| InvestorMint provides personal finance tools and insights to better inform your financial decisions. Our research is comprehensive, independent and well researched so you can have greater confidence in your financial choices. |

The trend of major brokerage firms snapping up smaller options brokerage firms continued in 2016 when ETrade acquired OptionsHouse.

OptionsHouse positions itself as the low-fee options platform. It bolstered its web platform capabilities in 2014-15 when joining forces with tradeMonster under the OptionsHouse brand name while still delivering the low-cost fees for which it was famous.

OptionsHouse Spotlight

| OPTIONSHOUSE SPOTLIGHT | |

InvestorMint Rating 4 out of 5 stars |

|

OptionsHouse Customers

OptionsHouse trading platform serves a broad range of customers from frequent traders to buy-and-hold investors.

As its name implies, OptionsHouse specializes in serving options traders but the OptionsHouse trading platform makes a compelling case to equities traders with its flat rate commissions.

OptionsHouse targets active, experienced options traders who trade frequently and reward them with highly competitive commission rates relative to industry peers. Investors who are oriented towards long term investment opportunities and seek to diversify their portfolios with mutual funds and exchange-traded funds will find other brokerages can better serve them.

OptionsHouse trading platform is best for traders who are:

- Options traders

- Active traders

- Self-directed traders

- Seeking low commission rates

- Equities traders

Fee conscious traders wishing to avoid the monthly maintenance fees and data feed charges incurred elsewhere will be pleased that OptionsHouse has no such penalty fees. OptionsHouse doesn’t charge customers when transaction volumes fall short of threshold levels either.

We could be facing one of the harshest economic challenges ever experienced thanks to an incompetent government and severe global unrest. If you aren't proactive, you could see yourself and your family become another financial casualty. But, the Inflation Survival Plan has you covered. Learn insider tips and tricks, IRS loopholes and more that will help your finances soar.

Take 15 Seconds to get the FREE Inflation Survival Plan and ensure your family's financial security.

OptionsHouse Promo Deal

OptionsHouse offers the following promotional deal for new accounts:

- Trade commission-free for 60 days with $5,000+ deposit

➤ Free Guide: 5 Ways To Automate Your Retirement

OptionsHouse Pros and Cons

OptionsHouse stands out from its peers with low commission rates, no maintenance fees, no penalty fees for low transaction volumes, a good mobile app and a fast web-platform. Where OptionsHouse falls short of peers like TradeStation is having fewer technical studies and offering limited educational resources.

| OptionsHouse Pros | OptionsHouse Cons |

| ✅ Excellent For Fee-Conscious Traders: $4.95 flat rate stock trades and an additional $0.50 per contract for options trades combined with no account balance minimums, no maintenance fees, no data feed fees and no penalty fees for low transaction volumes make OptionsHouse a standout winner for fee-conscious, price sensitive traders. | ❌ Limited Educational Offerings: Although OptionsHouse offers excellent options education as expected, its educational offerings related to equities and mutual funds don’t compare favorably to rivals. |

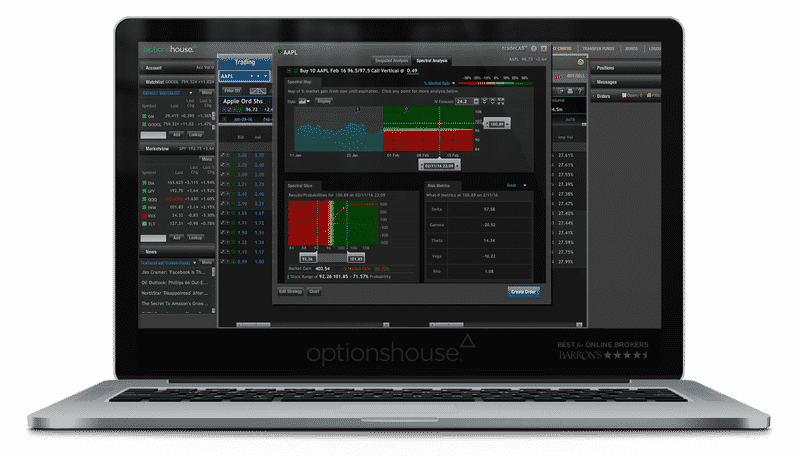

| ✅ Web Platform: OptionsHouse offers a fast web-platform that excels in tools offered to options traders, an excellent virtual trading platform to allow beginner traders accelerate up the learning curve, a feature to jot down trade notes, and a great visual risk/reward interface called tradeLAB. strategySEEK is an industry best options screener that matches strategies to stock price expectations. | ❌ Poor Customer Service: Commensurate with the lower cost structure is inferior customer service offerings compared to the likes of TradeStation and Thinkorswim. |

| ✅ Automation & Customization: OptionsHouse facilitates push notifications with trader orders and does so via a browser-based platform that allows for easy viewing across devices. | ❌ Technical Chart Studies: By industry standards, OptionsHouse falls well short of its peers with fewer than half the technical studies available on average at rival brokerage firms. |

| ✅ Mobile App: OptionsHouse succeeds in delivering a mobile experience that provides a good deal of functionality available on its web platform without compromising navigability or ease-of-use. | ❌ Research Reports: Unlike larger brokerage firms, third party research reports are not available nor are standard SEC filings, though ETrade’s acquisition of OptionsHouse may change this as time goes by. |

OptionsHouse Securities

Tradeable securities at OptionsHouse comprise:

- Stocks

- Options

- Futures

- ETFs

- Bonds

- Mutual Funds

Discover the top 3 hidden AI stocks that could hand you profits of 874% of more!

ChatGPT is the fastest growing app EVER – hitting 100 million users!

Jeff Bezos… Bill Gates… and Elon Musk are betting billions on this "game changing" technology. And you can get in on the ground floor.

Click here to download it for free – with no strings attached.

OptionsHouse Fees

OptionsHouse has an industry-leading fee schedule, particularly as it relates to options and stocks:

| Security | Fees |

| Stocks | $4.95 flat rate |

| Options | $4.95 flat rate + $0.50 per contract |

| Futures | $2.00 per contract |

| Mutual Funds | $20 per trade |

| Margin rate range | 3.50%-8.00% |

| Broker-assisted trades | $25 |

| Account Balance Minimum | $0 |

| IRA Closing Fee | $60 |

OptionsHouse Platform Features

| Type | Capability |

| Desktop | YES |

| Mobile | YES |

| Customer support | Email Support Live Chat Phone Support 8am-8pm ET Mon-Fri |

| Real-time quotes | FREE |

| Research | No Third Party Research |

| Chart Tools | FREE |

| Commission-free ETFs | A handful |

| No-transaction-fee Mutual Funds | No no-transaction-fee mutual funds |

OptionsHouse Summary

OptionsHouse makes a compelling case to active options traders seeking to keep transaction costs under control. Price sensitive, fee-conscious traders will love the low commission rates and fees at OptionsHouse.

Options traders too will be pleased by a comprehensive tool suite, top notch virtual trading platform, paperTRADE, and options educational resources.

Official tax return reveals how one trader nabbed annual gains of 228%, 309% and 339%. His tax return was released online, exposing this simple trading technique used to pocket nearly half a million in profits.

Click here to see the official tax return before it is deleted...

Leave a Reply