Fundrise is an online platform that matches investors with real estate investment opportunities. So you might be wondering is Fundrise a REIT?

A lot of similarities exist when we compare Fundrise Vs REIT investments. Both make real estate investing affordable and accessible to non high-net worth individuals.

And it’s possible to invest in residential real estate, commercial property, and single family homes through both Fundrise and REITs.

But Fundrise is much more than a traditional real estate investment trust. It offers an eREIT as part of its product lineup as well as an eFund, which aims to buy land and develop properties for residential homeowners.

Plus, Fundrise makes it easy to track investment performance day and night via its online dashboard. So is Fundrise worth investing in? We compare fees, returns, tax implications, and investment minimums to help you make a more informed decision.

REIT vs Fundrise Comparison

| Real Estate Investing | Fundrise | REIT |

| Reviews | Fundrise Review | REIT Review |

| Minimum Investment | $500 → $1,000 | Varies |

| Dividend Frequency | Quarterly | N/A |

| Fees | 1% | ~1% |

| Non-Accredited Investors | ✅ | ✅ |

| Diversified Investments | ✅ | ✅ |

| Passive Income | ✅ | ✅ |

| Liquidity | ❌ | ✅ |

| Leverage | ✅ | ✅ |

| Tangible Asset | ✅ | ✅ |

Why Choose REIT or Fundrise

A big attraction to Fundrise or REIT investments is the diversification they offer away from the stock market.

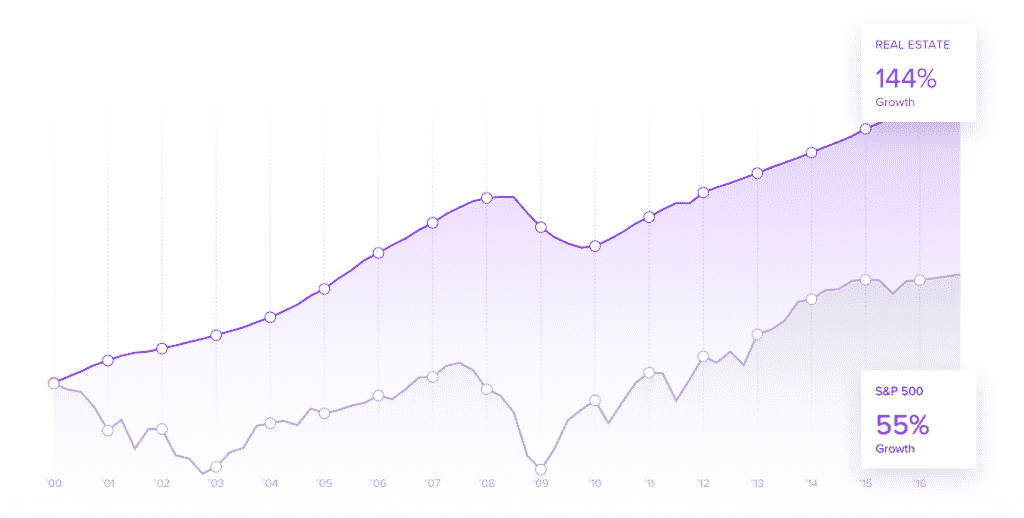

Real estate returns compared to stock market returns have been impressive this century.

Rich Uncles, an online real estate crowdfunding site that specializes in commercial real estate, researched the total stock market returns from 2000 → 2016 and compared them to real estate returns.

The research showed that real estate returns of 144% far eclipsed S&P 500 performance returns, which produced a gain of 55%.

Over different time periods, the stock market performance has beaten the returns of real estate. Nevertheless, the diversification into real estate as an asset class can be a boon for investor portfolios.

If you already have exposure to the stock market, it makes a lot of sense to diversify into real estate but how? Below we compare Fundrise vs REIT investments on key factors like investment minimums, taxes, and fees.

Biden's not holding back... He's warned you that he plans to raise: Income taxes, death taxes, capital gains taxes & corporate taxes. Some or all of which WILL affect you or your family in one way or another... But it's not too late... yet.

Thousands of Americans are getting their FREE IRS LOOPHOLE KIT to discover the secret to protecting your retirement savings from Biden, and inflation...

CLICK HERE to request a FREE Copy of the Guide To IRS Loopholes For Your IRA/401(k)

What Is a REIT?

A REIT is a real estate investment trust that makes equity or debt investments in commercial real estate.

They are aimed at individual investors seeking passive income and are a way to gain exposure to real estate without actually purchasing a property outright

Typically, they are very liquid so investors can cash out when they wish and investors are shouldered with none of the usual burdens of managing property.

REITs usually fall into one of three buckets:

- Private REITs

- Public REITs

- Public non-traded REITs

Private REITs usually have higher minimums so most investors are left to choose between publicly traded REITs or public non-traded REITs.

➤ Free Guide: 5 Ways To Automate Your Retirement

What Is Fundrise?

Fundrise is an online real estate company that enables investors to buy a share of residential and commercial properties.

Investors pool money so they can afford properties that may otherwise have been too expensive for any single investor.

Fundrise investors enjoy many of the similar benefits afforded to REIT investors, such as:

- Passive income

- No expertise needed

- Regular cash flow

- Diversification

Fundrise features two main products.

- eREITs, which are income-producing private real estate investment trusts

- eFunds, which pool investors’ money to buy and develop land and housing

>> See The Best Real Estate Crowdfunding Sites

Fundrise vs REIT

Investment Minimums

REIT Investment Minimum

REITs are one of the most accessible ways to invest in real estate, which is why investment minimums are generally low.

Typically, publicly traded REITs usually carry lower minimums than private REITs.

The investment minimums can be as low as $1,000 or even less in spite of high acquisition costs and operational expenses.

Fundrise Investment Minimum

The Fundrise investment minimum is between $500 to $1,000.

- eREIT minimum: $1,000

- eFund minimum: $500

How a 300-square-mile stretch of America's Heartland could power a multi-billion-dollar tech boom… and create a new generation of American millionaires

Learn more here.

Fundrise Fees vs REIT Fees

Fundrise Fees

Fundrise charges a management fee of 0.85% and an advisory fee of 0.15% for a total fee charge of 1% annually.

How Much Are REIT Fees?

The fees to manage REITs are usually in the ballpark of 0.50% annually.

This the charge applied to manage trust assets, and excludes other expenses that may apply.

| REIT Vs Fundrise | Fees |

| REIT Management Fee | ~0.50% |

| Fundrise Management Fee | 0.85% |

| Fundrise Advisory Fee | 0.15% |

Fundrise & REIT

Investment Strategy

REIT Investments

REIT Investment strategies can vary widely but generally aim to benefit investors by providing diversification, regular cash flow and tax benefits.

Solo investors in rental properties would find it very difficult to replicate the diversification possible through a REIT, which may have hundreds of properties under its umbrella.

An individual may find returns impacted significantly if a single property needs extensive renovation or repairs whereas a REIT property that requires capital investment may only slightly affect overall returns.

REIT investments generally offer a steady flow of dividends monthly. The monthly or quarterly distributions are ideal for investors seeking passive income.

Legally, REITs must distribute at least 90% of their taxable income but investors can claim a 20% tax deduction from earnings from loan interest.

REITs also avoid double taxation at the company and individual investor level.

Fundrise Investments

The portfolio options include:

- Starter

- Supplemental Income

- Balanced Investing

- Long-term Growth

In each portfolio is a mix of eREITs and eFunds. The mix and selection is decided by Fundrise.

>> Check Out Real Estate Investing For Dummies

Fundrise Returns vs REIT Returns

Fundrise Returns

Net of fees, Fundrise returns have been:

| Year | Fundrise Performance |

| 2017 | 11.44% |

| 2016 | 8.76% |

| 2015 | 12.42% |

| 2014 | 12.25% |

REIT Returns

According to REIT.com, total returns for REITs last year averaged 9.27%.

REIT vs Fundrise:

Which Is Better?

| REIT Wins | Fundrise Wins |

| ✅ Low Investment Minimum: Publicly traded REITs have low investment minimums, generally lower than ones imposed by private REITs such as those operated by Fundrise. | ✅ Passive Income: Investors seeking regular cash flow can receive dividends quarterly from Fundrise. |

| ✅ Liquidity: REIT shares can be bought or sold freely in public markets, so access to cash is simple and fast. | ✅ Product Selection: Fundrise offers more than REIT products – it also offers an eFund which is aimed at investors who want exposure to residential development opportunities. |

| ✅ Low Fees: Management fees for public REITs tend to be around 0.50% compared to 0.85% for Fundrise. | ✅ Track Investments: Unlike publicly traded REITs, Fundrise provides an online dashboard to track investments 24/7. |

| ✅ Tax Deduction: REIT investors can claim a 20% tax deduction from earnings. | ✅ Returns: The returns generated by Fundrise have historically eclipsed the average returns of publicly traded REITs. |

REIT vs Fundrise

Comparison Summary

Fundrise costs more than the average publicly traded REIT but it has also generated higher returns.

For investors who prioritize performance, Fundrise may be a better match – though future returns cannot be guaranteed.

The drawback of investing with Fundrise is your money is tied up whereas in a publicly traded REIT you can cash out anytime.

What Fundrise lacks in liquidity it makes up for in product selection. Beyond REITs, an eFund offers investment opportunities in land and development for sale to residential homeowners.

It’s also possible to track investments day or night via the Fundrise dashboard, a luxury not available to REIT investors.

Overall Fundrise has earned its stripes as one of the best real estate crowdfunding sites online so if you are eager to diversify away from the stock market it is well worth checking out.

Rising interest rates...Skyrocketing inflation...Exploding debt...A looming recession...It's no wonder Americans are becoming more and more concerned about their savings and investments. That's why I wrote my newest report…This FREE REPORT shows YOU how you could protect your retirement savings before it's too late. Request your free report today and learn how you could protect everything you've worked for!

Request Your FREE Ben Stein Report Today!