Real estate investment is a popular method of building wealth, but most average investors aren’t financially able to bankroll large developments alone.

Fortunately, there is an alternative. Real Estate Investment Trusts (REITs) offer an opportunity to pool your money with other investors to purchase and/or manage income-producing properties.

What is a REIT?

The concept of an REIT is similar to that of a mutual fund. The REIT manager handles the logistics of buying, managing, and selling real estate. Investors buy shares of the REIT, and income generated from the real estate holdings is returned to shareholders.

Because REITs are eligible for special tax treatment, they must meet certain IRS requirements to qualify in this category.

- The REIT must be organized as a corporation

- It must have a managing board of directors

- There must be a minimum of 100 shareholders

- No more than 50% of an REIT’s shares can be held by five or fewer individual shareholders

- A minimum of 75% of the REIT’s assets must be in real estate, cash, or US Treasuries

- At least 75% of an REIT’s net income must come from real estate

- At least 95% of an REIT’s income must be passive – for example, rental payments

- At minimum, 90% of taxable income must be paid to shareholders as dividends

Of course, the biggest question for investors is which REIT is most likely to generate the highest dividends?

How Many REITs Exist In North America?

Choosing the best REIT can be overwhelming. According to IRS records, approximately 1,100 REITs have filed tax returns. Of these, more than 225 US REITs are registered with the SEC to trade on major stock exchanges.

Most can be bought and sold on the NYSE. As a group, these REITs have more than $1 trillion in market capitalization.

With numbers like that, it simply isn’t practical to conduct research on all of them before making an investment decision.

Though bigger isn’t always better, understanding which REITs are largest can make it easier to select your investment. After all, size can be an indication of success in some cases. In others, it can be an indication of investors’ faith in the REIT.

These are five of the largest REITs in the United States today:

- American Tower – American Tower is the biggest REIT in the world when measured by market cap. Currently, this figure comes in at $74.0 billion. American Tower dates back to 1995, though it didn’t become an official REIT until 2012. It is headquartered in Massachusetts, and it owns and/or manages more than 170,000 global communications sites.

- Simon Property Group – Founded in 1993, Simon Property Group now has a market cap of $55.2 billion. This REIT is headquartered in Indiana, and it is primarily focused on retail properties. Simon Property Group is the largest US REIT by revenue, and it is the largest US operator of shopping malls.

- Crown Castle International Corporation – With a market cap of $42.5 billion, this Texas REIT is a leader in communications infrastructure. Crown Castle owns and/or operates more than 40,000 cell towers, as well as approximately 60,000 miles of fiber. It was founded in 1994, at the very start of the digital revolution, and there is room for growth as more smart devices come to market.

- Public Storage – You don’t have to be a Storage Wars fan to know that finding space to house unneeded items is a challenge. Public Storage stepped up with a solution. Since it was founded in 1977, this company has become the largest self-storage brand in the country with a market cap of $38 billion. It owns more storage facilities than any of its competitors, and in 2017, Public Storage earned double the amount brought in by its next-closest rival. This REIT is headquartered in California.

- ProLogis – This REIT targets industrial real estate, and it currently has a market cap of $34.1 billion. ProLogis was founded in 1983, and its headquarters are located in California. Today, ProLogis is considered the largest owner of warehouses and distribution centers in the world. Globally, it owns and/or operates around 3,300 facilities.

Though these five are currently the largest, they don’t represent the diversity available in REIT investing.

You can choose to focus your real estate investment dollars on health care facilities, office space, senior living centers, timberlands, and so forth.

Some REITs don’t specialize in a specific type of real estate. Instead, they own and/or operate properties used for a variety of purposes in an effort to mitigate the risk of losses if one industry experiences economic challenges.

Biden's disturbing new government program may be worse than Obama's. You are at risk for having your bank account frozen. A former bank regulator is blowing the whistle on Biden's frightening plan to take over your money.

Discover the immediate steps you need to take now.

How To Invest in REITs

Much like investing in mutual funds or trading individual stocks, the first step in buying REIT shares is opening a brokerage account.

Once your account is established and funded, you can trade shares as you would any other publicly traded investment.

The beauty of REIT investing is that you can build a passive income stream. Profits are paid out in dividends on a regular basis, so you can grow your wealth with additional investments.

➤ Free Guide: 5 Ways To Automate Your Retirement

REIT Alternatives

You don’t have to invest in a REIT to get exposure to real estate as an asset class. Other alternatives to REIT investing are available these days through real estate crowdfunding platforms.

Crowdstreet, Rich Uncles, and Fundrise, are just a handful of the many property marketplaces that allow individuals, both accredited and unaccredited, to get on the property ladder without the upfront cost.

| CROWDSTREET SPOTLIGHT | |

Investormint Rating 4.5 out of 5 stars |

via Crowdstreet secure site |

The SV Bank collapse marked the second-largest U.S. bank to close since the Great Recession…'God have mercy on us all': Robert Kiyosaki warned.

Kiyosaki is turning to gold and silver — a popular hedge against inflation. Gold can't be printed out of thin air like fiat money and it's value is largely unaffected by economic events.

'I'm buying gold because I don't trust the Fed," he said.

source: yahoo!news

Ready to dump your paper assets? Get Your Free Gold & Silver Guide Now

Similar to REITs, you don’t actually need to get your hands dirty and manage tenants when you invest in any of the deals on these sites.

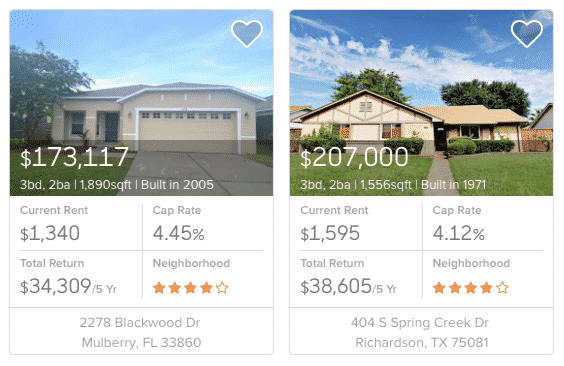

However, some investors like the idea of owning property outright and if you fall into that category but want to outsource the management of the property you own, Roofstock is the best place to begin.

Roofstock includes some perks, such as:

Every House Is Certified

A national inspection firm conducts a multi-point property inspection to assess habitability, risk, and safety.

Properties are examined both internally and externally.

Roofstock Negotiates List Prices For You

If you hate the idea of haggling over prices when you buy an investment property, Roofstock will be the answer to your prayers because it conducts the list price negotiation after performing a property evaluation and rental market analysis.

Certified Property Managers

Roofstock further simplifies the process of buying investment property by finding and certifying local property managers.

Roofstock Features

| Property Purchases Made Easy | 100% Online |

|---|---|

| Minimum Downpayment | 20% |

| Geographic Diversification | Nationwide |

| Property Type | Residential |

| Buyer Fees | 0.50% |

| Non-accredited Investors | ✅ |

| Passive Income | ✅ |

| Pre-Screened Property Managers | ✅ |

| 30-Day Guarantee | ✅ |

We could be facing one of the harshest economic challenges ever experienced thanks to an incompetent government and severe global unrest. If you aren't proactive, you could see yourself and your family become another financial casualty. But, the Inflation Survival Plan has you covered. Learn insider tips and tricks, IRS loopholes and more that will help your finances soar.

Take 15 Seconds to get the FREE Inflation Survival Plan and ensure your family's financial security.