The Illinois pension crisis is among the worst in the nation. Rating agencies, such as Moody’s and Fitch, have rated Illinois credit the lowest nationally.

So what has caused the Illinois pension crisis and what does it mean for you and your money?

Illinois Pension Funds 101

Over 1 million government workers and retirees rely on over 660 government pension funds in the City of Chicago and municipalities. These include police pensions, state university employee pensions, firefighter pensions, and pensions for other state employees.

Government-worker pension funds are defined-benefit retirement plans set up to pay government employees annual benefits during retirement. Workers contribute to these funds during their careers in exchange for promises to receive a certain annual payout upon retiring.

The pension funds invest the collective contributions of workers in the stock and bond markets; workers don’t have individual retirement accounts the way private sector workers who contribute to 401(k) plans do.

As a result, politicians can dip into the funds for political purposes, leading to budget shortfalls. Plus, liabilities are increasing because cost-of-living-adjustments automatically increase a retiree’s yearly benefit by 3%.

The problem in a nutshell is that the pension funds don’t have enough money to meet future payment obligations.

>> Related: How To Invest Money Wisely

7 Deadly Causes Of

The Illinois Pension Crisis

The reasons the Illinois pension crisis have spiralled to unsustainable levels stem from fundamental flaws in their design, including:

1. Defined Benefit Plan Flaws

Defined benefit plans are promises that government makes to retirees based on various assumptions, including mortality rates, cost of living increases, and investment returns.

If mortality rates increase or investment returns are lower than projected, shortfalls occur. And that’s exactly what has happened in the largest Illinois pension fund, the Teachers’ Retirement System, which is underfunded by about 60%.

The City of Chicago’s firefighters and police are also heavily underfunded. For each $1 they owe in future obligations, they have approximately $0.25 in assets.

2. Cost-Of-Living-Adjustments

Unlike private sector employees who contribute to IRA, Roth IRA or 401(k) retirement plans, many government employees who contribute to defined benefit plans in the State of Illinois receive guaranteed cost of living adjustments.

The automatic adjustments increase the annual payout to retirees by 3% annually. In some rare cases, the annual increases to retirees are so large that they rival the average annual social security payments received by private sector retirees.

3. Early Retirement Age

Unlike private sector employees, who are restricted from withdrawing contributions to retirement accounts until they reach their 60s, government worker retirees can fully draw from their defined benefit plans in their 50s.

The data shows that over 63% of retirees withdraw funds before the age of 60.

4. Higher Payouts Compared To Private Sector

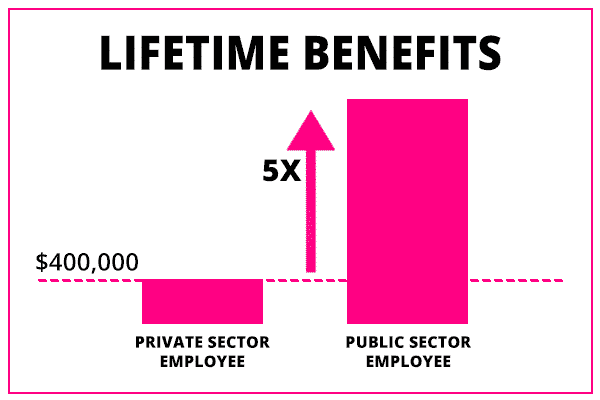

Private sector retirees who rely on social security income during their retirement years receive approximately $400,000 in lifetime benefits.

The average teacher retiring in Illinois who has worked for 30 years will receive 5x more than the average private sector retiree during their retirement years.

5. Political Slush Funds

To increase their likelihood of getting elected, politicians often make promises that result in short-term voter satisfaction at the expense of long-term discontent. For example, politicians in Chicago created a virtuous cycle that has amplified the capital shortfall in the Teachers’ Retirement System fund by redirected billions of dollars of contributions from the pension fund to teachers’ salaries.

Higher salaries now result in even greater obligations later, thereby increasing the shortfalls down the road.

6. Skewed Benefit To Contribution Ratio

Some Illinois retirees earned over $500,000 in pension payments annually. You might think that retirees have contributed large amounts during their careers to justify these high payouts but as it turns out most retirees contribute between 4% and 8% of their retirement benefits.

This means for every $1 contributed, government worker retirees receive between $12 to $25 in retirement benefits.

7. Pension Costs Weigh Down Budget

On average, pension costs amount to 4% of state budgets. In the state of Illinois, 25% of the budget is attributable to pension costs.

As time goes by, increases in pension obligations will hurt districts relying on state funding, causing state lawmakers to consider tax hikes to finance ongoing expenses.

Related: How Much Should Be In My 401(k)?

The #1 income play for 2023 is NOT a stock, bond or private company... Rather, it's a little-known alternative investment that could hand you big monthly income from oil and gas.

Find Out What It Is Right Here

The Fallout From Illinois Pension Reform

With payment obligations unsustainable, pension reform will be needed in Illinois.

State politicians may choose pension reform that segregates retirement accounts – similar to 401(k)s – as opposed to pooling them as happens now. Retirement age may increase and cost of living adjustments may be reduced.

Increasing taxes is an easy and obvious choice politicians may elect too. However, doing so will likely cause a migration exodus out of the state, thereby reducing tax revenues further, and exacerbating the Illinois pension crisis.

Investing in state and municipal debt is increasingly risky when budget shortfalls are so severe as they are in Illinois.

Although a worst case outcome, bankruptcy and some level of default on pension promises is a foreseeable scenario.

If you have invested in municipal or state debt, examine carefully your exposure with a financial advisor or connect with a company like Blooom, which specializes in retirement plans.

| BLOOOM SPOTLIGHT | |

InvestorMint Rating 4 out of 5 stars |

via Blooom secure site

|

Biden's disturbing new government program may be worse than Obama's. You are at risk for having your bank account frozen. A former bank regulator is blowing the whistle on Biden's frightening plan to take over your money.

Discover the immediate steps you need to take now.

>> Find Out How To Rollover A 401(k) To An IRA

>> What Are The Rules For IRA Withdrawals?

>> Find Out The Best Retirement Plans For Independent Contractors

The next 10 minutes could change your life. We've recorded a special sit-down interview with a reclusive millionaire who details how he's closed out winning trade after winning trade throughout the volatility of 2022. In fact, he hasn't closed a single losing trade since 2016. Sounds impossible? It's not - and he'll prove it to you.

Click to see this exclusive sit-down interview

Leave a Reply