Warren Buffett earned his nickname The Oracle of Omaha for consistently producing stellar investment returns, which have compounded at an average annual rate of 19% since 1965. Initial Berkshire Hathaway (tickers: BRK.A or BRK.B) shareholders have enjoyed a percentage gain on investment of 884,319%!

To put that in perspective, here is a chart of what $1,000 turns into with various percentage gains:

| Gain % | $1,000 Turns Into |

| 100% | $2,000 |

| 1,000% | $20,000 |

| 10,000% | $200,000 |

| 100,000% | $2,000,000 |

| 1,000,000% | $20,000,000 |

A $1,000 investment in Berkshire Hathaway in 1964 has increased in value to almost $20,000,000 in just over half a century.

Buffett’s company, Berkshire Hathaway, is compounding gains so fast that by the time you read this article, gains of 1,000,000% since inception might well have been reached.

Buffett and his business partner, Charlie Munger, have said in annual shareholder meetings that the percentage rate at which Berkshire Hathaway will grow in the future will diminish as the company grows. So new shareholders cannot expect to enjoy the same returns by investing in Berkshire Hathaway today as early investors previously enjoyed.

However, you can still discover time-tested ways to make money by reading the treasure trove of investing wisdom contained in Buffett’s letters to shareholders. Contained in these famous Berkshire Hathaway letters are money-making and money-saving principles any investor can apply to build more wealth.

Money Managers Make Money For Money Managers

Portfolio management fees and expense ratios can significantly harm long-term returns for the average investor. Warren Buffett recommends low-fee, passively managed index funds for most stock market investors.

The headline Money Managers Make Money for Money Managers might sound like a tongue twister but the lesson of how fees charged by money managers can hurt your net worth over time is perhaps the most important lesson of all.

Money management fees often seem small at first glance. After all, if your money manager charges you 1.5% annually but you make 8% each year, what’s not to like? Well, it turns out there is more to this simple calculation than meets the eye.

The first eye-opening surprise in store for investors who hand their money over to a professional is that portfolio management fees are just one of the major costs incurred.

A traditional financial advisor who manages your retirement nest-egg, such as an IRA or 401(k) account, may charge on average fees of 1.25%. Generally, your money will be invested in mutual funds that have ongoing expense ratios. When you factor in the total fees from portfolio management, expense ratios, and transactions, you might pay as much as 2% or more annually.

A managed portfolio incurring 2% annual fees growing at an average 8% per annum over a 30 year period grows to be about half as large as a self-directed brokerage account with no equivalent fees.

In the table below, you can see a no-fee $100,000 portfolio grows to the size of approximately $1,000,000 whereas the seemingly small 2% annual fee ended up costing the investor about $450,000 over the 30 year duration!

| Expense Ratio | |||||

| Year | Annual Gain (8%) | 0.50% | 1.00% | 1.50% | 2.00% |

| 0 | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

| 1 | $108,000 | $107,500 | $107,000 | $106,500 | $106,000 |

| 2 | $116,640 | $115,560 | $114,485 | $113,415 | $112,350 |

| 3 | $125,971 | $124,222 | $122,488 | $120,771 | $119,070 |

| 4 | $136,049 | $133,529 | $131,045 | $128,595 | $126,180 |

| 5 | $146,933 | $143,532 | $140,193 | $136,917 | $133,702 |

| 6 | $158,687 | $154,279 | $149,974 | $145,768 | $141,660 |

| 7 | $171,382 | $165,828 | $160,429 | $155,180 | $150,078 |

| 8 | $185,093 | $178,238 | $171,605 | $165,187 | $158,980 |

| 9 | $199,900 | $191,571 | $183,551 | $175,828 | $168,395 |

| 10 | $215,892 | $205,897 | $196,319 | $187,141 | $178,350 |

| 11 | $233,164 | $221,290 | $209,965 | $199,168 | $188,875 |

| 12 | $251,817 | $237,827 | $224,550 | $211,952 | $200,002 |

| 13 | $271,962 | $255,594 | $240,136 | $225,540 | $211,763 |

| 14 | $293,719 | $274,682 | $256,790 | $239,981 | $224,193 |

| 15 | $317,217 | $295,188 | $274,587 | $255,328 | $237,329 |

| 16 | $342,594 | $317,217 | $293,602 | $271,635 | $251,209 |

| 17 | $370,002 | $340,881 | $313,918 | $288,962 | $265,873 |

| 18 | $399,602 | $366,302 | $335,622 | $307,370 | $281,363 |

| 19 | $431,570 | $393,608 | $358,809 | $326,925 | $297,725 |

| 20 | $466,096 | $422,939 | $383,578 | $347,697 | $315,004 |

| 21 | $503,383 | $454,443 | $410,035 | $369,759 | $333,251 |

| 22 | $543,654 | $488,282 | $438,293 | $393,189 | $352,516 |

| 23 | $587,146 | $524,626 | $468,474 | $418,070 | $372,853 |

| 24 | $634,118 | $563,661 | $500,705 | $444,489 | $394,320 |

| 25 | $684,848 | $605,583 | $535,125 | $472,537 | $416,976 |

| 26 | $739,635 | $650,605 | $571,879 | $502,313 | $440,883 |

| 27 | $798,806 | $698,955 | $611,124 | $533,920 | $466,108 |

| 28 | $862,711 | $750,878 | $653,024 | $567,467 | $492,718 |

| 29 | $931,727 | $806,634 | $697,757 | $603,069 | $520,786 |

| 30 | $1,006,266 | $866,507 | $745,511 | $640,848 | $550,388 |

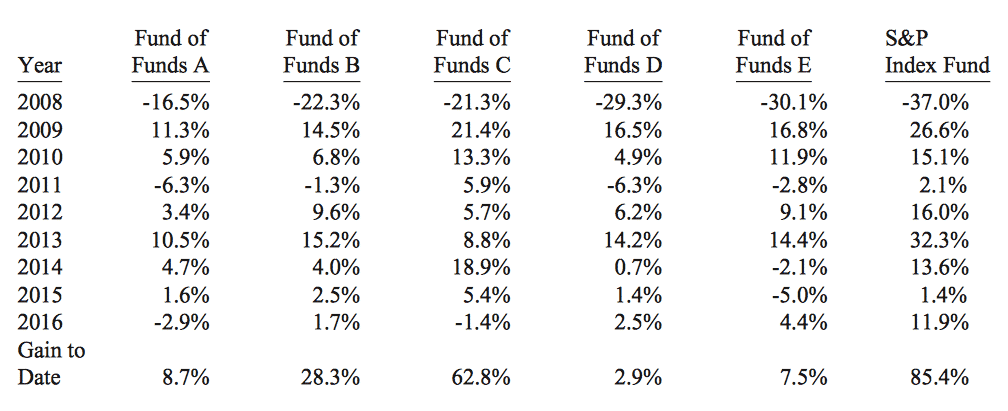

In his Berkshire Annual Shareholder letter, Buffett discusses a bet he placed with money managers because he was so certain that, when factoring in fees and active management, they would underperform a passive fund designed to track the general market. Here is what he wrote:

“Now, to my bet and its history. In Berkshire’s 2005 annual report, I argued that active investment management by professionals – in aggregate – would over a period of years underperform the returns achieved by rank amateurs who simply sat still. I explained that the massive fees levied by a variety of “helpers” would leave their clients – again in aggregate – worse off than if the amateurs simply invested in an unmanaged low-cost index fund.

Subsequently, I publicly offered to wager $500,000 that no investment pro could select a set of at least five hedge funds – wildly-popular and high-fee investing vehicles – that would over an extended period match the performance of an unmanaged S&P-500 index fund charging only token fees. I suggested a ten-year bet and named a low-cost Vanguard S&P fund as my contender. I then sat back and waited expectantly for a parade of fund managers – who could include their own fund as one of the five – to come forth and defend their occupation. After all, these managers urged others to bet billions on their abilities. Why should they fear putting a little of their own money on the line?

What followed was the sound of silence. Though there are thousands of professional investment managers who have amassed staggering fortunes by touting their stock-selecting prowess, only one man – Ted Seides – stepped up to my challenge. Ted was a co-manager of Protégé Partners, an asset manager that had raised money from limited partners to form a fund-of-funds – in other words, a fund that invests in multiple hedge funds.

Here are the results for the first nine years of the bet – figures leaving no doubt that Girls Inc. of Omaha, the charitable beneficiary I designated to get any bet winnings I earned, will be the organization eagerly opening the mail next January.” – Warren Buffett

The takeaway is clear. If you hand over your money to professional money managers, your portfolio may outperform over a short time period. But over the long term, a low-fee passive fund will almost certainly outperform a high-fee actively managed fund.

In his subsequent shareholder meeting, Buffett described money managers as one of the few professions where the professionals don’t add value in aggregate. Compared to doctors, nurses, engineers and a host of other professions where the professionals add value to clients and customers, money managers tend to line their own pockets at the expense of clients. It is for this reason that low-fee robo-advisors, such as Betterment and Wealthfront, have become so popular.

Focus On Intrinsic Value

Share price only tells you how much you pay, but intrinsic value tells you how much a company is worth. When you know what a company is worth, you can recognize when stocks are on sale, and when they are overvalued. You will be less likely to let greed affect your buying decisions and fear affect your selling decisions.

In Warren Buffett’s 2017 Annual Shareholder Letter, he wrote:

“Over time, stock prices gravitate toward intrinsic value”

But what is intrinsic value? And how do you discover it without opening up a spreadsheet and building a discounted cash flow forecast model like a Wall Street analyst?

Perhaps the best way to think of intrinsic value and share price is by way of example. Imagine for a moment that you wanted to buy a car. On Monday, you arrive to a dealership to make your purchase.

You have done your homework and know the car is worth $20,000 but when you get to the dealership the price listed is $23,000. Seems overvalued, so you leave.

The next day you come back and the price is now $26,000. Now, it is very overvalued, so you walk away in disgust.

But what if you come back Wednesday and discover the car is on sale for $15,000?

The price you pay for the car is akin to share price. And the intrinsic value is what the car is actually worth, $20,000 in this example.

Every day a different sale price was displayed on the car, just as every day a company’s stock price will display a different number. But what remained constant was what the car was actually worth.

Similarly, a company’s intrinsic value will remain fairly constant from one day to the next. Each quarter, the company will announce rising or falling earnings which will affect its intrinsic value, but for the most part you can think of intrinsic value as a fairly fixed benchmark. It helps you to gauge what a company is really worth, irrespective of the price the stock market displays each day.

HOW TO CALCULATE INTRINSIC VALUE

Intrinsic value is the value of a company determined through fundamental analysis and independent from its market value. To calculate intrinsic value, you estimate and sum the discounted future income generated by the company’s assets to obtain the present value.

If that sounds like a lot of hard work, it can be. But fear not, there is an easier way. For example, this tool below calculates the fair value of a company based on various valuation models. Once you enter the stock symbol, the fair value can be seen right away.

Now let’s revisit Buffett’s comment that over time, stock prices gravitate toward intrinsic value. This short statement encompasses many lessons. It is noteworthy that he does not say stock prices will reflect intrinsic value, but rather that they will gravitate toward intrinsic value.The message he is conveying is that the share price will fluctuate over time, but the intrinsic value is like a homing beacon that attracts the share price to it over the long term.

Knowing a company’s intrinsic value gives you confidence that even if a share price is severely depressed short-term, it will most likely end up bouncing back and converging on a price that more accurately reflects fair value.

If you know a company’s intrinsic value, you can ignore the worry of day-to-day market fluctuations and instead trust that, in the end, the market price and the fair value will match each other fairly closely.

If a stock has been sold off for a reason unrelated to its fundamentals then every dollar it falls lower is a greater opportunity to make more money in the end. Like in the example above with the car, if you could buy the car for half what it is worth you would be excited.

In the stock market, investors often see a stock on sale and run the other way for fear the price might be lower the next day. But if you know where the stock is headed in the end, you can have greater courage of your convictions.

The way Buffett describes this opportunity is:

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons.” – Warren Buffett

Discover the top 3 hidden AI stocks that could hand you profits of 874% of more!

ChatGPT is the fastest growing app EVER – hitting 100 million users!

Jeff Bezos… Bill Gates… and Elon Musk are betting billions on this "game changing" technology. And you can get in on the ground floor.

Click here to download it for free – with no strings attached.

Warren Buffett Investment Strategy

Sometimes, the greatest upside in the stock market is when widespread fear has set in among investors. If you follow the Warren Buffett investment strategy to buy when others are fearful and sell when others are greedy, you will likely move the odds in your favor of making more money over the long term.

You may know now to avoid paying high fees to money managers who invest in high fee mutual funds and that it is best for long-term wealth accumulation to pay a price below intrinsic value for stocks, but when should you buy them?

Theoretically, buying a stock anytime it is worth less than its intrinsic value should work out profitably in the end. But the best time to buy might be observed by paying close attention to Warren Buffett’s investment strategy.

If just one word had to be chosen to describe the Warren Buffett investment strategy, it would be rational. He lies in wait like a predator, waiting for the stock market to sell off, and for panic to set in. When it does, he pounces and makes large purchases in quick succession. He knows when everybody is fearful, the opportunity is greatest.

“First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy. It will also be unwarranted.” – Warren Buffett

He went on to note that investors who hold a collection of large American business with conservative financials (not overly indebted) are virtually certain to do well as long as they avoid high and unnecessary fees and other costs.

If you can overcome your own fear while recognizing the widespread fear in the market, and take action when it is at a peak, you might not see the reward in the short-term but fast forward a few years, and it is likely that you will look back fondly at having pulled the trigger just when it was most difficult to do so.

If historically you have had a hard time mastering your emotions, but want to stay fully invested for the long-term to take advantage of Buffett’s advice without paying a fortune in fees, a robo-advisor might be a good option for you. Robo-advisors tend to invest in low-fee exchange-traded funds, and charge management fees that are substantially lower than traditional financial advisors.

>> View 21 Legendary Investing Quotes

>> Discover Which Stocks To Buy Now

>> Find Out How To Make A Will

Thanks to forgotten 50-year-old legislation, often ignored by investment advisors, gold bugs, and silver hounds... You can now collect $10,000 or more in free silver.

Millions of Americans know NOTHING about this... Because it exploits a "glitch" in the IRS tax code that helps protect your retirement... While paying ZERO TAXES & PENALTIES to do it. That's why you need to see this NOW.

Click Here to get all of the details in this FREE Kit

Leave a Reply