Where most robo-advisors limit portfolios to a select group of asset classes featuring equities and bonds, Hedgeable allows its clients to invest in a broader range of investments, including bitcoin and venture capital-funded start-ups. This broader range of investment options is designed to provide better downside protection for your portfolio.

Plus, the Hedgeable platform is available to try out for free with no account balance minimum and, when you’re ready to start investing, at a cost in line with what other robo-advisors charge.

Hedgeable Spotlight

| HEDGEABLE SPOTLIGHT | |

InvestorMint Rating 4.5 out of 5 stars |

|

Hedgeable Customers

Hedgeable serves conservative investors looking for ways to hedge their portfolios during uncertain market periods by offering portfolio downside risk protection. Investors looking to goose returns with exposure to high-growth sectors can do so via Hedgeable’s venture capital fund. And socially responsible investors will be pleased to discover Hedgeable caters to ethical, environmental, social and corporate governance issues as well as impact investing.

Hedgeable caters both to risk-seeking and risk-averse investors. For the conservative investor keen to avoid holding a fully invested portfolio during stock market downturns, Hedgeable offers what it calls Downside Risk Protection, a feature that overlays each account with proprietary risk management to help minimize large losses that can hurt portfolio growth.

For investors who can withstand greater portfolio value volatility, Hedgeable offers access to its venture capital fund, which co-invests in deals syndicated on leading global platforms, such as AngelList, FundersClub and OurCrowd. These investments provide exposure to high-growth sectors, such as virtual reality, blockchain, drone technology, e-commerce, software-as-a-service, and consumer technology. Investors can also gain exposure to bitcoin, which is intended to act as a hedge to dollar denominated assets, at no extra cost.

For investors who don’t want to actively manage a portfolio, Hedgeable automatically rebalances portfolios and differs from most robo-advisors by being willing to substantially change portfolio compositions as the tides turn in the stock market. You even have the option to go fully to cash during periods of high risk in order to preserve capital.

Hedgeable recognizes an increased trend towards socially responsible investing and the company cites surveys reporting that over half of Millennials think about social factors when investing. On its platform, Hedgeable incorporates ethical, environmental, social, impact and corporate governance factors.

Hedgeable is best for:

- Conservative investors

- Cost-conscious investors

- Hands-off investors

- Investors wanting exposure to start-ups

- Bitcoin investors

- Socially responsible investors

If you're worried "transitory" inflation and "mild" recession will be worse than expected...

Gold and commodities helped during volatile times. BUT one asset 99% of investors miss helps protect your portfolio and has outpaced the S&P by 131% over the past 26 years.

Art.

And while historically you've needed millions to invest, one platform lets you invest in famous paintings for as little as $20.

You can skip the waitlist and become a Masterworks member today with this private link.

See important Reg A disclosures: Masterworks.com/cd

Hedgeable Management Fees

Hedgeable charges what is called a wrap-fee, which is an all-in-one fee as opposed to separate fees charged for portfolio management, expense ratios, custodial fees, and transaction fees.

Hedgeable charges a wrapped platform fee that includes all costs: management fees, custodial fees, product fees, trading costs, and fees relating to analytics, administration, technology and support. Any fees associated with exchange-traded funds are withdrawn at the fund level so you won’t be charged separate fees.

The monthly wrap-fee charged by Hedgeable is a % of assets under management, which declines as follows:

- $0-$49,999: 0.75%

- $50,000-$99,999: 0.70%

- $100,000-$149,999: 0.65%

- $150,000-$199,999: 0.60%

- $200,000-$249,999: 0.55%

- $250-$499,999: 0.50%

- $500,000-$749,999: 0.45%

- $750,000-$999,999: 0.40%

- $1,000,000-$9,999,999: 0.35%

- $10,000,000+: 0.30%

Compared to leading robo-advisors, such as Wealthfront, Personal Capital and Betterment, Hedgeable has slightly higher fees reflecting the broader range of investment options available.

As of March 1, 2016, according to Hedgeable’s Form ADV, it had $44 million in assets under management and $474 million in assets under advisement.

➤ Free Guide: 5 Ways To Automate Your Retirement

Hedgeable Investment Method

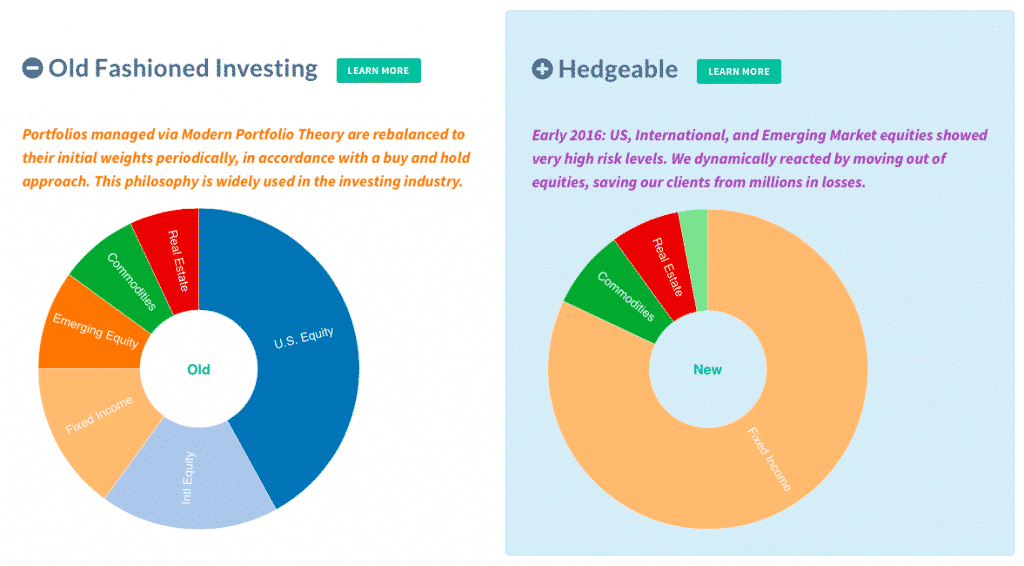

Hedgeable attempts to track markets on the way up and protect principal on the way down by dynamically rebalancing portfolios when risk levels are high. Unlike a traditional robo-advisor that may stick with a fixed portfolio composition through up and down markets, Hedgeable will remove what it perceives to be high-risk assets from portfolios from time to time. For example, a portfolio may comprise more fixed income investments and fewer equity investments when equities are perceived to have elevated risk levels.

Unlike most robo-advisors that adhere strictly to the investment method prescribed by Modern Portfolio Theory that seeks to invest across asset classes and optimize returns for each level of risk, Hedgeable goes beyond that and looks to track markets on the way up and protect capital on the way down.

In what Hedgeable describes as the “old-fashioned” way of investing, a sample portfolio might comprise a combination of equities, fixed income, commodities, and real estate. But Hedgeable believes that at certain times, risk levels will increase rendering some asset classes unattractive. For example, in 2016, Hedgeable reports that US, International and Emerging Market equities displayed high risk levels and dynamically reacted by moving clients out of equities as shown below:

Hedgeable employs an objective-based methodology to build portfolios, comprising three main steps:

- Up to 16 asset classes with unique risk and return profiles along with different correlative relationships are used to build portfolios.

- Every portfolio at Hedgeable has a goal associated with it. Portfolios can range from concentrated to diversified and the growth potential can vary from conservative to aggressive.

- After goals are set and benchmarked to indexes, Hedgeable constructs a mix of securities designed to match the benchmark’s return.

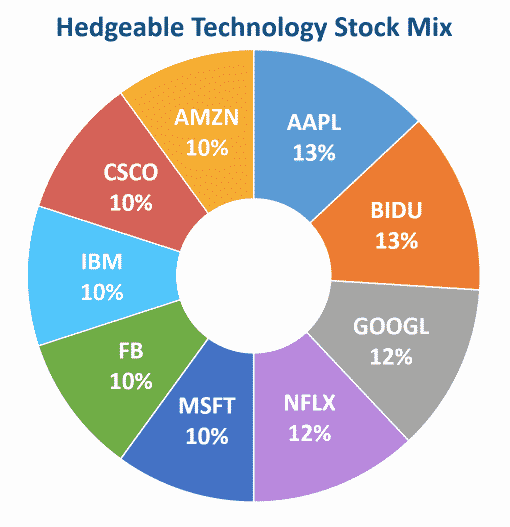

Below is an example of one such mix constructed by Hedgeable relating to the technology sector:

Hedgeable Asset Classes

Hedgeable has one of the broadest ranges of asset classes available to clients of any robo-advisor; it is edged out only by Schwab Intelligent Portfolios.

Hedgeable provides clients a much broader range of asset classes to invest in than most robo-advisors. Clients can customize portfolios to add a layer of personalization to meet needs and goals. For example, Hedgeable, like SigFig, recognizes that some clients who already have a nest-egg may be more interested in generating income than looking for growth and constructs portfolios with high-yielding ETFs, REITs, MLPs, and dividend-paying stocks to meet these needs.

Historically, venture capital investments have been accessible to ultra high net worth individuals but Hedgeable makes these investments accessible to clients who qualify as accredited investors.

Bitcoin has historically been inaccessible to most investors because acquiring bitcoins requires a process called mining, and no exchange-traded funds existed to track bitcoin performance. Hedgeable has partnered with Coinbase, a leading bitcoin platform, to allow clients gain exposure to the digital currency at no additional cost.

And for socially responsible investors keen to align their investments and values, Hedgeable facilitates allocating capital to socially responsible investments. Hedgeable claims to be the first automated platform to offer socially responsible investing. With the click of a button, a client can make their entire portfolio socially responsible, allowing exposure to categories such as Low Carbon Emissions, Alternative Energy, and LGBTQ equality.

In times of inflation, gold prices have an inverse relationship with the markets, growing in value during market volatility. Amid economic instability, some retirement savers see precious metals, as an opportunity for profit and wealth preservation. Get the practical insights to take back control of your retirement with safe-haven assets like Gold & Silver.

Download the latest Global Gold Report, featured in Fortune Investors Guide.

Hedgeable Pros and Cons

Hedgeable offers investors an attractive alternative to the traditional model of staying fully invested through upswings and downswings in financial markets. It also offers a wide variety of alternative investment opportunities, such as bitcoin, start-ups and socially responsible investments, similar to the thematic investments available at Motif and Stash.

| Hedgeable Pros | Hedgeable Cons |

| ✅ Investment Method: Time will tell if Hedgeable’s investment method, which strives to track markets on the way up and protect wealth on the way down will turn out to be more successful than the approach followed by most other robo-advisors, based on Modern Portfolio Theory, to stay fully invested in a portfolio through upswings and downtrends. So far, back-tested results show good performance statistics; its Downside Risk Protection shows strong performance returns over time. | ❌ Investment Method: Although Hedgeable’s investment method currently counts in its favor, it may one day count against it. Although back-testing has shown strong performance results through up and down market cycles, Hedgeable has not yet guided clients through a large market correction so the jury is out on whether the back-tested results will translate to real-world performance. |

✅ Alternative Asset Classes: Hedgeable is among the first automated platforms to offer clients investing opportunities in alternative asset classes, such as:

|

|

| ✅ Account Balance Minimums: No minimum threshold account balance is mandated by Hedgeable to get started. It’s possible to open an account, play around on the Hedgeable platform and, when comfortable, commit capital to start investing. |

|

| ✅ Free Rebalancing & Tax-Loss Harvesting: Tax-loss harvesting and rebalancing are free services available at Hedgeable, a benefit which some other robo-advisors, such as Wealthfront, offer but isn’t available on all platforms. | |

| ✅ All-In-One Wrap-Fee: Hedgeable charges a wrap-fee, which includes all custodial, management, transaction, technology, administration and support fees, so clients don’t have to worry about being nickled and dimed with separate fees for separate services. |

Hedgeable Fees & Minimums

Hedgeable gives clients breaks on fees as they invest more assets. Fees are considered wrapped, which means all fees: custodial, management, technology, administration, and support are included in one single fee charge. These fees range from 0.30% to 0.75%. The average ETF expense ratio is 0.15% and Hedgeable has no account balance minimum.

| Category | Fees |

| Account Management Fees | 0.30% – 0.75% |

| Tax-loss Harvesting | YES |

| ETF Expense Ratio | 0.15% (on average) |

| Account Minimum | $0 |

| Automatic Rebalancing | Free |

| Annual, Transfer, Closing Fees | None |

Hedgeable Accounts

Hedgeable caters to a broad range of account types, supporting individual and joint non-retirement accounts as well as IRAs, Trusts and 401(k)s.

| Type | Capability |

| Individual Non-retirement | YES |

| Joint Non-retirement | YES |

| Roth IRA | YES |

| Traditional IRA | YES |

| SEP IRA | YES |

| Rollover IRA | YES |

| Trusts | YES |

| 401(k) | YES |

Hedgeable Tax Strategy

Hedgeable believes more in preserving principal when markets fall than taking large losses and counting them against winners as part of a tax-loss harvesting strategy but it does still offer tax-loss harvesting as a service.

| Type | Capability |

| Tax Loss Harvesting | YES |

| Free Account Rebalancing | YES |

Hedgeable Summary

Hedgeable is not your average robo-advisor that keeps you fully invested during market upswings and downtrends. Hedgeable looks to track markets on the way up and protect capital on the way down by dynamically rebalancing when risk levels are elevated in asset classes.

Beyond its investment method, Hedgeable differs from other robo-advisors in providing accredited investor clients access to investments in start-ups via its venture capital arm, provides all clients bitcoin investment opportunities at no extra cost, and caters to socially responsible investors with a single click of a button on its platform.

With a single fee that includes management, technology, custodial and trading costs all in one charge, a broad range of standard and alternative investments, free portfolio rebalancing and tax-loss harvesting and a different take on investing methodology compared to most other robo-advisors, Hedgeable is a platform worthy of serious consideration for any investor wanting an automated portfolio management service with more than the usual bells and whistles.

Do you know how to read the candlesticks on your chart? If not don't worry. Chris Pulver created an ebook, Candlestick Cheat Sheet, that can teach you, in layman terms, the 10 most powerful candlestick patterns. It's a great start for those that are new to Forex and may want to trade on the conservative side when starting out.

Click here to download your copy now

Leave a Reply