WiseBanyan makes the bold claim that it is the “world’s first free financial advisor” charging no management fees, no trading fees, no custodial fees, no hidden fees, and no kickbacks. So how does it make money? The answer is by charging for optional products and services, such as tax-loss harvesting for which WiseBanyan charges 0.25% of assets under management, capped at $20 per month.

WiseBanyan Spotlight

WiseBanyan Customers

Hands-off, beginner and retirement-focused investors will find WiseBanyan delivers on its promise of free portfolio management.

WiseBanyan serves a wide range of customers, including beginner investors with little savings to invest, who can enjoy its free robo-advisory service.

WiseBanyan is best for:

- Fee-conscious investors

- Hands-off investors

- Retirement investors

- Investors with low balances who want free portfolio management

We have the world's leading artificial intelligence forecasting trends in the market. A strategy so precise it achieves a proven accuracy rate up to 87.4%. Check out the next 3 stocks this A.I. has on its radar for you in this free, live training.

Claim your seat now by clicking here.

WiseBanyan Management Fees

WiseBanyan has a free robo-advisory portfolio management solution that stacks up against its marketing claims. Only SoFi comes close to matching this by offering free portfolio management to its borrowers, though even SoFi charges new users (who are not SoFi borrowers) a monthly fee.

- 0.0% of assets under management for robo-advisory service

- 0.25% for add-on tax-loss harvesting service

WiseBanyan has an innovative business model in charging no fees for its standard portfolio management service but it does charge a 0.25% fee for its add-on, optional service, WiseHarvesting, which performs tax-loss harvesting. In contrast, other robo-advisors, such as Wealthfront, charge a fee for managing portfolio assets and include tax-loss harvesting at no additional cost.

➤ Free Guide: 5 Ways To Automate Your Retirement

WiseBanyan Investment Method

WiseBanyan employs Modern Portfolio Theory to build diversified portfolios that are designed to optimize returns for each level of risk. Other robo-advisors, such as Personal Capital, apply the same Nobel-prize winning theory.

WiseBanyan builds diversified portfolios that minimize fees and taxes by leveraging Modern Portfolio Theory, a framework for combining assets in a portfolio to generate the highest returns possible for a given level of risk. The process results in portfolios comprised of different asset classes and securities that often move independent of each other.

Individual holdings are limited to certain weightings to ensure asset allocation is diversified. The mix of holdings are chosen by analyzing the potential returns of each asset class along with sensitivity to interest-rate risk, inflation, currency strength and other economic factors. Portfolios are stress-tested across market cycles to evaluate performance and optimize composition.

WiseBanyan provides exposure to US government and corporate bonds, short-term high-yield bonds, emerging market and international equities, as well as US equities, Treasury inflation-protected securities (TIPS), and real estate. Most exchange-traded funds are from iShares and Vanguard, renowned as the low-cost leader.

Investors who wish to transfer assets in-kind to WiseBanyan will be disappointed that investments must first be liquidated, which can lead to substantial tax consequences, and should be carefully considered first.

WiseBanyan Tools

WiseBanyan offers users a goal-based method to save for specific life events, such as vacations, birthdays, and health, using a feature called Milestones.

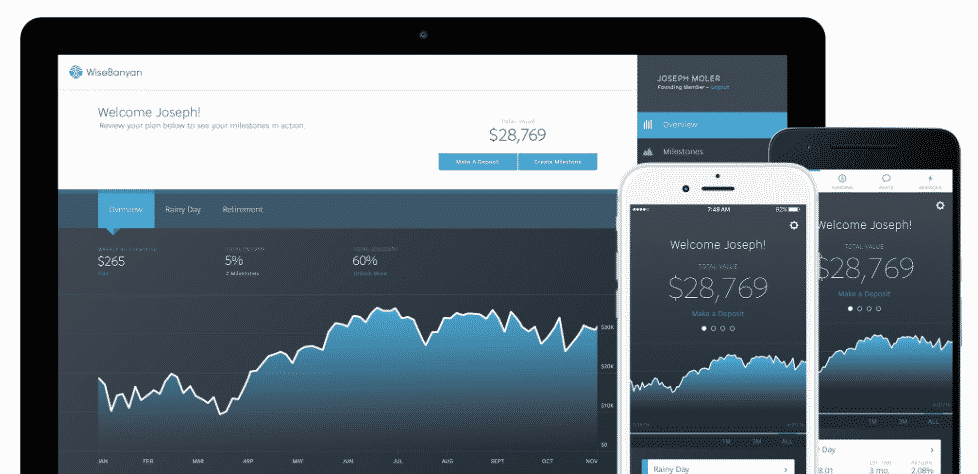

WiseBanyan constructs tailored portfolios for new clients by first inviting them to answer questions about investor preferences. Users are asked to specify an investing time horizon before they need to draw upon invested funds, as well as to share risk aversion and how much money they have saved and available to invest. From this data, WiseBanyan assesses risk and return goals to construct portfolios that are optimized to meet long term goals. The user interface is easily navigable and allows users to update their risk score which in turn will automatically update investment recommendations.

A nice feature that WiseBanyan has rolled out is called Milestones and features a goal-based approach to saving for various buckets, such as vacations, birthdays, special events, and so forth. Users can specify income, net worth, time horizon and goal amount. Milestones at WiseBanyan are very similar to the goal-based method Betterment offers to help investors chunk savings objectives into smaller, manageable, focused categories.

Rising interest rates...Skyrocketing inflation...Exploding debt...A looming recession...It's no wonder Americans are becoming more and more concerned about their savings and investments. That's why I wrote my newest report…This FREE REPORT shows YOU how you could protect your retirement savings before it's too late. Request your free report today and learn how you could protect everything you've worked for!

Request Your FREE Ben Stein Report Today!

WiseBanyan Pros and Cons

The pros of WiseBanyan’s service include its free portfolio management service, low account minimums and bucket-based approach to saving for milestone financial events. Limited account selection and add-on costs for tax-loss harvesting count as drawbacks.

| WiseBanyan Pros | WiseBanyan Cons |

| ✅ Free Portfolio Management: Unlike most other robo-advisory services that charge a fee for assets under management, WiseBanyan offers a truly free basic portfolio management service with no minimums. Co-CEO, Vicki Zhou is making a bet that users will pay for add-on services, like WiseHarvesting, which performs tax-loss harvesting, as well as other optional paid products. | ❌ Limited Account Offerings: Most robo-advisory services offer joint accounts so spouses can invest together and most also support Trust accounts, but WiseBanyan does not offer either yet. |

| ✅ Goal-based Investing: WiseBanyan offers a goal-based investing tool, called Milestones, which allows users categorize financial goals into buckets, such as Vacation, Health, Birthdays, and so forth. Like Betterment, WiseBanyan offers this type of goal-based service to chunk down investment objectives into manageable, easily trackable categories. | ❌ Fee-Based Tax Optimization: WiseBanyan charges a 0.25% fee on assets under management to perform tax-loss harvesting, a service that is included in the management fee at most other robo-advisory firms. |

| ✅ Account Balance Minimums: WiseBanyan has no account balance minimum. |

WiseBanyan Fees & Minimums

WiseBanyan delivers on its claims to be the world’s first free financial advisor for its basic service though add-on services, such as tax-loss harvesting come at a cost of 0.25%.

| Category | Fees |

| Account Management Fees | 0.0% for basic service |

| Tax-loss Harvesting | 0.25% of assets under management; capped at $20 per month |

| Investment Expense Ratio | 0.12% (on average) |

| Account Minimum | $0 |

| Automatic Rebalancing | Free |

| Annual, Transfer, Closing Fees | $75 to transfer non-retirement accounts $90 to transfer IRA accounts |

WiseBanyan Accounts

WiseBanyan offers a limited range of accounts at this time; married couples cannot set up a joint non-retirement account unlike at most other robo-advisors. WiseBanyan does not cater to 401(k)s or 529 Plans; most robo-advisors do not cater to 529 Plans.

| Type | Capability |

| Individual Non-retirement | YES |

| Joint Non-retirement | NO |

| Roth IRA | YES |

| Traditional IRA | YES |

| SEP IRA | YES |

| Rollover IRA | YES |

| Trusts | NO |

| 401(k) | NO |

| 529 Plans | NO |

WiseBanyan Tax Strategy

Unlike most robo-advisory firms offering tax-loss harvesting at no cost, WiseBanyan charges a 0.25% fee for tax-loss harvesting, though it is capped at $20 monthly.

| Type | Capability |

| Tax Loss Harvesting | YES (but costs 0.25%, capped at $20 per month) |

| Free Account Rebalancing | YES |

WiseBanyan Summary

Retirement, beginner and hands-off investors seeking a truly free portfolio management service will find WiseBanyan offers a robust service. It remains to be seen whether investors will fully adopt WiseBanyan’s free robo-advisory service while incurring add-on fees for optional additional services, such as tax-loss harvesting, or whether they prefer a more traditional arrangement of being charged a portfolio management fee based on assets under management as offered by most other robo-advisory services with additional services included.

Rising interest rates...Skyrocketing inflation...Exploding debt...A looming recession...It's no wonder Americans are becoming more and more concerned about their savings and investments. That's why I wrote my newest report…This FREE REPORT shows YOU how you could protect your retirement savings before it's too late. Request your free report today and learn how you could protect everything you've worked for!

Request Your FREE Ben Stein Report Today!