Most investors think of Amazon as an online retailer with low margins and a high price-to-earnings ratio. But Amazon is so much more than an online shopping destination. These days Amazon is a goliath in not only retail but also in cloud computing, logistics, consumer technology, and media and entertainment.

Amazon AWS, its cloud business, generates scintillating margins. Its Echo device and Alexa AI assistant has been a huge hit with consumers. Approximately 1 in 2 U.S. households has a Prime membership. And some Wall Street analysts project Amazon will mushroom higher at an astonishing 16% compounded annual growth rate thru 2025.

In spite of the lofty projections, Amazon has had its fair share of flops in the past. Famously, its Fire phone fizzled out and it has lost tens of millions by investing in failed startups like Kozmo.com. But overall the company has thrived to make Jeff Bezos the richest man in the world (depending on what day you look) and continues to disrupt a wide variety of industries from book publishing to grocery stores.

So is Amazon stock worth buying or is time to sell, sell, sell?

Amazon Stock Price & Valuation

To assess the merits of buying Amazon stock, we can crunch valuation figures and analyze its corporate strategy using quantitative and qualitative research.

QUANTITATIVE RESEARCH

Amazon is a notoriously difficult company to value because it defies conventional wisdom by keep margins razor thin, especially in its online retail segment.

These low margins result in dizzyingly high price-to-earnings ratios. Nevertheless, we can apply six valuation models to estimate the current value of the company, including:

- 5Y DCF Growth Exit

- 10Y DCF Growth Exit

- 10Y DCF Revenue Exit

- EBITDA Multiples

- Revenue Multiples

- 5Y DCF Revenue Exit

Generally, what we find is the longer term ten year forecasts lead to higher share price projections compared to shorter term 5-year estimates.

And it’s no surprise that EBITDA and revenue multiple calculations for Amazon lead to share price estimate that are approximately half of what the discounted cash flow forecast models project.

Below, you can compare Wall Street analysts’ consensus share price estimates with the estimate arrived at using theoretical valuation models.

QUALITATIVE RESEARCH

Amazon has not only succeeded in growing organically but it has acquired other businesses strategically when it finds a “dreamy business” in the words of Jeff Bezos:

“A dreamy business offering has at least four characteristics. Customers love it, it can grow to a very large size, it has strong returns on capital, and it’s durable in time – with the potential to endure for decades”

~Jeff Bezos

Some of Amazon’s largest deals include:

| Year | Business | Acquisition Amount ($M) |

| 2009 | Zappos | $1,200 |

| 2012 | Kiva Systems | $775 |

| 2014 | Twitch | $970 |

Amazon’s acquisitions are not limited to the U.S. It snapped up Souq, the “Amazon of the Middle East”, in 2017 for between $650M → $750M. This acquisition opens up Amazon to markets in Saudi Arabia, Egypt, and the United Arab Emirates.

More recently, acquisitions have been in a key growth business for Amazon. The margins in Amazon’s cloud computing AWS service have astonished investors, so it is no surprise to see the company continue to invest heavily there with in order to further boost its product offering:

| Acquired Company | What It Does |

| NICE | Software for technical computing |

| Cloud9 IDE | Collaborative development platform |

| Harvest.ai | Cybersecurity |

| Thinkbox Software | Digital video maker software |

| Do.com | Enterprise meeting productivity |

Acquisitions will clearly play a big part in Amazon’s future growth strategy following the launch of its Alexa Fund which has a war chest of $100M and a laser focus on companies related to the internet-of-things and voice technology.

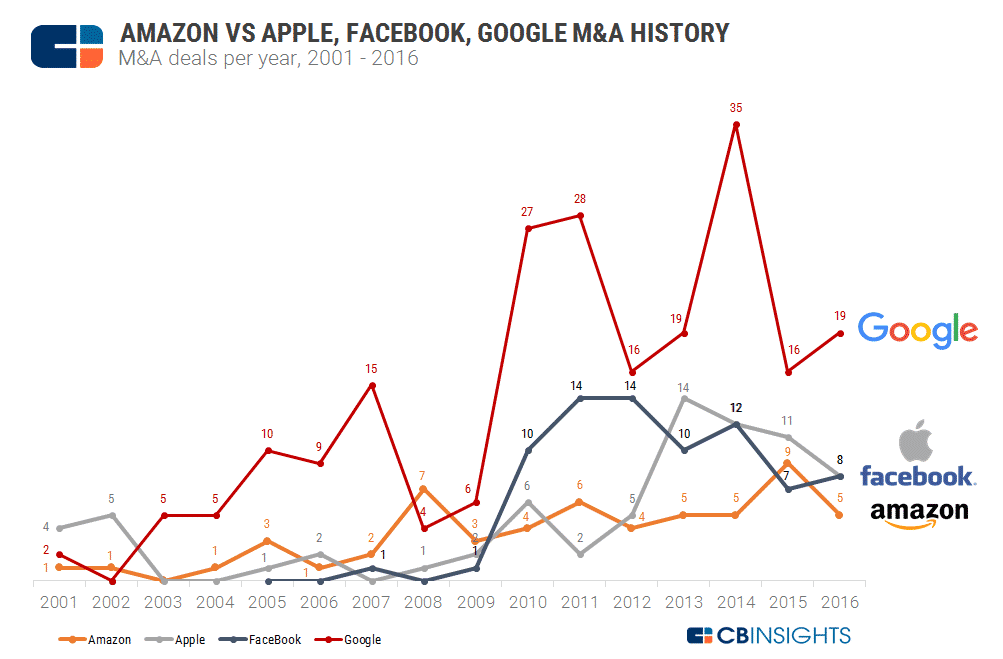

It’s notable that rival tech leader Alphabet invests much more aggressively in a wide variety of companies while Apple shies away from acquisitions unless it can own a company outright – similar to Facebook’s acquisition strategy (e.g. WhatsApp and Instagram).

Source: CBInsights

You can clearly see where Amazon expects future growth to come from when it comes to its Alexa Fund acquisitions: instructing devices to respond to your voice commands.

Some acquisitions it has made to enhance the Alexa ecosystem include:

| Acquired Company | Description |

| Rachio | Connected sprinkler system |

| TrackR | Track small items |

| Nucleus | Connected intercom system |

| Petnet | Smart pet feeder |

| Musaic | Connected speakers |

| Scout Security | Connected security cameras |

AMAZON HEALTHCARE

Perhaps the scariest prospect for companies is the idea of Amazon entering its market.

Until Amazon purchased Whole Foods, the idea of it becoming a heavyweight in the grocery industry might have seemed far-fetched.

And until Amazon launched Prime Video, the thought of it competing with Netflix to stream entertainment content and produce original shows seemed hard to imagine.

But Amazon has a knack for shocking incumbents with bold moves, and one burgeoning opportunity is in the healthcare industry.

Amazon invested in biotech start-up GRAIL, which concentrates on genomics for cancer diagnosis.

A gene sequencer called Illumina has already spun out from GRAIL and complements Amazon’s AWS well because of the computing power needed for genomic sequencing.

AMAZON DRONES

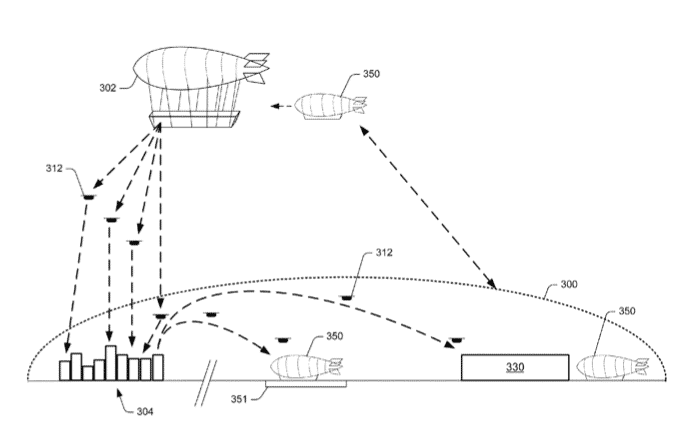

Among Amazon’s most ambitious bets for the future is its investment in drone delivery technology.

Whether Amazon is leading investors on a wild goose chase, there is no denying the patent it applied for regarding an airborne fulfillment center:

Other adventurous bets can be seen from patent applications that span a wide gamut of areas from “virtual machines” to “unmanned vehicles”, and even to “cryptographic keys.”

It’s unclear whether Amazon plans to take payment from cryptocurrencies in the future, but what cannot be denied is that it has already purchased domain names such as:

- AmazonBitcoin.com

- AmazonEthereum.com

- AmazonCryptocurrency.com

- AmazonCryptocurrencies.com

Perhaps Amazon is simply protecting its brand name from trolls or maybe it’s a sign of greater ambitions to take cryptocurrency payments in coming years.

Amazon Stock Price History

Amazon’s share price has soared since it went public with gains of 35,000% over a couple of decades, but what is next?

Amazon stock is notoriously volatile. Because the company spreads its wings so far by attacking a diverse group of industries, it has its share of hits and misses, causing both euphoria and dismay among investors.

While Amazon’s share price has historically been choppy, Jeff Bezos has argued that his company pays close attention to what will remain constant over time as much as it focuses on new opportunities:

“I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one.

I almost never get the question: ‘What’s not going to change in the next 10 years?’

And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time.

… in our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery, they want vast selection.

It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff I love Amazon; I just wish the prices were a little higher,’ [or] ‘I love Amazon; I just wish you’d deliver a little more slowly.’ Impossible.” ~ Jeff Bezos

If you look over a ten year period, you will see wild swings in share price, but perhaps investors can derive some comfort knowing some things will remain constant: low prices, fast delivery, and vast product selection.

Even if you were to examine Amazon stock over any one year period, you would see a share price that has had its fair share of volatility, a representation of the struggle investors experience when attempting to accurately value a company with so many moving parts.

>> Find Out How To Research Stocks

As you've no doubt seen on the news, our economy is facing uncertain times ahead. Inflation continues to skyrocket, the Fed has been failing us left and right, and the government is in shambles. As it stands, your money is not safe. But there is hope, the Inflation Survival Plan will tell you everything on how to not only survive, but actually thrive through this harsh economic change.

So don't wait until it's too late, act now and secure your future TODAY!

Crunching The Numbers:

Amazon Revenues & Earnings

As an online retailer, Amazon was famous for delivering low earnings figures quarter after quarter but thanks to its cloud computing division, margins look better.

When Amazon started out in 1995, Jeff Bezos raised almost $1,000,000 from a handful of early investors.

Just one year later, Bezos sold a 13% stake to Kleiner Perkins Caufield & Byers for $8 million, which valued Amazon at $60 million.

And a year after that Amazon went public at a valuation of $381 million. In the next few decades, Amazon stock skyrocketed 35,000%, not least because of stunning revenue growth.

Total historical revenue growth across its entire business operations has been phenomenal over time.

When revenues grow so quickly it sometimes takes time for earnings to catch up. But as an online retailer, earnings never really have caught up to revenues, causing investors to scratch their heads as to how best to value a company growing so fast yet not turning much of a profit.

These days, Amazon AWS delivers such high margins that the company as a whole is likely to experience earnings grow at a rapid pace over the next decade – unless Bezos deploys profits back into new ventures.

➤ Free Guide: 5 Ways To Automate Your Retirement

Amazon Return On Invested Capital (ROIC)

When you take into account the amount of capital invested, ROIC measures the profitability and value-creating potential of Amazon.

Great companies sustain value creation over time and that is demonstrated through high returns on invested capital.

You can think of return on invested capital, or ROIC, as a gauge of whether the company is generating a return for its shareholders and bondholders.

Amazon’s ROIC is slightly lower than investors might expect given the extraordinary value creation reflected in its market capitalization. But it’s not really a surprise to see that just as Amazon confounds investors when it comes to earnings so too does it challenge investors when it comes to ROIC.

Because Amazon invests so heavily, it is no surprise to see that the returns to-date on those investments are lower than investors might wish.

Investors will just have to wait and see whether Amazon can turn its investments into higher returns on capital in the decades to come.

>> What Are The Best Stocks To Buy?

Amazon Debt To Total Capital

Amazon has comparatively low debt levels but Amazon’s core business as an online retailer may suffer in terms of revenues during tough economic periods.

Unlike debt-laden companies that increasing struggle when interest rates rise following a Fed rate hike, Amazon has very little debt overall and should face no real hurdles from its financial obligations during higher interest rate environments.

However, Amazon reaches approximately 1 in every 2 U.S. households, who are on the whole heavily indebted, and so the likelihood is they will need to tighten spending during periods of economic recession, and this in turn may affect Amazon’s revenues.

This list ranks the top optionable stocks daily based on trend, volume, price and our proprietary algorithm. FREE bonus: a strategy for generating income in 8 minutes per day.

View this list for FREE now!

Amazon WACC

Weighted average cost of capital, or WACC, is a measure of how much it costs a company to raise capital from its stakeholders.

Shareholders and bondholders demand a yield, and the combined return is captured in the Amazon WACC.

Imagine for a moment that Amazon needed to raise $1 billion from its shareholders and bondholders, 50% from each.

If lenders expected a 4% return and shareholders demanded a 10% return, the WACC would be 7%. So, Amazon would need to generate at least a 7% return to keep both debt and equity holders happy.

The Amazon WACC is shown below:

Amazon Financials

Amazon’s financials featuring a 5 year DCF Revenue Exit model is shown below:

Have you invested in Amazon stock? Share your investing tips below:

>> Is Twitter Stock A Buy Or Sell?

>> 7 Financial Goals To Live A Better Retirement

>> How Much Should I Save For Retirement?

How a 300-square-mile stretch of America's Heartland could power a multi-billion-dollar tech boom… and create a new generation of American millionaires

Learn more here.

Leave a Reply