 6% |

| Customer Credit | Good → Excellent | Excellent | Good → Excellent |

If you travel less frequently but spend more heavily at grocery stores, the Blue Cash Preferred® card from American Express may be a better fit.

The Barclaycard Arrival Plus® World Elite Mastercard® competes well with the American Express Premier Rewards Gold Card because both charge zero transaction fees and the rewards rate is double the industry rate. Plus, both cards waive the annual fee for the first year.

American Express Premier

Rewards Gold Pros and Cons

| American Express Premier Rewards Gold Pros | American Express Premier Rewards Gold Cons |

| ✅ High Rewards Rate: Earn 3x rewards when booking directly with airlines, 2x rewards at supermarkets, gas stations, and restaurants, and 1x rewards on all other purchases. | ❌ Ongoing Annual Fee: After year one, the annual fee is $195 though if you travel frequently you can likely offset $100 of that with the airline travel credit. |

| ✅ $100 Airline Credit Fee: The airline credit fee can be counted against incidental fees like baggage fees. | ❌ Late Fees: A $38 late fee or 2.99%, whichever is greater, applies to late payments. |

| ✅ No Foreign Transaction Fees: When traveling abroad, no foreign transaction fees apply. | ❌ Payment Acceptance: American Express isn’t as widely accepted as Visa and Mastercard. |

| ✅ $75 Hotel Credit: Qualifying charges enjoy a $75 hotel credit as well as a free upgrade upon checking in where available. | ❌ Only Good Credit Users: Cardmember credit ratings usually need to be good → excellent in order to be approved. |

| ✅ $0 Fee In 1st Year: The annual fee is $195 after the first year but new cardmembers enjoy a $0 fee in the first year. | |

| ✅ Sign-up Bonus: Earn 25,000 Membership Rewards points after spending $2,000 in first 3 months. | |

| ✅ Interest Rate: Because the Premier Rewards Gold Card is a charge card, an interest rate does not apply as long as the balance is paid off in full each month. | |

| ✅ Personalized Travel Services: Receive a Personalized Travel Service to help you book flights, schedule ground transportation, or book hotels. | |

| ✅ Extensive Network Of Transfer Partners: You can transfer your points to a wide variety of partners and stretch your points even further. |

Premier Rewards Gold Card Fees

You will be charged a “returned late payment fee” of up to $38 and late fees of $38 or 2.99%, whichever is higher.

Plus, the annual fee is $195 after the first year, which is free.

| Fees | Amount |

| Late Fees | $38 or 2.99% (whichever is greater) |

| Annual Fees | $195 ($0 for the 1st year) |

| Returned Late Payment Fee | Up to $38 |

| Foreign Transaction Fees | $0 |

Premier Rewards Gold Card FAQ

| FAQ | YES/NO |

| If I have a credit score under 690 can I get the card? | Unlikely |

| Are foreign transaction fees charged? | NO |

| Is purchase protection included? | YES |

| Is rental car collision coverage provided? | YES |

| Will it help me build my credit? | YES |

| Is is a charge card or credit card? | Charge card |

Premier Rewards Gold Card Review

The Premier Rewards Gold Card by American Express is best for cardmembers who travel frequently.

If you travel on planes often, the $100 airline credit fee can be used to offset incidental travel fees like baggage costs, airport lounge day passes and in-flight refreshments but you can’t use it to book flights directly.

Once you arrive at your destination, you will pay no foreign transaction fees abroad.

Another nice perk of the Premier Rewards Gold Card is the credit of $75 on dining, spa, and resort expenses when you spend at least 2 consecutive nights at a hotel that is a part of an American Express Hotel Collection.

When you book directly with airlines, you earn 3x points and can transfer Membership Rewards to an extensive network of hotels and airlines, which can often be exchanged on a 1:1 basis.

Plus, the sign up bonus of 25,000 points and $0 intro annual fee makes the card compelling for frequent travelers.

Keep in mind the balance must be paid off monthly as the Premier Rewards Gold Card is designed as a charge card so late fees apply if you don’t pay off your full balance.

How Much Are Membership Rewards® Points Worth?

To keep things simple, let’s say you had 10,000 Membership Rewards® points that could be used towards gift cards, shopping, travel, entertainment, point-of-sale, or even charity, how much are they worth in each category?

Gift Cards

| Air & Lodging | Points Value |

| Aria Resort & Casino | $100 |

| Bellagio Las Vegas | $100 |

| Best Western | $85 |

| Carnival | $100 |

| Delta Air Lines | $70 |

| Fairmont Hotel & Resorts | $100 |

| Hilton | $70 |

| Hotels.com | $70 |

| Mandalay Bay Resort & Casino | $100 |

| Mandarin Oriental Hotel Group | $85 |

| Marriott® | $70 |

| MGM Grand Hotel & Casino | $100 |

| MGM Resorts International | $100 |

| The Ritz Carlton® | $70 |

| Uber | $70 |

Somewhat surprisingly, an American Express Gift Card can only be converted to value of $50.

But you can exchange your points on standard car & rail services as follows:

| Car & Rail | Points Value |

| Amtrak® | $100 |

| Avis® | $100 |

| Enterprise Rent-A-Car® | $100 |

| Express Rewards® Gas Card | $50 |

| Hertz® | $100 |

| Mercedes-Benz | $100 |

Amex has partnered with a wide range of Dining partners where your 10,000 points can be converted according the following listing:

| Dining | Points Value |

| Benihana | $100 |

| Bonefish Grill | $100 |

| California Pizza Kitchen | $100 |

| Chili’s® Grill & Bar | $100 |

| Fleming’s® Prime Steakhouse & Wine Bar | $100 |

| Legal Sea Foods | $100 |

| Lettuce Entertain You® Enterprises, Inc. | $100 |

| Maggiano’s Little Italy® | $100 |

| Morton’s The Steakhouse® | $100 |

| OpenTable® | $70 |

| P.F. Chang’s® | $100 |

| Ruth’s Chris Steak House® | $100 |

| Seasons 52 | $100 |

| Starbucks | $70 |

| The Capital Grille® | $100 |

| The Cheesecake Factory® | $85 |

If you’re an adventurer, points can be converted a wide range of experiences including to ski resorts.

| Experience | Points Value |

| Aspen Snowmass | $70 |

| Express Rewards® Golf Card | $50 |

| Jackson Hole® Mountain Resort | $100 |

| Snowshoe Mountain | $100 |

| Steamboat Ski Resort | $100 |

| Stratton Mountain Ski Resort | $100 |

| Winter Park Resort | $100 |

When you purchase gift cards at the following retail outlets, 10,000 Membership Rewards points convert to the following values:

| Retail | Points Value |

| Athleta | $100 |

| Banana Republic | $100 |

| Barnes & Noble | $100 |

| Bath & Body Works® | $100 |

| Bergdorf Goodman | $100 |

| Brooks Brothers | $100 |

| Coach | $100 |

| Cole Haan | $100 |

| Crate & Barrel | $100 |

| $85 | |

| Gap | $100 |

| Intermix | $100 |

| iTunes® | $85 |

| Macy’s | $85 |

| Neiman Marcus | $100 |

| Nike | $100 |

| Nordstrom | $85 |

| Old Navy | $100 |

| The Gap Inc., Brands Options | $100 |

| Pottery Barn® | $100 |

| pottery barn kids® | $100 |

| PBteen® | $100 |

| Ralph Lauren | $100 |

| REI | $100 |

| Restoration Hardware | $100 |

| Saks Fifth Avenue | $100 |

| Sam’s Club | $70 |

| SpaFinder Wellness 365 | $100 |

| Sephora | $85 |

| Staples | $100 |

| Target | $70 |

| The Home Depot® | $100 |

| Tiffany & Co. | $100 |

| Victoria’s Secret | $100 |

| Walmart | $70 |

| west elm® | $100 |

| Williams Sonoma® | $100 |

| Zappos.com | $100 |

Shopping

When you shop at popular online retailers, you can use your points too.

| Merchant Partner | Points Value |

| Shop At Merchant Partners With Member Rewards Points | $50 |

| Shop With Points at Amazon | $70 |

| Transfer Points to Plenti℠ | Plenti determines how many points are required to be used for savings at checkout with certain Plenti partners |

| BestBuy.com® | $70 |

| Newegg.com | $70 |

| Staples.com | $70 |

| Boxed.com | $70 |

| Grubhub | $70 |

| Seamless | $70 |

| Amex Express Checkout | $70 |

Travel

When you book flights, reserve prepaid hotels, take cruises, or plan vacations and charge the expenses through American Express Travel, the points values are as follows:

| Travel | Points Value |

| Flights charged through American Express Travel | $100 |

| Reserve Prepaid Hotels charged through American Express Travel | $70 |

| Cruises charged through American Express Travel | $70 |

| Vacations charged through American Express Travel | $70 |

| Excise Tax Offset Fee | $50 |

| Expedia.com | $70 |

Entertainment

You can buy tickets to sports events, concerts, and theater events among others through Ticketmaster and AXS using points. And 10,000 points converts as follows:

| Entertainment | Points Value |

|

$50 |

|

$50 |

Point Of Sale

| Point Of Sale | Points Value |

| New York City Taxis | $100 |

| Rite Aid | $70 |

Charity Donations

| Charitable Giving | Points Value |

| MembersGive℠ Up to 1st 500,000 points | $100 |

| MembersGive℠ In Excess Of 500,000 points | $50 |

The SV Bank collapse marked the second-largest U.S. bank to close since the Great Recession…'God have mercy on us all': Robert Kiyosaki warned.

Kiyosaki is turning to gold and silver — a popular hedge against inflation. Gold can't be printed out of thin air like fiat money and it's value is largely unaffected by economic events.

'I'm buying gold because I don't trust the Fed," he said.

source: yahoo!news

Ready to dump your paper assets? Get Your Free Gold & Silver Guide Now

Leave a Reply