Uber stock may not be traded publicly yet but that doesn’t mean you can’t own a piece of the ridesharing app.

Historically, it was only possible to invest in private companies like Uber before their Initial Public Offerings (IPOs) if you were an institutional investor or a high net worth private client.

But what if you are an ordinary Joe or Jane investor wanting to own shares of the ridesharing app that has innovated in the formerly stodgy industry of ground transportation? How do you get a piece of the pie?

As it turns out, a lot of investment avenues are open to prospective Uber investors but first you should have clear reasons why you want to invest in Uber.

Why Invest In Uber Stock?

Like any company you invest in, you should have an investment thesis about why you want to exchange your hard-earned money for shares of stock. The best investors in the world have conviction in a thesis, meaning when the investment horizon sours you still have faith in your investment.

If you owned shares of Facebook, your investment thesis may be based on the network effect whereby the community of users are highly engaged with the platform and even those who want to leave are often drawn back because their friends are still on the social networking site.

Alphabet shareholders may buy into an investment thesis that Google holds a dominant market share position in the search industry which makes it nearly impossible for a competitor to dislodge them from their perch.

And Amazon stock owners might have conviction knowing that the company has acquired almost 1 in every 2 American households as Prime members and has been responsible for putting many brand name retailers out of business thanks to perceived low cost goods and services, and fast delivery times.

But why invest in Uber stock? Like Facebook, Uber enjoys a network effect advantage. It has a marketplace business that features both riders and drivers. When more drivers are on the platform and more riders hail vehicles, Uber can commoditize transportation prices in any given city.

If Uber launched in a city with nine other competitors, the other ridesharing companies would likely charge different prices and it would be difficult to build a dominant market share position and a brand name.

Beyond a simple investment thesis, you should have deeper insight into Uber financials to see how the company is growing revenues and cash, how much it is spending, and how much it is generating in profits or losses.

Uber Financials:

Income Statement

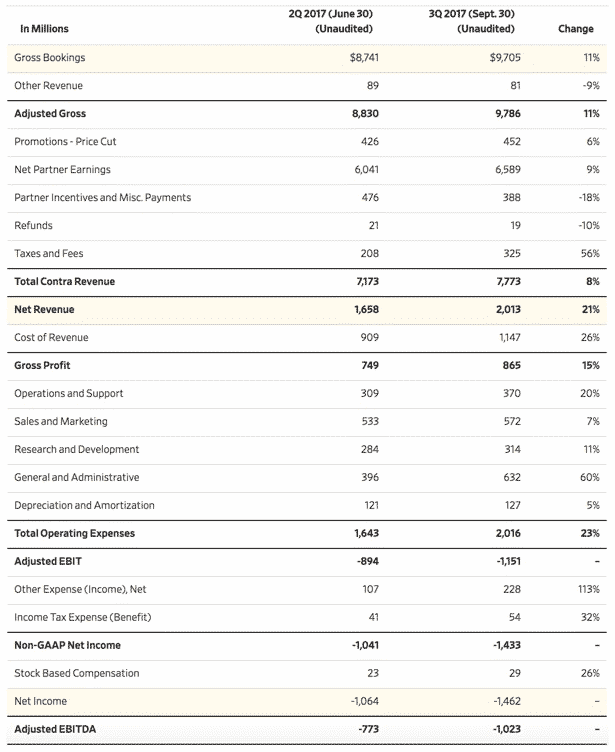

Although Uber is not required to disclose its financial records as a privately held company, the Wall Street Journal did get a hold of and report on its quarterly statements.

Gross bookings for Uber are the sum of its trips before Uber takes its cut. When gross bookings increase it means overall demand for rides as well as freight and food deliveries are on the rise. During the second and third quarters of 2017, Uber grew bookings by 11% compared to 17% in the first and second periods.

After paying its drivers, Uber keeps its share of revenues, which are called net revenues. The growth rate in net revenues during the same period last year was 21%, which is higher than the growth in bookings. The reason Uber grew net revenues faster than gross bookings is because it reduced incentive payments to drivers, which it calls net partner earnings.

During the third quarter in 2017, Uber grew quarterly revenues to $2 billion for the first time. By comparison, it took Facebook nine years to cross this threshold when it was growing quarterly revenues at a pace of 11%.

Source: Wall Street Journal

But revenue growth alone is not sufficient to make a company successful. While Uber has prioritized growth globally in order to establish a market share in cities worldwide and prevent competitors from gaining traction, it needs to earn a profit in the foreseeable future or risk further eroding its cash reserves.

As a company that commoditizes prices in its industry, Uber constantly faces price wars in the cities in which it operates. Facing battles with competitors, like Lyft and Didi Chuxing, Uber has sacrificed earnings for growth and lost a whopping $1 billion in the third quarter of 2017.

Rising interest rates...Skyrocketing inflation...Exploding debt...A looming recession...It's no wonder Americans are becoming more and more concerned about their savings and investments. That's why I wrote my newest report…This FREE REPORT shows YOU how you could protect your retirement savings before it's too late. Request your free report today and learn how you could protect everything you've worked for!

Request Your FREE Ben Stein Report Today!

Uber Funding Rounds

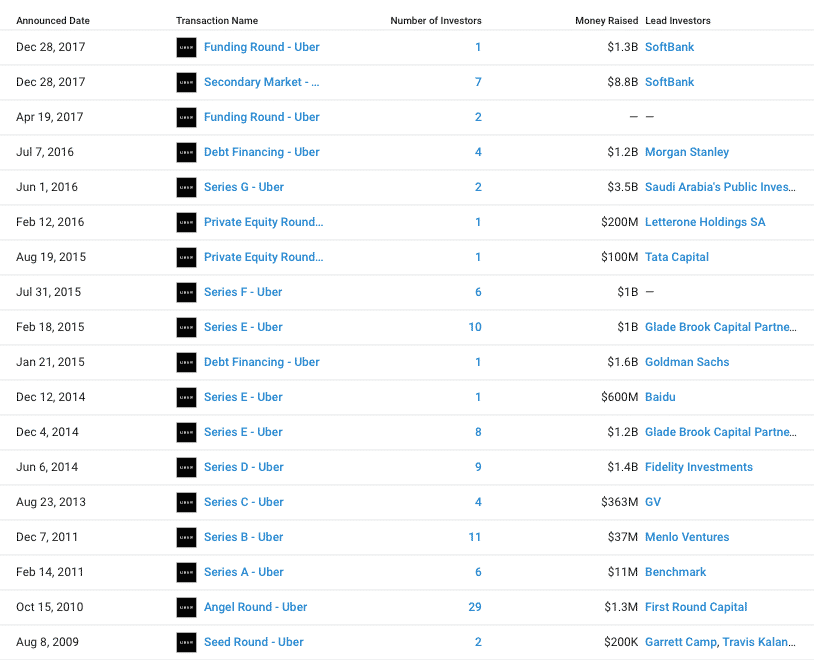

Uber has issued a lot of equity to investors. From its first seed round in 2009 financed by former CEO, Travis Kalanick, and co-founder, Garrett Camp, Uber has raised billions of dollars from top tier investors, including Goldman Sachs, Morgan Stanley, SoftBank, Benchmark, First Round Capital, Fidelity Investments, Baidu, Tata Capital, and Glade Brook Capital Partners.

Source: Crunchbase

➤ Free Guide: 5 Ways To Automate Your Retirement

Uber Financials:

Balance Sheet

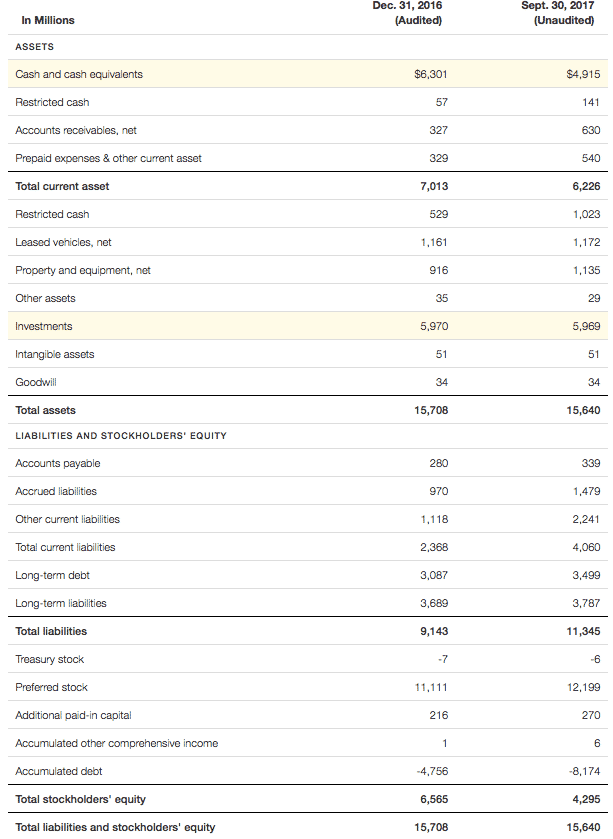

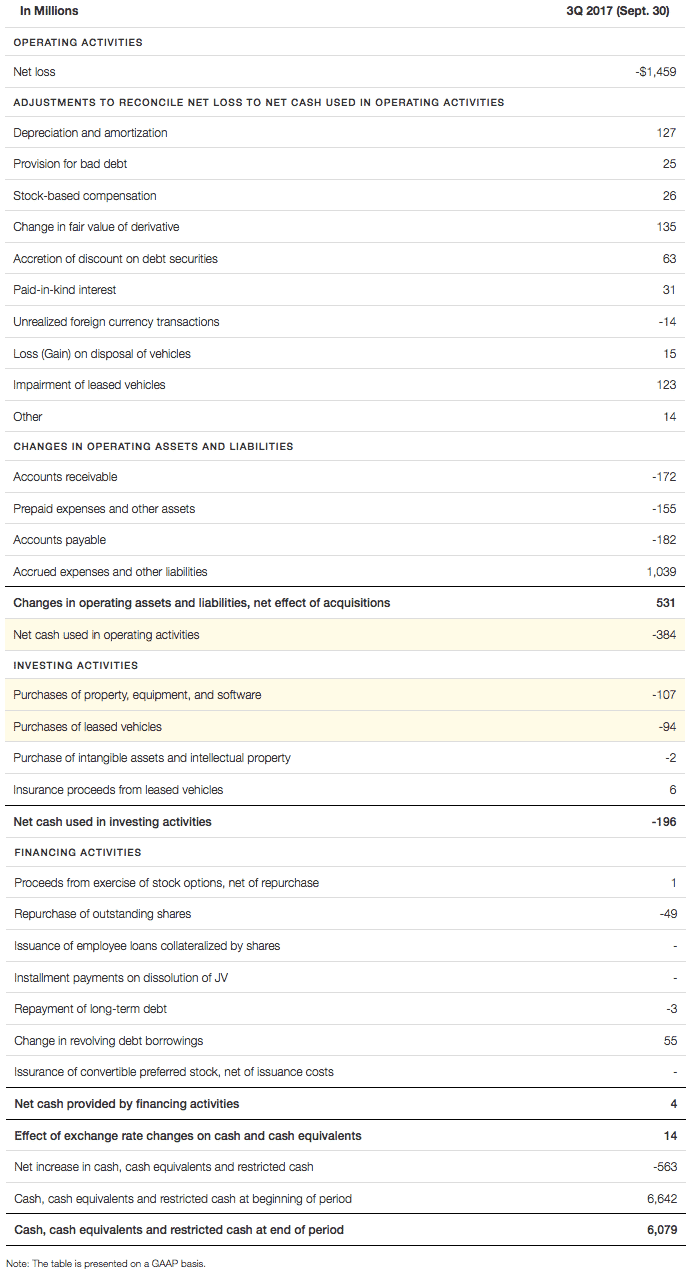

By issuing so much equity and debt to investors, Uber has raised substantial cash reserves despite burning through a lot of cash at a fast rate to finance operations, marketing and growth.

Nevertheless, it is clear from one quarter to the next, cash is shrinking. But Uber isn’t burning cash as fast as net losses might suggest at first glance.

Although net losses in the third quarter of 2017 eclipsed $1 billion, free cash flow was negative to the tune of $585 million.

Source: Wall Street Journal

Excluding the most recent investment from SoftBank, Uber would not burn through its existing cash reserves for another 4 years.

The key reason net losses and free cash flow look so different is that the latter is defined as operating cash flow minus both capital expenditures and the cost of leased vehicles.

Source: Wall Street Journal

Uber Financials:

What You Need To Know

It is easy to gloss over the many numbers on Uber’s financial statements but a few numbers stand out that are worth paying close attention to before investing.

Gross profit in the third quarter was $865 million while total operating expenses were approximately $2 billion, so Uber has a shortfall of approximately $1.1 billion to reach breakeven.

Marketing costs were $572 million and research & development costs were $314 million, so even if you stripped both of those expenses out of the income statement, there is still a leap to reach the breakeven mark.

But naysayers should be wary of getting too bearish on Uber because SoftBank invested a whopping $7 billion at the end of 2017 in exchange for approximately a 15% stake in Uber.

The vast majority of the capital is used to buy out existing shareholders while an additional $1.25 billion in new capital was added.

It is noteworthy that the valuation at which SoftBank invested was significantly lower than the valuation in the prior funding round. For optimistic investors however the discounted valuation of $48 billion might be an attractive entry level for a long-term investment opportunity.

So how can you invest in Uber stock?

The #1 income play for 2023 is NOT a stock, bond or private company... Rather, it's a little-known alternative investment that could hand you big monthly income from oil and gas.

Find Out What It Is Right Here

Invest In Uber Stock Indirectly

One of the ways to invest in Uber stock is to purchase shares in a company that has already invested in Uber. Alphabet, Inc., better known as Google, has invested as has Microsoft, so you could buy shares in those technology companies as a proxy approach.

When Uber goes public, the shares of Uber owned by the tech giants will be added to their respective balance sheets.

This indirect approach is not necessarily going to be the best way to invest in Uber stock however because both Alphabet and Microsoft are gigantic companies and the fate of Uber won’t make or break their respective share prices.

So what other ways to invest in Uber exist?

Invest In Uber Competitors

For investors who are pessimistic about the prospect of Uber succeeding, it is possible to invest in its competitors.

Although Lyft, its primary U.S. competitor, is pre-IPO too, Medallion Financial Corp [TAXI] is a company that loans money for taxicab medallions in New York and other major metropolitan areas in the United States.

As medallion prices plummeted due to the competitive pressure from Uber, dividend yields spiked for Medallion Financial Corporation, so you could potentially gain not only from an upside in share price but also from a handsome dividend payment.

On the other hand, if you are bullish on the upside potential for Uber, you could look to short stock or buy bearish put options.

Invest In a Private Equity Fund

Private equity funds and venture capital funds regularly invest in private companies that have high potential like Uber.

To become a client of a private equity fund or VC fund, you will need to be an accredited investor, which means as an individual you earn an annual income of $200,000 or more for two consecutive years or you have a net worth of $1 million excluding your primary residence. As a couple, the income threshold rises to $300,000 annually.

If you are among the lucky few who qualify as an accredited investor, check out the companies (in the Crunchbase Funding Rounds graphic above) who have invested in Uber. The next step is to call them up and enquire whether it is possible to purchase shares in Uber if you become a client.

Invest In Uber Via

Private Company Broker/Dealers

In the past when companies like Uber mushroomed to dizzyingly high valuations, insiders were historically unable to cash out.

But these days marketplaces exist where employees who acquire stock options grants or early investors can sell to interested buyers.

Sharespost is a broker/dealer as well as a fund for private company stocks that matches buyers and sellers. The company has historically enjoyed a good reputation as an intermediary for both sellers and buyers.

Another company that enables private companies and investment funds to customize, control, and execute primary and secondary transactions is SecondMarket, now called NASDAQ Private Market after SecondMarket was acquired in 2015.

SecondMarket had been a registered broker/dealer and member of FINRA, MSRB, SIPC, and an SEC registered alternative trading system (ATS) for private company stock.

It also earned a solid reputation having been backed by top tier investors, including FirstMark Capital, The Social+Capital Partnership, Silicon Valley Bank, New Enterprise Associates (NEA), Li Ka-shing Foundation, and Temasek Holdings.

While Sharespost and NASDAQ Private Market are among the better known companies that facilitate private company trading markets, they have competition from Knight Capital Group, GFI Group, Liquidnet and Cantor Fitzgerald. So, if you run into an issue on one platform where you cannot buy shares, you can try any of the others.

What Are The Risks Of

Investing In Uber Stock?

The Queen of England famously described 1992 as “annus horribilis”, a horrible year, and the same could be said for Uber in 2017.

Uber has been dogged by negative press and scandals in recent years, so you should factor in the downside risk of betting on the company before parting with your hard-earned money.

| FY 2017 | Uber Scandals, PR Disasters & Negative Press |

| June | Travis Kalanick, co-founder and CEO, resigns. |

| June | Uber board member, David Bonderman, resigns after making a sexist joke. |

| June | Top Uber executive obtained medical records of a woman who was raped by an Uber driver to cast doubt upon victim’s account, which later led to the woman suing Uber for violating her privacy rights and defaming her. |

| June | 20 Uber employees were fired following an investigation into sexual harassment claims. |

| May | Uber admitted it underpaid New York drivers by taking a larger cut than it was entitled to and paid out tens of millions of dollars. |

| April | Uber was caught spying on rival Lyft with a secret program called “Hell” which allowed the ridesharing company uncover drivers who also worked for Lyft. |

| March | Senior employees, including former CEO, Travis Kalanick, were found to have visited an escort and karaoke bar in Seoul in 2014. |

| March | Travis Kalanick was caught on camera arguing with an Uber driver who complained how difficult it was to make a living due to declining rates. |

| March | According to the New York Times, Uber used a tool called Greyball to systematically deceive law enforcement. |

| February | Alphabet filed a lawsuit against Uber claiming that Uber had engaged in a “calculated theft” of its autonomous driving car technology. |

| February | Uber engineer, Susan Fowler, alleged sexual harassment and discrimination which catalyzed a wave of claims of professional misconduct and sexism in numerous Silicon Valley startups. |

| January | A viral campaign, called #DeleteUber, spread as the company lifted surge pricing during a taxi protest at a New York airport. |

| January | Uber paid $20 million to settle claims of false advertising to drivers about potential earnings. |

In spite of the negative press, Uber financials show the company has continued to grow bookings and net revenues.

Following the resignation of former Uber CEO, Travis Kalanick, Dara Khosrowshahi took over as CEO of Uber. He was previously the CEO of Expedia, and the hopes are high among investors that he can instill a corporate culture that leaves the aforementioned scandals in the past.

So, if you want to invest in Uber stock, you should carefully weigh the risks and rewards, as well as the opportunity costs before parting with your hard-earned money.

Are you an Uber rider or driver? Would you invest in Uber stock if you could? Share your thoughts in the comments below, we would love to hear from you.

>> Is Facebook Stock a Buy or a Sell?

>> Should You Buy Alphabet Stock?

>> Will Netflix Stock Rise or Fall This Year?

The next 10 minutes could change your life. We've recorded a special sit-down interview with a reclusive millionaire who details how he's closed out winning trade after winning trade throughout the volatility of 2022. In fact, he hasn't closed a single losing trade since 2016. Sounds impossible? It's not - and he'll prove it to you.

Click to see this exclusive sit-down interview